Spread (also called "spread") is financial term, which means the difference between the closest buy and sell limit orders financial asset. The spread changes over time, can be floating or fixed, and is present on any market at any time.

In exchange trading, the spread is indicated not in money, but in points. If for some shares the quote is $45.15/$45.16, then the spread is said to be one point (1 cent). If the exchange rate of a currency pair is 1.3056/1.3058, then the spread is two pips.

Measuring the spread in points makes it more convenient to compare spreads for different financial instruments. The smaller the spread, the more liquid the asset is, and the lower the costs for each transaction. There are limits on the spread on exchanges. If this level is exceeded, trading stops.

If there is a market maker on the market offering orders for both buying and selling, then he can form a fixed spread that does not change when the exchange rate changes. The more players on the market, the easier it is to make a fixed spread. Most often, this situation occurs in the Forex market, especially if you trade through a dealing center. On the stock market a constant spread is present when trading CFD contracts. If the spread cannot be kept within a certain range, then such a spread is called floating.

Often the cost of the spread is the main fee for opening a position, especially in the foreign exchange market. If the quote of the currency pair is 1.4545/1.4547, then the cost of the transaction will be equal to two points. Having bought a currency at 1.4547, a trader can immediately sell it only at 1.4545, i.e. two points cheaper. If the rate rises to 1.4547/1.4549, then the trader will be able to sell the currency at 1.4547, that is, he will “go to zero”.

On the stock exchanges a method often used is spread trading. It involves the simultaneous placement of two opposite limit orders on the exchange. A buy order is placed at the bid price, and a sell order, respectively, at the ask price. This technique is effective if the market does not experience a lot of volatility, and market orders are mostly executed inside the spread.

We wish you only profitable trading!

Spread is the difference between the best buy (ask) and sell (bid) prices of an asset (currency, shares, futures, options, etc.) at the same moment in a stock market or foreign exchange.

Buy low - sell high. This rule has been familiar to people since 687 BC. e. - the time of the appearance of the first gold money. Even then, clever merchants managed to pay less for goods.

They turned the coins in a circle, leaving some of the gold for themselves. And from buyers accepted full-fledged banknotes. So a precious metal settled in the pockets of merchants. Over time, to protect the coins, their edges began to be jagged. This made it possible to recognize money with a smaller weight by touch and stop fraud.

And although a trifle has not been minted from gold for a long time, the tradition of making the edge ribbed has been preserved. As well as the rule to buy and sell at different prices, actively used on Forex market. Only the difference between the purchase and sale price is called - the spread.

Ask and Bid - learn the Forex alphabet

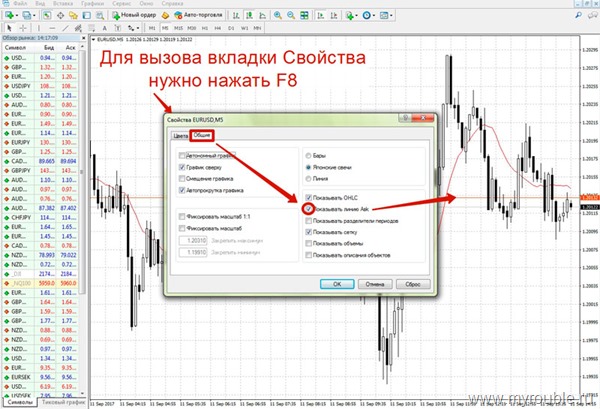

Before studying the spread in detail, you need to understand how it is formed. The Ask and Bid lines will help you with this. It looks on the graph as follows (Fig. 1).

Enlarge Image

In the Forex market, there are 2 prices at the same time: supply and demand. Best price The rate at which traders are willing to buy an asset is called Ask. And the one for which you can sell it - Bid (Bid).

And here lies the first trick of brokers: the Ask price is not reflected on the chart by default! Thanks to this, the trader successfully forgets about the price difference and ... gets into the money. You can enable the line in the Properties tab (F8 - General - Show Ask line). (fig2)

Enlarge Image

Let's look at an example. Trader Kolya wants to sell €1000, but there are no people in his town who want to buy the currency. A broker (intermediary company) gives him access to a huge market with thousands of buyers. And he offers to sell the euro for $1,175.

Meanwhile elsewhere the globe trader Petya wants to buy just €1000. And the same broker sells the currency to Colin for $1,221.

Broker income: $1,221 – $1,175 = $46. This is the spread. Only it is measured not in currency, but in points. Why? Let's talk further.

How the spread is measured - converting pips into money

What is a point? This is a change in the last digit of the quote. Note! There are 2 calculation systems: according to the old one, there can be 2 or 4 decimal places in the quote. For example, 108.57 for USD/JPY and 1.1987 for EUR/USD. And on the new one - 3 or 5 digits (108.578 and 1.19878, respectively). A point is a change in the 2nd or 4th digit after the decimal point. (fig.3)

Enlarge Image

The size of the spread depends on the size of the amount you are trading. The higher it is, the more deductions to the broker. Depending on the amount of the transaction, 1 point of the spread can be equal to $1, or maybe $1,000!

For example, when trading 1 lot, each point (that is, 0.0001) will be multiplied by 100,000. When entering the market with 2 lots, by 200,000 and so on. Therefore, if the spread is incorrectly calculated, then the entire deposit can be drained. More on this below, in the Leverage section.

Calculating the true size of the spread is difficult. After all, it depends on several conditions:

- Spread type (fixed or floating). The fixed spread is equal to the number of points agreed in advance in the trader's agreement with the broker. Floating - can change every second. The former is better suited for trading on the news and at night. And the second one is for long-term transactions (for a week, a month, etc.).

- Lot size. A lot is a portion that you are trading. Standard 1 lot = $100,000 (99 of which are given by the broker under the terms of leverage 1:100). But no one forbids the "diet regimen"! You can trade 0.1 and even 0.01 lots (10,000 and 1,000 respectively).

Attention! Floating spread "for convenience" is indicated by 0.000 points. But this does not mean at all that commissions are not charged on the pair! This is a signal to refine the current size additionally.

Leverage and spread calculation

And now about the leverage. Entering Forex with a hundred bucks is an unrealistic idea. After all central banks and corporations will not buy trillions bit by bit! The minimum transaction amount here is $100,000.

But what if 99% of traders do not have such free money? In this case, the broker is ready to substitute his leverage - the intermediary company. And this is called "shoulder" - credit. Its size can be 1:1, 1:10, 1:50 and even 1:500.

What does it mean? The broker adds the missing amount to your contribution in order to reach the required 100,000. And the number after the colon indicates how much the trader himself should invest.

For example, 1:100 means 1 lot (100,000) divided by 100. That is, you open a trade by investing $1,000 (100,000/100= 1,000). Another $99,000 is added by the broker. You can already trade with this amount!

But don't worry, out of the 99k credit you won't lose more than your deposit. As soon as the loss approaches the amount of the initial investment, Stop Out will be triggered. And the broker will take his money. Got it? Now back to spread calculation.

Example: EUR/USD transaction (rate 1.1920), 1 lot (remember that this is $100,000). 1 point under the terms of the deal will be equal to: ($100,000*0.0001)/1.1920 = $8.4.

Where did the number 0.0001 come from? This is the designation of 1 point in a four-digit quote (4 digits after the decimal point). 0.0001 is the step of the price movement on the chart. For example, 1.1920 - 1.1921 - 1.1922, etc. Each time the sum changes exactly by 0.0001.

The spread for the euro/dollar pair at Forex brokers is 0.5–3 points. This is written in the Contract Specification sections on the companies' websites. We multiply this number by $8.4 (the value of a pip in our trade) and we get $4.2–25.2.

Second example: USD / JPY (dollar / yen), also 1 lot, but at the rate of 110.65. 1 point here will equal ($100,000*0.01)/110.66 = $9. 1 point is indicated by the number 0.01, since the quote has 2, not 4 decimal places. On the USD/JPY pair, the spread is 2–4 points. These are the numbers you will find in the documents of brokers approved by the exchange. In our case, it is $18–36.

You can compare spread sizes in points for different brokers using the following table.

Comparison of spread sizes at TOP brokers in points

| Broker | Spread on EUR/USD | Spread on GBP/USD | Spread on USD/JPY | Spread on USD/RUB | Silver Spread XAG/USD | Spread on gold XAU/ USD |

| Alpari* | 0,8 – 1,3 | 1,3 – 2 | 1,2 – 1,4 | 18 – 19 | 22 – 25 | 26 – 32 |

| teletrade** | 1,5 | 1,6 | 1,7 | 40 | 5 | 40 |

| RoboForex*** | 2 | 3 | 3 | 40 | 3 | 100 |

| Forex4you | 2 | 3 | 2 | – | 5 | 100 |

| InstaForex | 3 | 3 | 3 | 40 | 40 | 60 |

| FxPRO | 0,6 – 1,4 | 0,9 – 2 | 0,6 – 1,6 | 40 | 3 | 30 |

| freshforex | 2 | 3 | 2 | – | – | – |

– the spread size is not specified in the Contract Specifications;

* floating spread in the European session (10:00 - 17:00 Moscow time);

** floating spread, indicated minimum value;

*** fixed spread on cent account.

Note! Floating spread can change significantly on the news and at night (increase by 10-15 times).

Minor sums, you say? Yes, for assets with high liquidity (those that sell and buy well), it can be ignored. But there are only about 10 such assets! You can find a complete list of them below. Now it's time for the third truth.

Liquidity comes first

What is liquidity? This is the ability of a product to sell and buy well.

Let's take an example from life:

What do you think, which car in the secondary market will be more liquid, Hyundai Solaris or Porsche Caen? Answer: Solaris. Let's look at the process of selling both cars through the eyes of the seller. There are more Korean cars on the market than Germans. The price for Hyundai is much lower, which means that there will be an order of magnitude more buyers for this brand. In other words, if you had both brands and decided to sell them, then it would be easier for you to find a buyer for Solaris at the right price. Caen will be sold for a long time at the price you need. And in order to sell it faster, you will have to lower the price a lot, which will be unprofitable.

Now let's look at the same example, but through the eyes of the buyer. Let's say you have 500,000 rubles. for a used Solaris for his wife and 2 million rubles. for a used Caen for yourself. Solaris at this price will be 100 pieces of which it will be easier for you to pick up a car that is not broken and technically sound. But Caens at this price will be 20 pieces, however, upon closer examination, many of them will disappear, since they will either be broken, or repairs will require considerable investments, in other words, it will be much more difficult to find an unkilled caen.

In the Forex market, the analogue of the Solaris is the euro/dollar pair. Every 3rd trader in the world (37%) trades this asset. This means that it has high liquidity and brings a regular income to the broker. Therefore, the spread here is minimal.

Unlike the USD/ZAR pair, which is an analogue of Caen (dollar/South African rand) in Forex. Have you heard of rand before? Now imagine how often it is bought, even if the name of the currency does not tell you anything. It is clear why the spread here is 80–250 points (considering the low exchange rate, this is $60–190 with a volume of 1 lot). However, liquidity does not only depend on the type of asset! (fig.4)

Enlarge Image

Influencing factors are time of day, holidays and news releases. Recall the Swiss franc, which collapsed in New Year holidays! And let's talk about how the spread changes, in different periods.

How to protect your deposit from spread jumps - 2 "golden rules"

Spread (even fixed) has the ability to expand. It is always stated in your contract with the broker that in cases of force majeure it may increase. This is exactly what happened to the Swiss franc in January 2015 due to the decision of the National Bank to stop cash injections to support the currency. Then the spread widened from 3 to 300 pips in 1 hour and traders suffered huge losses due to the Stop Out execution.

And with a floating spread, jumps are 90% more common than with a fixed one. The gap between bid and ask is widening:

- at night up to +50 points (especially from 21:00 to 00:00 until the Tokyo Stock Exchange is open);

- on holidays (liquidity drops due to the small number of players on the exchange);

- when important news is released (the ask price rises sharply, but the bid remains in place, or vice versa).

What follows from this?

Rule #1: if you want to win by using a lower floating spread, close trades before big news releases. Here are some examples of such important news:

- Nonfarm every last Friday of the month,

- speeches by the heads of central banks;

- presidential election results

- decisions on entry/exit from the EU, etc.

Rule #2: always check the actual spread. This can be done on the broker's website or by installing a program that displays this parameter in the MetaTrader window.

The following video will help consolidate the knowledge gained.

Spread or commission - 3 assets on which you can get rich or lose everything

Have you heard of zero spread accounts? A tempting thing! Up close, everything turns out to be not so rosy, because 0 spread points are compensated by the commission. And you pay the same amount, only it is called differently. But there are assets where commission and spread levels are very different (you can save up to 50%):

- USD/CAD (Canadian dollar): on zero spread accounts, the commission is 2 pips, and on traditional accounts it is 4 pips.

- XAG/ USD (Silver). This is the opposite option, when on accounts with a zero spread, the commission is 2 times higher than the traditional spread. Accordingly, the commission is 10 points against 5 points of the spread.

- BTC / RUB (bitcoin / ruble): commission - 0.1%, spread - 0.8%.

In what cases is the commission also more profitable than the spread?

- If a trader trades pending orders. That is, it sets a condition to automatically open a deal when the price reaches a certain level. In this case, spread may cause the order to fail. For example, news about the UK's exit from the EU is expected. The trader assumes that the pound will fall against this background. But he knows that at such moments the servers are overloaded, and it is almost impossible to open an order. Or is at work, away from the computer. The way out of the situation is a pending on the GBP/USD. According to it, if the price falls below 1.3398, a Sell order is opened. But there is still a spread of 8 pips! And in fact, the trade will not open until GBP/USD reaches 1.3390. And the quotation may not reach this level.

- The commission is also preferred by pipsers (scalpers). After all, if a trader makes a profit of 3-5 points, it is simply not profitable for him to give 4 for spread! Whereas the commission will be equal to 1 point.

- When trading intraday (when orders are not left overnight). Because of the spread, the price often does not reach Take Profit or knocks down Stop Loss. After all, this is a kind of “trailer” that the deal pulls with it. And there is no such problem with the commission.

Dangerous and safe transactions - how spread can "eat" your deposit

At the beginning of 2016, Chris Davison conducted an official study of the profitability of Forex trading. According to its results, only 30% of traders regularly earn. And here is an interesting coincidence! Only 30% of respondents check the spread size before opening a trade. Is there a connection between these numbers?

TOP 10 low spread assets

There are about 10 assets with low size spread (up to 5 points). This:

- AUD/USD - Australian dollar ("Audi") against the US dollar;

- GBP/USD - English pound to dollar;

- EUR / CHF - euro / Swiss franc (“chif”);

- EUR / GBP - euro / British pound sterling;

- EUR/JPY - euro/Japanese yen;

- EUR/USD - euro/US dollar;

- NZD / USD - New Zealand dollar ("kiwi") / US dollar;

- USD / CAD - US dollar / Canadian dollar;

- USD / CHF - dollar / Swiss franc;

- USD / JPY - dollar / yen;

- XAG / USD - silver / dollar.

Usually, these tools are enough to make a profitable trade. But there are times when it makes sense to trade other assets!

Where you can run into a $200 spread

High spread values are usually set on exotic currency pairs. As well as gold, corporate stocks and cross pairs (excluding USD).

Let's take gold as an example. Considering its growth by 8,500 points from August to September 2017, it is possible to invest in a purchase. But only if your deposit can withstand big drawdowns. After all, by opening a deal, you will immediately find yourself in the red from 18 to 80 points! This is how much the spread is for different brokers. The slightest rollback, and Stop Loss or Stop Out (lack of funds in the account) takes away your savings. (fig.5)

Enlarge Image

Other high spread assets (10 pips or more):

- AUD / NZD - "Audi" / "Kiwi" (Australian dollar / New Zealand dollar);

- GBP/AUD - British pound/Australian dollar;

- GBP / CAD - pound / Canadian dollar;

- GBP / CHF - pound / "chef";

- GBP/NZD – pound/New Zealand dollar (“kiwi”);

- EUR / AUD - euro / Australian dollar ("Audi");

- EUR/NZD - Euro/Kiwi;

- EUR/PLN - euro/Polish zloty;

- NZD / CAD - "kiwi" / Canadian dollar;

- NZD / CHF - "kiwi" / Swiss franc ("chif");

- USD / MXN - US dollar / Mexican peso;

- USD/PLN – US dollar/Polish zloty;

- USD/RUB – US dollar/Russian ruble;

- USD/ZAR – US dollar/South African rand.

Stop Loss and Take Profit - how to set the levels correctly

Spread affects the execution of Take Profit and Stop Loss. But before we figure out how, let's take a look at these concepts. (fig6)

Enlarge Image

Take Profit - an order to close a deal when a certain profit is received. Why is it needed? The price movement on the chart resembles steps. It cannot go in one direction all the time and jumps up and down, forming a corridor. The boundaries of this corridor are called support and resistance lines. For them, the quote goes out very rarely and immediately returns back.

Therefore, the trader always puts Take Profit in front of these lines. This is necessary to take profit before the price rolls back. How does the spread affect order execution?

It does not allow to close the order at the specified cost, automatically postponing the execution by several points. As a result, the chart hits the resistance/support line and reverses. And the trader is left with nothing!

A similar situation with Stop Loss is an order to close a trade with minimal losses. Only here the execution occurs before the price reaches the line you set. Again, by several points equal to the size of the spread.

How to deal with it? Set the spread value when calculating Take Profit and Stop Loss. That is, put Stop Loss a little further, and Take Profit - closer.

How spread affects trading strategy

Spread does not affect trading strategy if it is tied to long-term transactions (weeks and months). Indeed, in this case, the price goes up to 10,000 points. Against their background, the same 250 spread points are lost without damaging the deposit.

And vice versa, this type of deductions can reduce to zero the profitability from short term trading. It knocks down closely spaced Stop Losses, which is typical for scalping. It does not allow you to make money on the news, eats up profits from night trading.

Therefore, scalpers, as well as traders trading on the “night shift”, need to look for a broker with suitable conditions for the assets of interest for a long time. And carefully check the current spread values.

Rebate services – how to return up to 90% of the spread

Spread on Forex is one of the very pitfalls that have crashed more than one thousand deposits. But it turns out that you can also make money on it! How? By registering in Rebate-services.

These are Internet companies that are ready to return to the trader a part of the funds he spent on spread. Brokers themselves have a similar service, but the percentage there is much lower (about 15%).

Why take the spread first and then give it back? This is a multi-move, like in chess. The broker takes a commission from the trader. Then he enters into a partnership agreement with a rebate service to attract new customers for money. Further, the Rebate service advertises its services, attracting people to the broker's company, and receives its reward. He pays part of it in the form of interest on the spread. Everyone is happy!

conclusions

Let's summarize:

- Spread is the difference between the buy price and the sell price, or in other words, the difference on the chart between the Ask and Bid lines.

- If the Ask price is not reflected on the chart, then fix it in the terminal settings

- The spread is measured in points.

- To determine the spread, 2 calculation systems are used.

- The size of the spread depends on the size of the amount you are trading. The higher it is, the more deductions to the broker.

- The spread can be fixed and floating.

- The minimum spread is usually highly liquid assets, for example, the euro/dollar pair.

- High spread rates are usually set on exotic currency pairs.

- The spread is also affected by the time of day, holidays and news releases.

- To protect yourself from spread jumps, always close trades before the release of important news and regularly check the relevance of the spread value.

- The spread can be zero, but this does not always mean a benefit for the trader, because in this case the broker's commission comes into play.

- According to research, only 30% of traders check the spread size before opening a trade.

- You can return part of the spread if you use Rebate services.

- Spread influences the investor's trading strategy if it is based on scalping, cross pairs, gold or exotics.

- It reduces the likelihood of triggering pending orders and Take Profit. And vice versa, it increases the probability of hitting Stop Loss. Therefore, when setting these levels, set the spread size in them.

We hope our tips will help you avoid losses in the Forex market and make your trading strategy even more profitable. Like and don't forget to subscribe for new articles.

Video for dessert: Chic log lamp

Alexander Gushchin

I can't vouch for the taste, but it will be hot :)

Many consider oil and spread to be homogeneous products, which is not true. Products differ in composition, useful, harmful properties, effects on the body. Since 2004, GOST means that the spread is not butter, the product is not included in this category, but has its own requirements for taste and appearance. A distinctive feature of the oil is the price (at least 200 rubles per pack). A substitute costs two or three times less.

What is spread

A food product based on milk and vegetable fats (from 39 to 95%) is called a spread. Translated from English, the word spread (read "spread") means smearing or stretching. The product is not margarine or butter, as it is not made from natural cream, but based on fats. Additionally, flavors, flavors and vitamins are used to make a substitute.

Prior to the appearance on July 1, 2004 of the GOST of Russia “Spreads and melted mixtures. General technical conditions ”(GOST R 52100-2003) the product was called together with the word oil: “light”, “soft” or “combined”, etc. With the adoption of GOST, the spread got its name, a product category, which must be indicated on the packaging. This is the general name for all spreadable products (including mixtures of vegetables, cottage cheese or other products), the word "spread" is rarely used.

A quality product can be distinguished by taste and appearance, to which certain requirements are imposed. According to GOST “Spreads and melted mixtures. General specifications "(R 52100-2003) oil spread must:

- be plastic, even when chilled, retain the property of easy spreading on bread;

- have a color from completely white to yellowish, glossy;

- have a slightly shiny, shiny, dry cut;

- be of uniform consistency;

- have a taste and smell of sweet-cream, sour-cream, cream or the taste of aromatic additives;

- milk and cream that have not passed the veterinary and sanitary examination and are not documented are not allowed to manufacture the spread;

- the composition should not contain antioxidants: butylhydroxyanisole, tert-butylhydroquinone, butyloxytoluene, gallates.

Compound

The substitute consists of vegetable and milk fats (its type depends on their percentage: vegetable-creamy, vegetable-fat or creamy-vegetable). The chemical composition consists of saturated fatty acids (monounsaturated and polyunsaturated) and vitamin A, does not contain cholesterol in large quantities. The composition of the ingredients consists of:

- milk fat;

- natural or modified vegetable oils: coconut and palm;

- milk or cream;

- food additives (preservatives, dyes, flavor enhancers) and antioxidants (E310-E313, E319-E321).

Kinds

The spread is distinguished by the percentage of fat per product with a low (from 39 to 49.9%), medium (from 50 to 69.9%) or high (from 70 to 90%) percentage of fat content. There are three types of this product:

- Vegetable-creamy. A sweetish substitute for a creamy product (more close to it) with a high nutritional and biological value. By consistency, it is plastic, soft, well smeared on bread. The product is combined in composition, so it includes: palm, coconut, soybean oils, emulsifiers, natural dyes, flavors, sorbic acid. Fats make up to 82% of the total nutritional value. Calories: less than 670 kcal per 100 grams. The shelf life of the product is within 120 days.

- Vegetable fat. The composition of this product substitute: fats of vegetable, animal origin, vitamins A, D, phytosterols, minerals, a small amount of butter. The latter indicator affects the fact that there is almost no cholesterol in the product. The substitute contains a minimum of calories: 360 kcal per 100 grams. Vegetable-fat butter substitute spread is used in the prevention of heart disease associated with obesity.

- Creamy vegetable. The composition is enriched with vegetable oils. Slightly sour solid product is rich in polyunsaturated acids, which allow you to normalize the activity of the cardiovascular and digestive systems, biological fibers, pectin, inulin. The fat content is up to 85.5%. Shelf life - up to 3 months in the refrigerator.

Benefit

A well-made spread according to all the rules of GOSTs leads to improved health. The positive qualities of a butter substitute include:

- low calorie;

- a small percentage of cholesterol (replaces a creamy product for people who monitor indicators);

- high nutritional value;

- a product surrogate can be included in the diet when losing weight on a diet;

- the composition contains vitamins (E, D, A,);

- the composition is rich in minerals;

- quality compositions are enriched with acids (Omega-6);

- substitute improves health;

- regulation of digestion;

- slowing down the aging of the body;

- does not contain harmful preservatives;

- preventing diseases;

- has a long shelf life.

Harm

Negative consequences Spread consumption occurs if the product contains cholesterol, trans isomeric acids and trans fats (hydrogenated). Excessive consumption can lead to diabetes, vascular and heart problems, infertility, Alzheimer's disease, oncology (in difficult cases). Doctors strongly recommend using the product if the percentage of trans fats is not more than 8%.

Spread manufacturers solve this issue by replacing oils with palm or coke oils, which do not contain dangerous fatty substances. Doctors focus on the content of sunflower and soybeans in the product, which pose a health hazard after processing. The composition of a safe product dispenses with these types of product. Substitutes obtained by enzymatic interesterification from several fats are recognized as harmless.

What is the difference between spread and oil

The GOST states that the spread does not belong to the “oil” category. This is due to the difference between them in a number of properties:

- Fats. Butter is made from natural fats ( percentage not less than 64%), spread - half consists of vegetable fats.

- Additives. As part of the substitute, you can find palm, coconut, sunflower oils (together or one type). Saturated fats predominate in the creamy product. In 2005, the WHO (World Health Organization) recommended reducing saturated fat to avoid the risk of heart disease.

- Production method, corresponding trans fat indicator. The spread is based on hydrogenation, which excludes or minimizes trans fats in the composition (this also distinguishes the product from margarine). Permissible safe rate for the body - no more than 8% concentration. In a creamy product, trans fats occupy about 10% (excessive consumption, especially in summer, is prohibited).

- Calorie content. A distinctive feature in the store will be that the substitute is on average 100 kcal less calories than the oil product.

- Package. The easiest way to understand what kind of food is on the counter. It is mandatory to indicate on the front or back whether the product is an oil or a spread (often the word "oil" is indicated in large letters on the package, and "spread" on the back in small print). For the latter, the variety is indicated on the package.

Video

Did you find an error in the text? Select it, press Ctrl + Enter and we'll fix it!

Many people believe that the spread is a low-quality analogue of oil, but they are mistaken. In fact, this is a very healthy and low-calorie product with high nutritional value.

Spread and its types

This combined oil substitute only came into wide production in 2003. The name came from English word"spread", which literally translates as "smearing". Since 2008, in Russia, a spread is understood as a food product that is made from milk and vegetable fats (at least 39% of the total mass). The substitute has a plastic consistency and is easily smeared on bread.

There are three types of spread:

1. Vegetable fat.

2. Vegetable and creamy.

3. Creamy vegetable.

Each of these substitutes differs in the content of milk fat. In the first form of the product of this substance should be less than 15%, in the second - from 15 to 50%. The most high-calorie is the creamy-vegetable spread - this is a product with a milk fat content of more than 50%. In dietology, all three types are allowed.

It is impossible to ignore such a thing as the return of the spread to the state of the oil. If desired, you can make a full-fledged fatty product from a substitute, but this is impossible at home.

The difference between spread and butter

What these two products have in common is that they are made from milk cream. If natural fats are used for manufacturing (at least 64%), then it will be butter. Spread is a combined product. It should at least half consist of vegetable fats.

For the manufacture of a substitute, oils such as palm, sunflower, coconut are used. Most often, the spread includes all three types, but sometimes manufacturers save on quality, limiting themselves to one of the cheapest ingredients. It should be noted that the consistency of the product depends on the concentration of coconut and palm oils, and the enrichment of the substitute with polyunsaturated acids depends on sunflower oil. Often an olive is added to the composition.

Spread production is based on the hydrogenation of oils. This method allows you to exclude the ingress of trans fats into the composition of the substitute. No more than 8% concentration of these substances is allowed, otherwise the product will be unsafe for the body. In the future, it is planned to reduce this figure to 5%. As for butter, cream contains about 10% trans fats, so its excessive consumption, especially in summer, is strictly prohibited.

Spread is a food product created artificially. However, it is enriched not only with vitamin complexes and microelements, but also with phospholipids.

Advantages

One of the main advantages of a butter substitute is that, due to the low concentration of milk fat, it practically does not contain such a harmful substance as cholesterol. When creating a spread, many manufacturers use interesterification technology, thanks to which final product enriched with positive acids, for example, Omega-6. This substance is necessary for the body to normalize the activity of the cardiovascular system and lower cholesterol levels.

It should be noted right away that the spread is the only fatty product allowed for the first and second degrees of obesity. It cannot be said that it has few calories, but their number is much less than in the same butter. Also, this substitute is able to improve metabolism, removing excess acids from the body. Spread is allowed even with strict diets. In addition, it is useful for the prevention of many heart diseases, such as ischemia.

The results of numerous studies have repeatedly demonstrated the organoleptic properties of the product, due to which the substitute does not cause allergies and is quickly absorbed in the body.

vegetable cream type

This type of butter substitute has a slightly sweet taste. By consistency, it is plastic, therefore, it is well smeared on bread. In addition, the product has a high biological and nutritional value and is widely used in dietetics.

The vegetable-cream spread indicator, which distinguishes it from all other types, is a combined composition. A real quality substitute must necessarily include oils such as palm, coconut and soybean. Cow's milk is used only in skimmed form. Also, the composition of this spread includes emulsifiers, natural dyes, flavors and sorbic acid.

Most of the nutritional value of the substitute is given to fats - up to 82%. The rest is equally divided between proteins and carbohydrates. As for calories, it should not exceed 670 kilocalories per 100 grams. The shelf life of the product depends on the method of its creation and varies within 120 days. It is recommended to store it only in the refrigerator.

Vegetable fat spread

The composition of this type of food substitute includes fats of both vegetable and animal origin. Also, the product contains a small amount of butter, so there is practically no cholesterol in it. The spread indicator of vegetable-fat origin is its minimum calorie content. For 100 grams of product, the energy value will be about 360 kcal. As for the chemical composition of the substitute, it is similar to ordinary margarine.

This type of spread is the lowest calorie, but it is also the least nutritious of all the others. The fact is that there are practically no milk fats in it. In production, they are replaced with oil from sunflower seeds or soybeans. Thus, the amount of trans fats, which impair metabolism and prevent useful substances from being fully broken down and absorbed into the blood, is minimized.

The vegetable-fat spread contains such groups of vitamins as A and D, as well as phytosterols and vital minerals. The product has received the widest application in dietetics, as it contains many times fewer calories than butter. In addition, the substitute is recommended in the prevention of serious heart disease associated with obesity.

Return of this type of spread is not possible, since its chemical composition is significantly different from oil. The shelf life of the product varies within five months.

Creamy vegetable variety

The quality of this type of substitute directly depends on the fat content. The composition includes mainly oils of vegetable origin. That is why this product is so rich in polyunsaturated acids, which allow you to normalize the activity of the cardiovascular and digestive systems.

Creamy-vegetable spread is used less often than other types of substitutes in dietology, since its fat content significantly exceeds 50%. Sometimes the figure reaches 85.5%. This type of substitute is produced only by interesterification, due to which a large amount of trans fats is removed from the product. The creamy-vegetable spread tastes slightly sour. Consistency is noticeably firmer than other types. The ratio of milk fat in the product can reach 11%.

The composition of the creamy-vegetable substitute includes many biological fibers, as well as pectin and inulin, which are extremely beneficial for the body. The first strengthens the ionic bond of metals, and the second normalizes digestion. Shelf life in the refrigerator - up to 3 months.

Calorie content of creamy-vegetable spread

The energy value is determined by the amount of fats included in the substitute. Both vegetable and animal oils are taken into account. The ratio of these components is approximately 3 to 1. That is why this spread is a vegetable product.

The substitute can have both 50% fat and 80%. The most common creamy-vegetable spread contains about 72%. There are manufacturers who produce a product with a fat content of 85.5%.

The calorie content of such a spread is from 900 kcal. Recommended for people with high blood lipids.

The benefits of a creamy-vegetable spread

This substitute is allowed to be included in the daily diet, as it helps to normalize the work of almost all internal organs person.

Its main advantage lies in the low content of cholesterol, which leads to the destruction of the walls of the arteries (the result of the disease can be an ischemic stroke or myocardial infarction).

Creamy-vegetable spread contains special fatty acids that improve the activity of the central nervous system. It also contains a whole complex of vitamins such as A, D, E and K.

To date, a very small number of people are familiar with such a concept as "spread". What is spread? Where is it used? Some say it's a type of butter, while others say it's margarine. Let's look into these issues.

Spread - what is it?

In fact, spread (translated from English as “spread”) is not margarine or butter. Although at the first appearance of this product in our country it was claimed that this is a special type of oil - “light”. But about ten years ago, the views on these products changed significantly, because GOST was created, which clearly stated that the spread does not belong to the “butter” category.

As you know, butter is a product that is made from natural cream, the fat content of cream varies between 50-80%. And the spread, in turn, is made from milk fat or various kinds vegetable oil, sometimes it is possible to add other components. According to its structure, the spread belongs to plastic types of products, and its fat content is in the range of 40-95%.

Due to this difference in fat content, spreads are divided into two types:

- Spread with a low percentage of fat content.

- Spread from a high percentage fat content.

The main element in any spreads is vegetable oil.

Vegetable Spread Features

Vegetable spread only 49% (and sometimes less) consists of milk fat, the remaining percentages are various vegetable fats.

When buying a vegetable spread, it is imperative to read the composition, since its quality directly depends on the type of vegetable fat that was used to make this product. For example, hydrogenated fat is very dangerous for human health. The danger is manifested in the fact that it contains transisomers that can cause problems with blood vessels and the heart.

To reduce the risk of morbidity when using this type of spread, it is recommended to buy a vegetable spread, which includes palm oil. It does not harm human health, because it is a natural product. You can also pay attention to vegetable spreads, which include various vitamins.

Features of vegetable-fat spread

The vegetable-fatty spread is distinguished by the fact that it contains fats obtained both from plants and animal origin.

This type of spread was created to be a substitute for natural butter, but it never achieved its goal.

Vegetable fat spreads are highly nutritious and low in calories. According to average calculations, 360 kcal are present in 100 grams of product. It is important to note that the properties given type spread is very similar to regular margarine.

When creating a high-quality vegetable-fat spread, vegetable fat is mainly used and only a small proportion of animal fat or its substitutes in general.

What kind of spread is better to use?

Spread - what is it? How to choose it correctly? Despite the different composition, vegetable and vegetable fat spreads can be of the same quality. Therefore, when choosing a spread, you need to focus on taste, health status and the composition of the spread.

For lovers of food with a low percentage of fat, a vegetable-fat spread is great, and for those who prefer more fatty foods, you should pay attention to vegetable.

The best spread is the one in which low interest transisomers.

Positive aspects of using the spread

Spread - what is it? Can it be useful for the body? Due to the fact that the spread belongs to a low-calorie type of food, but has a high degree of nutrition, even women who are on diets can use it. The benefit of the spread is that it is able to satisfy hunger and not add excess weight.

These products can be stored for a sufficiently long period, after which it is possible to use them raw or add flour products during baking.

The composition of the spread includes many vitamins that improve health, slow down the aging process of the body, and prevent the emergence of new diseases.

In addition, the spread is much cheaper than butter and some types of margarine.

How to distinguish oil from spread?

It is quite easy to distinguish spread from natural butter. The main difference is that in the manufacture of the spread, various vegetable fats, food additives, vitamins and, of course, vegetable oil are added to it. In addition, this product is divided into several types. This can be determined by the elements present in the product and by the degree of fat content.

You can also pay attention that the spread has fewer calories per 100 grams than butter.

In stores, product packaging indicates whether it is butter or spread. If the packaging indicates that this is a spread, then there must be an inscription where the variety will also be indicated.

After analyzing these factors, it is very difficult to make a mistake when the spread differs from the oil. The only thing they have in common is similarity. appearance and taste.

Negative moments when using the spread

The main negative factor in the use of the spread is the presence of trans fats in its composition (these fats are formed chemically). Unfortunately, a large percentage such fats can lead to serious diseases, among them diabetes mellitus, problems with blood vessels and the heart, and in difficult cases, even the appearance of oncology is possible. In order to avoid such problems, you need to carefully monitor the composition of the spread, especially the presence of trans fats and what their percentage is. Medical workers claim that the spread can only be consumed if the percentage of trans fats does not exceed 8%. You also need to look at the percentage of fat in those products.

What is included in the spread, its main varieties

The main components of the spread:

- Milk fats.

- Natural and artificial cream.

- Butter.

- Various vegetable oils, both natural and artificially obtained.

- All kinds of nutritional supplements and vitamins.

A spread is considered to be of high quality and safe for health if it contains less than 8% trans fats.

Depending on the elements that make up the spread, it is divided into several varieties:

- Creamy-vegetable spread - the amount of milk fat in the composition of the product varies from 50 to 95%.

- Vegetable spread - the amount of milk fat in the composition of products varies from 15 to 50%.

- Vegetable-fat spread - milk fat is either completely absent or does not exceed 15%.

Depending on the amount of fat in the spread, there is another division into types:

- High fat spreads - fat is between 70 and 90%.

- Spreads with an average percentage of fat content - the proportion of fat in the composition is from 50 to 69.9%.

- Low Fat Spreads – Fat ranges from 39% to 49.9%.

Although the spread has not surpassed butter in popularity, it is a widely used product. Therefore, before you start to feel negative about the spread, it is recommended to try it. You just need to be sure that it is really a spread, and not a fake, and that it is really of high quality.

Bon Appetit!