Wages are a remuneration that the company worker receives in exchange for his work. Article 57 of the Labor Code of the Russian Federation suggests that the amount of remuneration and the method of its formation are required conditions employment contract.

When calculating wages The procedure for remuneration established at the enterprise, as well as additional promotion and compensation is taken into account. They can be established by law, for example, compensation for work in harmful working conditions, or adopted by the Organization on their own (surgery for years of service, premiums for the implementation of financial indicators, etc.). Also, the calculation takes into account various recovery, deduction from the salary and.

Monthly size earnings cannot be lower than the minimum wage.

Existing calculus systems

Meet two calculation systems Wages:

- Timeless. In this case, the calculation takes into account the days or hours spent by the employee or hours in the month and its salary (tariff rate). The monthly job salary is established by the employee, according to a staffing schedule. Usually this form of remuneration is from specialists and managers. The tariff rate may be an hour or daytime. In addition to the simple form, there is a one-time-premium pay. Additionally, a premium is paid to the main earnings. The size of the prize is indicated in labor or collective agreements or other regulatory documents and constitutes some percent of the salary (tariff rate).

- Piecework. It was designed to increase the productivity of workers, as a rule, applied in the production sector. There are several varieties of this system:

- Straight. In this case monetary remuneration Determined, based on the number of products manufactured and piece prices for a unit of products. Party rates are developing an organization, on the basis of the rules of development and established hourly rates;

- Partly premium ;

- Piecework-progressive . Rates are increasing when it is developed above the established standard;

- Indirect . It is calculated as follows: the salary of one category of employees, usually this service personnel depends on the size of the remuneration of the main production workers.

The main document for calculating the time-based earnings - which establishes a monthly norm in days and hours and the actually spent time is noted separately for each employee of the company.

The main document for calculating the time-based earnings - which establishes a monthly norm in days and hours and the actually spent time is noted separately for each employee of the company.

If the employee worked the whole month, it gets a salary in full. In other cases, earnings are calculated by formula:

salary / installed day rate * spent number of days

For example: for the production calendar for 2015 in December 23 working days. The executive secretary was established in the amount of 28,900 rubles., The number of worked days in December was - 18. We get: 28,900 rubles. / 23 days x 18 days \u003d 22 617,39 rub.

Now suppose that the secretary in addition to the salary is also due to the premium. Its size is 10% of the salary. According to the data given above, the secretary's earnings in December will be - 24,879,13 rubles. (22 617.39 rubles. + (22 617.39 rubles. X 10%)).

Formulas for calculating a piecework salary differ depending on the type:

Formulas for calculating a piecework salary differ depending on the type:

- Direct piecework: The number of products produced x piece value unit of products.

For example: the plant has the following piece rates: for the processing of the part - 45 rubles, for the assembly of the part - 95 rubles. The worker has collected and processed 243 details for the month, its wages will be: (243 pcs. X 95 rubles) + (243 pcs. X 45 rubles) \u003d 34 020 rub. (23 085 + 10 935); - Partly premium. In this case, the calculation is made by the same formula with adding a bonus.

Suppose, in our case, the premium is 10% of the piece of salary, we get: 34 020 rubles. + (34 020 rub. X 10%) \u003d 37 422 rubles; - Piecework-progressive: (Number of products manufactured within the normal range of products of products) + (Number of products made above the norm * Increased payment per unit of products).

Example: The norm of the processed parts is 280 pcs., A piece of charge - 50 rubles., Increased piece price - 75 rubles. Worker for a month processed 500 parts: (280 pcs. X 50 rub.) + (220 pcs. X 75 rub.) \u003d 30 500 rub. (14,000 + 16,500); - Indirect. Unified formula for calculation is not provided, the organization can develop it on its own at its discretion. It can be tied to the volume of products manufactured, the wages of the main production work or to count with the help of special coefficients.

Additional information on some difficulties in the calculation of wages is reviewed in the following video:

If you have not registered the organization, then the easiest way do it with online servicesthat will help free to form all the necessary documents: if you already have an organization, and you think about how to facilitate and automate accounting and reporting, the following online services come to the rescue, which will completely replace the accountant at your enterprise and save a lot money and time. All reporting is formed automatically, signed electronic signature And goes automatically online. It is ideal for IP or LLC on USN, ENVD, PSN, TC, is based on.

Everything happens in several clicks without queues and stress. Try and you will be surprisedhow it became easy!

Hold

Each employee is subtracted monthly from wages. The amount of tax is 13%. The amount of tax can be reduced by the amount of tax deductions.

They are:

- Standard: (1400 rub. - First and second child, 3000 rubles. - Third and subsequent), deductions for veterans of the Second World War, Blochadnikov, Disabled I and II Groups and other categories of persons specified in 218 of the LC of the Russian Federation (500 rubles);

- Property. Have the right to receive persons who produced the cost of building or acquiring real estate objects;

- Social. This includes deductions for treatment, training, voluntary pension and others;

- Professional. The deductions apply to individuals engaged in private practice and individual entrepreneurs.

Additionally, out own funds companies, the employer pays for state extrabudgetary fund. In 2015, the total amount of contributions is 30% of the wage foundation.

Retention and recovery from employee wages can only be done based onprovided by law:

- According to the Labor Code (Article 137): For the unreought-after days of vacation (when dismissal), for the indisputable advance, the repayment of unnecessarily paid and unused travel expenses, in the case of an accounting error (total all deduction per month may not exceed 20% of earnings);

- By executive documents (FZ No. 229 of 02.10 2007): Payment of Aliments; loan repayment; Reimbursement caused by moral and physical harm (50-70%).

Dates of payout

Wages paid every two weeks (Art. 136 of the Labor Code of the Russian Federation).

Dates of payment are indicated in labor or collective agreements or other regulatory acts of the company. The first part of earnings is paid in the current month, usually up to 25 numbers and is reflected as an advance. The second part is paid at the beginning of the month following the calculated one.

there is two options Advance payment:

- proportionally spent time (for the first two weeks of the month);

- a fixed amount that is set as a percentage of a monthly salary, for example, 40%.

Everything hold Produced when salary accrual (nothing is held from the advance).

The employer is obliged monthly find an employee with its salary size and her component parts, as well as with the deductions and the grounds for this. This is necessary in writing, usually the calculated sheet is used for these purposes.

Currently, the payroll calculation is usually made using specialized accounting programs. But it does not exempt from the need to know the basic rules and principles for calculating wages, because even the program may be mistaken. And, it means that its calculations need to be able to check. On how to make the calculation of wages by salary, we will tell in our material.

Broken wage system

Warry payment by salary is one of the simplest systems in terms of calculating the salary. Under salary it is understood to be a fixed amount of remuneration of the employee for the execution of labor (official) duties of a certain complexity for the calendar month without taking into account compensatory, stimulating and social payments (Part 3 of Art. 129 of the Labor Code of the Russian Federation). The busting system of remuneration, as a rule, is established by employees, the result of the labor of which cannot be quantitatively measured and appreciated. Therefore, the main criterion for the accrual of the full size of the salary is to comply with the working time and labor standards, i.e., the testing of the total number of working days in estimated period Based on the consistent time of working time.

At the same time, under the salary it is understood not the amount that the employee will receive "in the hands" when working out a full month, and the amount to the accrual from which the NDFL will be retained, as well as other retention in accordance with the legislation or the statement of the employee itself (for example, alimony or loan repayment).

How to determine salary for the month: calculation formula

To determine the wage earned by the employee for the month, based on the salary, you can use the following formula:

Example of calculating salary by salary

An employee of the organization has a monthly salary of 65,000 rubles at a five-day work week. We will pay salary in 2016 for August and September.

The calculation of remuneration on any kind of commercial and state enterprise is due to legislative actsacting in this moment time. The amount of it depends on the official salary, prescribed in the labor contract, spent over a certain period of hours and other details. The amount put to pay is calculated by an accountant based on a number of documents.

What is taken into account when counting?

To date, two types of fees are most often practiced:

- Timeless . The first one provides for a specific salary contract for the spent time - an hour, day, month. Often, the monthly rate is practiced. In this case, the final amount depends on the time spent over a certain period of time. It is used mainly when calculating the salary to employees, from which the number of products created - accountants, teachers, managers does not depend.

- Piecework . Depends on the amount of product created for a certain period. Often used on factories. It has several subspecies that we will look at a little later.

So, timeless payment of labor provides that the head of the enterprise or another executive We must lead and fill out the working hours tab. It is drawn up in form №1 13 and filled daily.

It should be celebrated:

- number of working hours spent during the day;

- outputs "On Night" - from 22:00 to 6:00;

- exit inoperative time (weekends, holidays);

- pass due to different circumstances.

Complete payment provides for availability route card or outfit on a certain amount of work. In addition, they are taken into account: hospital lists, orders for bonuses, issuance orders material assistance.

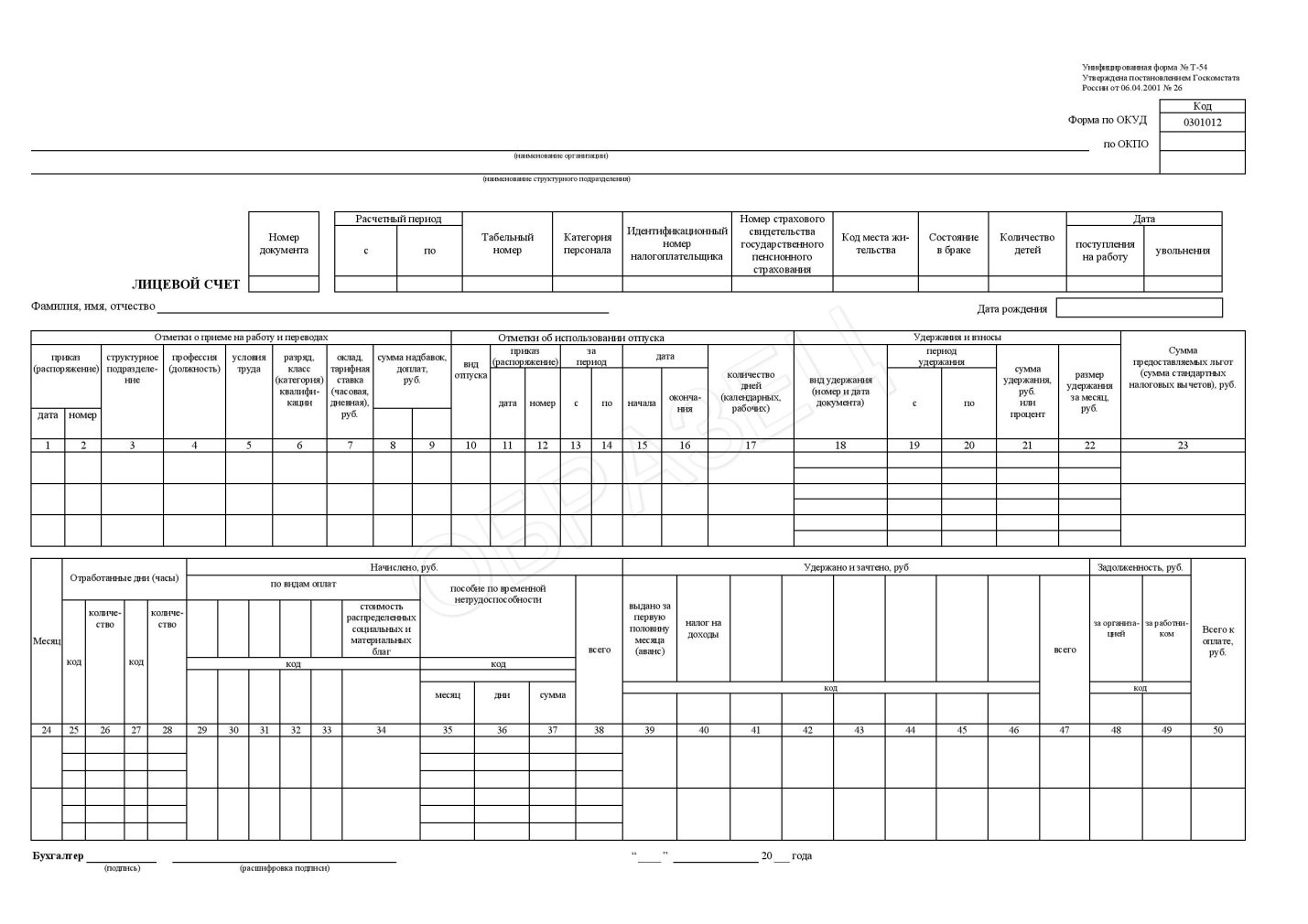

After accepting to work, each accountant must conduct analytical accounting of wages and fix it in the form of №U-54. This is the so-called facial employee account. The data specified in it will be taken into account when calculating hospital payments, vacation and other types of benefits.

About how holidays are calculated, you can find out.

Calculation formula and examples

Timeless payment of work provides for labor payment according to spent time and salary of the employee.

It is calculated as follows:

For the monthly salary:

Zp \u003d o * code / cd, where

- O - fixed salary for the month;

- Code - spent days;

- CD - the number of days in the month.

For hourly / daily fixed salary:

Zp \u003d corks * o, where

- Sn - salary without taxes;

- Cove - the amount of spent time;

- O is salary for one time unit.

Consider an example:

Tatyana Ivanovna has a monthly salary of 15,000 rubles. In the month there was 21 working days, but since she took his vacation at his own expense, she worked only 15 days. In this regard, she will pay the following amount:

15 000 * (15/21) \u003d 15 000 * 0.71 \u003d 10,714 rubles 30 kopecks.

The second example:

Oksana Viktorovna works with a daily salary of 670 rubles. This month she worked for 19 days. Her salary will be:

670 * 19 \u003d 12 730 rubles.

As we see, the formula for calculating wages with this form of payment is quite simple.

Schedule payment - how to calculate?

With piecework of labor, the amount of work performed is paid. At the same time, rates are taken into account in the ratio of work volumes.

With piecework, wages are calculated by the following formula:

Zp \u003d ri * kt, where

- Ri - rates for the manufacture of one unit;

- CT - the number of products produced.

Consider the following example:

Ivan Ivanovich for a month produced 100 engines. The cost of one engine is 256 rubles. Thus, for the month he earned:

100 * 256 \u003d 25 600 rubles.

Piecework-progressive

It is worth considering this type of payment to separately as a piece-progressive, at which the price has depends on the amount of production produced during a certain period.

For example, if for the month the employee produces 100 engines, then it receives for each 256 rubles. In the event that it exceeds this rate, that is, produces more than 100 engines per month, the cost of each engine manufactured supernorm is already 300 rubles.

In this case, the earnings for the first 100 engines are considered separately and separately for the next. The resulting amounts are folded.

For example:

Ivan Ivanovich manufactured 105 engines. His earnings amounted to:

(100 * 256) + (5 * 300) \u003d 25 600 + 1 500 \u003d 28 100 rubles.

Other payment systems and their calculation

Depending on the specifics of the work, payment may be:

- Accordable . Often it is applied when paying the work of the brigade. In this case, there is a wage of the brigade as a whole and is issued to the brigadier. The resulting amount of workers share among themselves according to the arrangement in their brigade.

- Payments based on bonuses or interest . A bonus or commission system is applied to employees, on which the company's revenue depends (see also). Quite often apply it to sellers-consultants, managers. There is a constant, fixed bet and percentage of sales.

- Watch work . The workshop of work provides for the payment according to the employment contract - that is, one of either the work performed. This may contain percentage surcharges for complex working conditions. For exits in non-working, festive days, payment is calculated in the amount of at least one day or hour bet on top of the salary. In addition, the allowance for the watched method of work is paid from 30% to 75% of the monthly salary. Interest rate Depends on the region in which work is run. For example, Ivan Petrovich works by the Watch method. His monthly rate is 12,000 rubles, the surcharge for work in this region is 50% of the salary (o). Thus, his wage will be 12,000 + 50% O \u003d 12,000 +6,000 \u003d 18,000 rubles per month of work.

Payment of festive exits and night shifts

Whenaming work is paid each shift depending on the tariff rate of each shift. It is either established by the workforce, or is calculated by an accountant.

It should be borne in mind that exits on weekends, holidays are paid at a higher rate - raising rates by 20%. In addition, outputs at night from 22:00 to 6:00 also at the rate of raising rate by 20% of the cost of the hour of work.

Wage taxes

Calculating wages, do not forget about taxes. Thus, the employer is obliged to pay 30% of the amount of consistent wages to the fund of insurance premiums.

In addition, employees are removed 13% of wages to NDFL. Consider how the tax is accrued.

First of all, the tax is numbering the entire amount of wages except the cases in which the tax is deduction. So, out total amount wages calculated deduction for tax and only then to the value obtained tax rate.

The right to deduct tax has a number of socially unprotected categories, the list of which is registered in Article 218 of the Tax Code of the Russian Federation. These include:

- Veterans of the Second World War, Disabled, whose activities were associated with nuclear power plants. The tax deduction is 3000 rubles.

- Disabled, participants of the Second World War, soldiers - 500 rubles.

- Parents, on which one or two children are dependent - 1,400 rubles.

- Parents, on the dependency of which are from three children - 3,000 rubles.

For the last two categories there is a limit. So, after the amount of wages received from the beginning of the calendar year will reach 280,000 rubles, tax deduction It does not apply before the next calendar year.

Example:

Salary for the month of Ivan Ivanovich amounted to 14,000 rubles, as he worked for a full month. He got disability while working at nuclear power plants. Thus, its tax deduction will be 3,000 rubles.

NDFL tax is calculated for him as follows:

(14 000 - 3 000) * 0.13 \u003d 1430 rubles. This is the amount that must be kept when paying wages.

Thus, he will receive on hand: 14,000 - 1430 \u003d 12 570 rubles.

The second example:

Alla Petrovna Mother of two minor children. Her salary is 26,000 per month. By December, the total amount of wages paid to it will be 286,000 rubles, therefore, it will not be deducted to tax.

Payment of payments and calculation of delays

According to the same legislation, wages must be paid at least 2 times a month. Eliminate an advance, which is issued in the middle of the month and actually salary.

The advance on average ranges from 40 to 50% of the total amount of payments, at the end of the month the remaining part of the payments is issued. This is usually the last day of the month if it falls on the weekend - the last working day of the month. With untimely accrual of wages, the employer is obliged to pay a fine.

In addition, compensation is provided for an employee, which is issued at its request and is 1/300 rates for each day of delay.

Video: Simple salary calculation

Check out the main nuances of the calculation and salary accrual. An experienced accountant will tell you how to correctly calculate wages depending on the wage system you have chosen.

The calculation of remuneration is made by an accountant based on a number of documents. Allocate two main wage systems: piecework and timeless. The most popular timeless wage system is quite simple and applied on most industries.

Weaving payments on the salary are very widely used when setting the payment system for employees of the enterprise and usually does not cause difficulties in its accrual. However, it makes sense to stop a little more detail on the process of its accrual. This information may be useful not only to beginners, but also more experienced specialists.

I want to immediately note that on the Internet there are a large number of software that allows you to make this calculation, not reinforcing the formula for calculating wages by salary. Newcomer, however, will simply be able to deal with their interface, which includes of different types Directories, graphs and conditions. For this I am writing an article.

The algorithm for calculating wages is not at all difficult, but there are some nuances that should be known and consider when charging wages.

Salary \u003d Salary / Number of Days Plan * Number of Days Fact

Such a calculation is quite viable when the planned and actual spent time coincides and there are no processing or neurodes to work.

But life is diverse and any employer has to put up with the fact that employees may be absent at work on some important reasons for them. And sometimes it even has to pay such a lack. Therefore, I will tell all the nuances of calculating payment by salary.

Step 1: Find out the value of the salary and the tariff rate

First you need to write yourself the source data for the calculation. First of all, this is the value of the salary of the employee who should make the calculation of wages.

As a rule, the size of the official salary is established from the calculation for the month. Other periods apply to the Russian Federation rarely.

Official salary is usually established in cases where the nature of the employee does not provide for substantial fluctuations in the number of time spent time month from the month. That is, the employee practices his working days in the usual mode of operation, for example, for the 40-hour work week, and he does not need one week to work for 4 working days, and to another - 6.

Usually the salary is assigned to managers, specialists and employees. It is rarely applied to the workers, but this is practiced. For example, for highly skilled workers can install a personal increased salaryTo secure it in the enterprise.

The hourly tariff rate is used where a month from the month occurs a significant change in the number of spent time by employees. For example, in one month, the worker performed his duties on the approved schedule within 12 shifts at 8 o'clock, and 16 shifts worked. With the payment system by salary, wages in these months would be the same.

That is, the time spent at work was different, and payment is the same. This is a prerequisite for all sorts of labor conflicts. It is more fair to pay the work of the worker depending on the spent time.

Salary or tariff rate - is established by the system of remuneration of the enterprise. You will need only to note this or that type of basic bet for yourself, as the choice of the calculation algorithm will depend on it.

Step 2: Find out the time of work time for the estimated month

Depending on the number of weekends and holidays in each month, the actual number of working days is all the time different. That is, a different rate of time.

Find out the exact number of working days and hours in every month can be in the production calendar. Below for example, the production calendar is shown for 2016:

For example, if the employee is installed 40 hours of work week, in July 2018 he had to work 21 working day, or 168 hours.

If an employee works on a "sliding" graphics or simply "shifts", then the time rate should be taken from the work schedule approved in the organization.

Such charts are usually installed for the entire year and are rarely subject to revision. The revision of such graphs requires the implementation of certain personnel procedures, with a warning period for at least 2 months.

Step 3: Collect information about all types of paid time for a specific employee

The next step is needed to take information about the time actually spent time. At the same time, to fulfill all the requirements of labor legislation, it is necessary to distribute all spent time in this way:

Time must be taken into account not only spent, but also when the employee was not present at work. This is done because there are some reasons for the lack of a person at work, which the employer must pay, even if the employee worked for an incomplete month.

List them:

- Absence due to illness;

- All types of vacations, other than vacation, without salary salary;

- Service business trips

- Performance of state duties (work in elected bodies, call for military fees, agenda to court and a number of other grounds)

- Easy for various reasons when the corresponding order was issued

There may be other types of lack of work, which are paid by the employer.

Step 4: Find out all types of supplements established by a specific employee.

Practice shows that even the simplest wage systems are complicated with time. This is due to two factors. First of all, the fact that there are demands of labor legislation regulating the need for additional payments and allowances in some cases. Read more about them in this article.

Secondly, the emergence of various types of premium is due to the fact that an effective payment system should "adapt" under each employee, take into account the effectiveness of his labor. It is additional payments and allowances to accurately customize the system, being a good addition to the employee bonuses system.

In addition to the list of surcharges, find out the conditions of their application and check if there are grounds for calculating and paying each of them to apply correctly.

It can be said simplified so that surcharges and surcharges can be three species:

- fixed amount, do not depend on spent time (for example, personal surcharge);

- a fixed percentage to the amount of payment for each spent day (for example, surcharge for work experience);

- fixed percentage of payment amount for a specific spent day (for example, surcharge for the night shift)

Knowing all kinds of surcharges, you can not miss important elements Calculation of salary.

Step 5: Perform salary calculation

In order to accomplish this calculation, it is necessary first of all to determine the average hour earnings in the estimated month. For this, the salary set by the employee is divided by the number of working hours this month.

CIDS \u003d salary / RV,where

SCS - Medium-hour earnings

RV - working time rate, watches

After that, it is necessary to multiply the average hour earnings to the number of hours actually worked as an employee. But this is not yet completing the calculation, as it is necessary to take into account all surcharges and surcharges. In more detail about them, they were told in the 4th step of our algorithm.

Suppose, in the salary of 20,000 rubles, the employee has the following surcharges in his compensation package:

- support for work experience 10% to salary

- "Night" in the amount of 40% to the salary

- monthly premium in the amount of 50% to the salary

Under the norm at 168 hours, they worked 144 hours, including 18 hours at night. That is, an incomplete working period has been worked out.

Then the calculation of salaries on the salary will have the following form:

Salary \u003d (core * 144 h. + Country * 18 h. * 0.4) + core * 144 h. * 0,1 + cc * 144 h. * 0.5

The formula, of course, looks difficult. But the payroll is not a very simple matter. We need to take into account many factors affecting the cost of labor. I think that the example above explains how to calculate it on what principle.

However, for convenience, I bring an example of a salary calculation table in Excel.

In the table you must substitute all the necessary values, the information about which was collected in the previous steps of the algorithm.

It is also possible to use any online calculator For such a calculation. But such services, as a rule, do not take into account all the peculiarities of a particular company and give only an approximate calculation.

Step 6: Calculate NDFL

Income tax individuals In the Russian Federation set in the amount of 13%. Accordingly, the resulting amount of payment must be multiplied by 0.87 (the coefficient, taking into account the NFFL).

The resulting result and will wages, owing an employee in this month.

What to pay attention to

What moments should pay attention to the calculation of salary by salary:

- From month to month, the number of working hours at the 40-hour work week is different, due to weekends and holidays. However, the size of the salary will be constant in these months. If in January 2015 was only 15 working days (120 hours), then in March it was already 21 working days (168 hours). However, the monthly job salary should be the same in the same month. That is, the cost of an hour changes.

- The above rule does not work with time-based payment at a clockwise rate. There will already be a significant difference in payment.

- Most often, all surcharges and salary surcharges, as well as premiums, are calculated on the size of the salary (tariff rate). The exception is the district coefficient and the allowance for work in special climatic conditions ("Northern"). To accrual a district coefficient, there are rules.

- The income tax of individuals is calculated from the total income of the employee (including in kind, not monetary terms. Example - coupons for free food).

- Do not forget about the advances paid earlier. In accordance with the Labor Code of the Russian Federation, wages are paid twice a month. Therefore, it may be that the calculation "I forgot" about the money paid into account.

Salary is the main motivative moment labor activity man. From its size, it depends in many ways, as an employee "laid out" by fulfilling his labor duties. Secondary, but not less an important factor, It is the correctness of its accrual and justice to establish its size compared to pay for other employees. For the employer, salary is one of the main costs of expenses. At the same time, the costs that need to be covered periodically and without delay. Moreover, from the wage fund needs to be done mandatory deductionswhich are also a substantial expenditure.

This place of wages in the system of relations between the employee and the employer, as well as the state, requires an attentive approach to the establishment of wage systems, both in entrepreneurs and enterprises, as well as to pay the salary to specific employees. The proposed article will tell about how to properly produce, what actions should be made up to this point and what to do not disrupt the law when calculating remuneration.

Founding of calculation and payout payments

The main regulatory act regulating the procedure and conditions is the Labor Code of the Russian Federation. It provides the main key pointsthat need to be taken into account when establishing and paying wages:

- order of definition and value minimum size wage,

- component elements of wages,

- wage systems

- order and restrictions on retaining with salary.

In the future, each employer, whether an entrepreneur or organization, determine the main parameters of the wage of their employees in local regulations:

- collective agreement,

- regulations on wages,

- regulations on the bonuses (motivation).

The amount of remuneration for specific posts is established by a regular schedule. And already with a specific employee, its salary amount is coordinated in the labor contract.

Please note: in the employment contract concluded with the employee, the employer must indicate the specific salary amount (salary, tariff rate) of the employee. Drawing up a contract without specifying a specific amount of remuneration, for example, only with reference to the staff schedule, is illegal (Letter Rostrud No. 395-6-1 dated 19.03.2012).

The amounts of salaries paid monthly and determined on the basis of the above documents, as well as the work time accounting tables, orders and other documents, are indicated in the settlement statements.

Wage components

The payment of the work of each employee can take from the content of the internal local acts of the employer and agreements decorated by the employment contract. According to the labor legislation, the labor payment of a particular employee may consist of the following parts:

- remuneration for work (actually salary, for example),

- compensation payments (surcharge, compensation),

- stimulating payments (premiums, surcharges, other remuneration).

As mentioned above, general terms and Conditions Remuneration for labor is established by the employer by publishing internal local regulatory acts. A significant part of wages of many employees is precisely various surcharges and prizes.

Internal local acts Supplements can be established by various categories of workers. The following common grounds for surcharge are most common:

- for the experience (for those workers who work for a long time at the employer),

- for labor tensions,

- for non-normalized working day

- for knowledge of foreign languages \u200b\u200b(naturally, if these knowledge is used in operation).

In some cases, those common to the whole team are set up on the basis of the employer's desire (his personnel policy), in others, on the basis of the requirements of the law.

Some surcharges can be installed in a fixed amount, which will be paid monthly, others in percentages to the salary or the established amount will be calculated in proportion to spent time.

A big role in paying wages, and in the motivational policy of employers in relation to their employees, play premiums. They can also be in the form of fixed amount or percentage of salary. As often happens, the employee receives such payments every month about the same amount. In this regard, many employers have introduced into practice a decrease in the size of the monthly premium in the event of unfair execution by employees of their duties. Such actions of the employer are called a fine, although in fact no retention of employee wages is not produced.

Opinion expert

Roman Efremov

Work experience more than 7 years. Specialization: Labor law, right social security, intellectual property right, civil process, criminal law, general Theory rights

Forms of wages

Such forms of wages are legally approved:

Massage salary

Calculated on the basis of time spent time at a set watch rate. Often this form of earnings is used if:

- the final development does not depend on the employee and its skills, there is a direct relationship between the production and technological process;

- the result of labor cannot be calculated with accuracy (scientists, teachers, civil servants, etc.).

In turn, the timeless salary is classified in two directions:

- simple salary, also referred to as "naked salary", "rate";

- the premium earnings, which provides for the possibility of obtaining additional financial preferences, provided that a certain result is achieved.

Partial salary

Directly depends on the number of final product, it is used in situations where the result of labor has a close relationship with the efforts of the most hired employee.

Distinguish such species of piecework salary:

- easy earnings;

- partly premium payment, in which a bonus is guaranteed for achieving certain labor indicators, a premium is guaranteed;

- completely regressive salary: it rarely meets, it provides that payment is going on one rate for the execution of the norm, for over-fulfillment of the plan's plan reduced;

- partly progressive earnings: As part of the execution of the plan, one price is applied, when it is over-fulfilling the rules, payment goes on higher rates;

- accord wage, in this case, the final earnings depends directly from the cost of completed work. Used in spheres where there is a need to perform a definable work.

Earnings can be differentiated depending on the location of the labor object. For the regions of the Far North and equivalent to local areas, there are increasing coefficients.

Salary settlement

For most employers, the final document preceding the direct issuance of wages is a salary statement. Depending on the terms of payroll and the material equipment of the entrepreneur or legal entity One of the three provided regulatory acts Vedomosti:

Proper filling estimated statement By salary:

- settlement payment,

- payment,

- calculated.

Employers with a small number of workers use in their activities expendable cash order. In view of the widespread practice of paying salary on bank cards Employees are becoming increasingly popular with the estimated statement.

The form of the settlement statement is established by Rosstat. A document is drawn up in the employer's accounting department for the work for the month. The basis for filling the statement is the data of documents for the development and use of working hours:

- staff schedule (contains salaries and tariff rates),

- orders (on employment, on the establishment of additional payments, on a premium, vacation, etc.)

- accounting table of working time (with remuneration time),

- orders-outfits (for piecework wages),

- applications for application standard deductions and notifications from IFTS on the use of property and social deductions,

- executive documents (executive sheets, judicial ordersDecisions bailiffs) in retainings from the salary,

- disability leaves.

A statement is compiled in one instance. Stored after drawing up for five years. Responsible for the preparation of statements is (the main, or the only one in a small enterprise, or an accountant - the calculator at large enterprises, where each accountant has its own specialization). A statement is signed, depending on the applied form, by the head, the chief accountant, the cashier and the accountant that was a statement.

In the Vedomosti for which the issuance of wages (payment and payment and payment) is affixed by the painting of employees who have wages, or records about the deposit of incoliated amounts.

Order and formulas for calculating wages

Having understood with the grounds for paying salary, documents that are used, and paying wages, consider the question: how to count the employee's salary. Practical workers, employees of accounting, calculators, relevant formulas that allow them to calculate wages to employees.

So, in particular, the formula for calculating salaries by salary is as follows:

Zp \u003d o / et * up to + pn -

ZP - wages for the month.

Oh salary.

DR - working days on the manufacturing calendar.

Until - days actually spent by the employee.

PND - premiums, surcharges, spending other stimulating and compensatory payments. In this case, such payments can be established both in a solid size and, depending on the number of days spent in a month.

N is the tax on the income of individuals. The tax rate is 13% of the amount of payment. It is worth paying attention to that some categories of citizens are given the right to a tax deduction. And in this case, the tax from wages is not detected or is held with a reduced tax base. For example, if deduction for a child is 1000 rubles, then with a monthly salary in the amount of 20,000 rubles, the tax will be retained only with the amount of 19,000 rubles.

U - hold. It is necessary to pay attention here. general rule The amount of deductions from the amount of remuneration cannot exceed 20%. Special rules are provided, for example, when held by several executive sheets - 50%, while hold for the payment of alimony - 70%.

To calculate wages on piecework, another formula is applied:

ZP \u003d C1 * K1 + C2 * K2 + CN * KN + P + DV-N -

The following indicators are added to the explanation of this formula:

C1, C2, CN - piece rates for produced by the employee products (product, operation, work, etc.)

K1, K2, KN - the number of units produced by a product worker. For example: 50 cylinders or 70 hole drilling operations.

DV is an additional remuneration that is paid to the employee on piecework of labor, for days, which are non-working and festive.

At the same time, particles can, as can be seen from this formula, be involved both on the implementation of one operation (manufacturing of one detail) and on several.

From the total amount of wages for the month it is necessary to subtract the advance payment (wages for the first half of the month).

The process of calculating wages is quite complicated. The calculator may forget to take into account a particular document, make a mistake in the calculations and so on. All this can lead to a violation of the rights of the employee. To minimize cases of improper calculation of payments to employees, in Labor Code The Russian Federation provides for the obligation of the employer to inform its employees about all the components of its wages, their amounts paid to taxes and other deductions. Monthly before paying salary, employees should receive a printout of components of salaries, the so-called "conviction", on which they can check how the salary calculation is made and whether it is properly paid.