We can see the same information in the 1C 8.3 program: Go to the account description: In 1C 8.3, a description of the account is displayed: where the expenses of future periods are reflected in 1C 8.3 in the program 1C 8.3 Accounting 3.0, a special directory has been created to reflect those or other RFBs: in this directory Cards already created by the RFB are stored, and there is also an opportunity:

- Create the new kind RBP;

- Grouped by "folders" (groups) already available cards;

- Or find the necessary RFB:

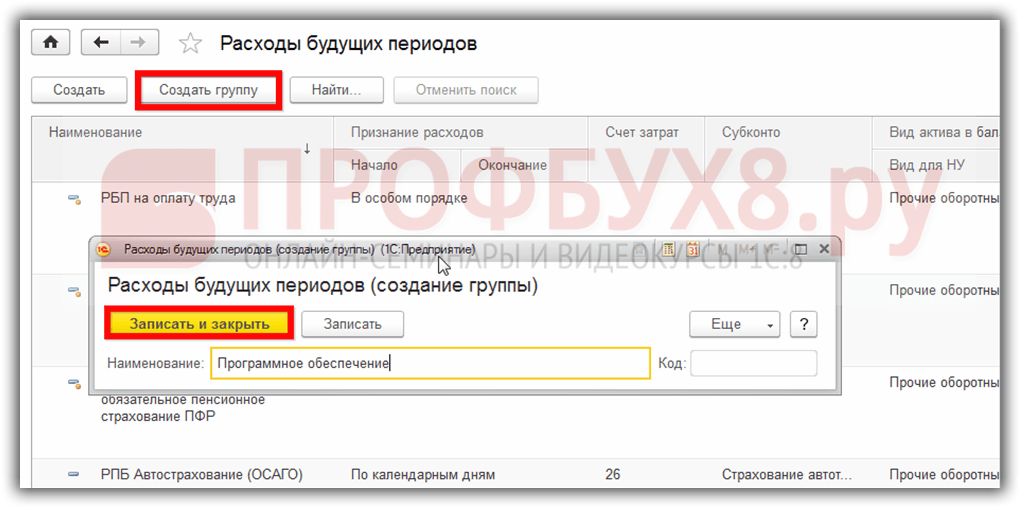

How to reflect the expenses of future periods in 1C 8.3 - step by step 1, for example, create a card of this type of RBP as "Program 1c accounting company Basic" and put it and others software products The Software Group. To do this, create a group of software: Step 2 After that, we postpone into this group already available in the RBP list.

Expenses of future periods in 1C 8.3, inventory, write-off, accounting

To do this, press the Add button to add and fill out the output card of the nomenclature: the name of the nomenclature in the program 1C 8.3 is used to search for goods / services. It is more convenient to make it brief and informative to make it easier to use the fast search in the program.

And the full name is the name of the nomenclature from the receipt document. Both of these names may coincide (then choose the name from the receipt document): It is very important for the integrity of accounting in 1C 8.3 Accounting 3.0 to create one card for one type of nomenclature.

That is why creating a new type of product / services more correctly use typical / established names, or adopted at the enterprise.

Inventory of expenditure of future Inv-11 periods for BP 3.0

In the fields "Expenses of future periods", select the previously created element of the same name of the directory of the same name. The cost division is not mandatory, but we still fill it.

Additional analytics will not hurt us. Next, click on the "OK" button and swipe the document. The image below shows the movements of the created document of the receipt.

Important

As you can see, in the wiring not only the invasions we needed, but also subconto. Write off the expenses of future periods. Write-off RBP in 1C 8.3 Accounting is performed when closing the month.

In this example, the expense of the program, attributed to the expenditures of the future periods, should be debited during the year monthly.

Reflection of the expenditures of future periods in 1C accounting 8.3 (3.0)

Under the expenses of future periods in 1C Accounting 8.3 imply the expenses that we suffered in the past or reporting periodBut at the same time they will be included in the cost of goods or services produced by us. Simply put, bought now, and income will be in the future. For example, we bought the 1C: ERP program. This program Let us reduce the labor costs of workers (dispatchers, technologists, storekeners). Thus, we will not have to consequently increase staff.

We can also optimize the costs of manufacturing and loading manufacturing workshops. Also, the program will allow us to competently build plans, which will undoubtedly affect the revenue of the enterprise in a positive side.

The cost of buying software can be attributed to the expenditures of future periods in accordance with the second paragraph of paragraph 39 PBU 14/2007.

Inventory of the expenditure of future periods of the Involution

Summary of the Report Connection Instructions To connect a report, you must in the Administration section on the Navigation Panel to use the command " Printed forms, Reports and processing "-" Additional reports and processing ". Next, in the form of a list of additional reports and handlers, use the "Create" button.

Attention

A recording form with an external report file selection dialog will appear. Select a file. Then you must specify the sections in which the report will be available.

In the "Quick Access" column, specify users who need this report. And in conclusion, click the "Record and Close" button. After recording, the report may be launched by selecting the command<Выбранный — «Отчеты» — «Дополнительные отчеты».

Expenses of future periods in 1C 8.3 Accounting

We indicate respectively the starting off date and the end date. Pour 267 video tutorials for 1C for free:

- Free video tutorial for 1C accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

Now you can click the "Record and Close" button and go to the registration of the adoption of expenditure of future periods: Registration of expenditure of future periods in 1C 8.3 Registration We produce a document "Receipt of goods and services" on the "Services" tab. We go to the "Shopping" menu, hereinafter refer to the "Arrival of goods and services".

Click the "Arrival" button and select "Feed Services". The document cap fill as usual during admission (described more than once).

There should be no questions here. Let us turn to the filling of the tabular part. Add a new string, choose the nomenclature, indicate the number and amount.

8.x Inventory RBP

The expenses of future periods can be written off daily, monthly, at the same time, any other ways to your discretion. Content

- 1 Handbook "Expenses of future periods"

- 2 FUTURE CONTENTS OFFER

- 3 Write off future periods

Handbook "Expenses of future periods" First of all, you need to add to 1C 8.3 our purchase of the program.

To do this, open the Handbook "Expenses of future periods". It is located in the "Directories" section. As a name, we indicate "Program 1C: ERP". In the fields "View for Well" and "asset type in balance" will leave the default values. In the "Amount" field, we specify the cost of the program you purchased - 360,000 rubles. We will recognize the costs for months during the year, starting from the current date. As an article costs in this example, it is more correct to indicate the 26 account - "general expenses".

Expenses of future periods in 1C 8.3

Service in 1C 8.2 (8.3) See in our video lesson: Step 7 In the document receipt of services: Act we see purchased RBP, indicate its quantity. And in order to correctly reflect the price, you should pay attention to the right upper angle of the document: Depending on how the attendance is available on the hand (the price is "with VAT", or "without VAT, or" including VAT ") and Selection is dependent:

- If the price of the purchased Tru in the document is already indicated with VAT, then must select the price of the VAT document in the amount in order for the 1C 8.3 program to re-accrued VAT for the cost of labor.

- If, in the receipt document, the prices are shown without VAT, but the supplier and your organization - VAT payers, should choose VAT from above so that the program 1C 8.3 automatically accrued VAT for the cost of labor.

- If you get the goods without VAT, then in the price of the document there is no need to go.

Write off the expenditure of future periods is produced in three ways:

- monthly, in a specific date range;

- daily (referring calendar days), in a specific date range;

- arbitrary (special) way. As a rule, it means a one-time write-off.

These settings are specified in the "Expenses of Future Expenditures" of the same name. Acquaintance with the expenditure of future periods Let's start with this reference book and its fill. Entering a new object and configure the debiting of expenditure of future periods will go to the directory. We will enter the "Directories" menu, then into the submenu "Expenses of future periods". In the list of elements of the reference book, click the "Create" button. The setup form opens. Fill the following details forms 1C:

- Name. Suppose we purchased a domain in the "RU" zone.

So impress: "Domain in the zone" RU ".

- View for tax accounting purposes will indicate "Other".

- The type of asset in the balance sheet: "Other revolving stocks".

- Field "Amount": indicated solely for information purposes. The amount of the write-off is calculated by the algorithm below and on the basis of the balance of the amount to write off according to the accounting data.

We indicate here the amount of buying a domain - 2600 rubles. per year.

- In the write-off parameters, we indicate the frequency. For example, "by months".

- Cost account Let it be 26.

- Article costs - "Other expenses".

- It remains to specify the period for which the full cost of expenses should occur. Suppose we plan to run and make our website popular for 4 months.

Let us consider in this article the question of how to take into account the costs of future periods in 1C 8.3 "Company Accounting 3.0". RBP in the 1C accounting program 8.2 is reflected in the same way, so you can use this instruction for older versions of 1C.

The expenses of future periods (RBP) are the costs that we have taken into account in the current period, but we plan to receive income in the future. In other words, they spent today in order to receive income tomorrow.

Such expenses do not have to directly affect profits. For example, we bought a domain (domain name) in order to deploy the website of your company. The purpose of the site is to attract customers who will bring income to us. Since the site first needs to be created, then "promotion", profit it will begin to bring only some time after some time. Domain purchase costs and are expenses of future periods.

Write off the expenditure of future periods is produced in three ways:

- monthly, in a specific date range;

- daily (referring calendar days), in a specific date range;

- arbitrary (special) way. As a rule, it means a one-time write-off.

These settings are specified in the "Expenses of Future Expenditures" of the same name.

Acquaintance with the expenditure of future periods Let's start with this reference book and its fill.

Go to the directory. We will enter the "Directories" menu, then into the submenu "Expenses of future periods". In the list of elements of the reference book, click the "Create" button.

The setup form opens. Fill the following details forms 1C:

- Name. Suppose we purchased a domain in the "RU" zone. So impress: "Domain in the zone" RU ".

- View for purposes Point "Other".

- The type of asset in the balance sheet: "Other revolving stocks".

- Field "Amount": indicated solely for information purposes. The amount of the write-off is calculated by the algorithm below and on the basis of the balance of the amount to write off according to the accounting data. We indicate here the amount of buying a domain - 2600 rubles. per year.

- In the write-off parameters, we indicate the frequency. For example, "by months".

- Cost account Let it be 26.

- - "Other expenses".

- It remains to specify the period for which the full cost of expenses should occur. Suppose we plan to run and make our website popular for 4 months. We indicate respectively the date of the beginning of the write-off and the end date.

Get 267 video tutorials for 1C for free:

Now you can click the "Record and Close" button and proceed to registration of the expenditure of future periods:

Calculation of expenses of future periods in 1C 8.3

Registration We produce a document "" on the "Services" tab.

The document cap fill as usual during admission (described more than once). There should be no questions here.

Let us turn to the filling of the tabular part. Add a new string, choose the nomenclature, indicate the number and amount.

Of interest is the column of accounting accounts. It is necessary to delete what the program offers by default, and click the Account Selection button. In the window that opens, indicate:

- Accounting cost accounting: 97.21.

- The first subconto account will indicate our entry in the Handbook "Expenses of future periods", namely "Domain in the" RU "zone.

- For the completeness of analytical accounting, we also specify the unit.

Tax accounting is configured similarly.

Here is an example of setting account account accounts:

An example of a completed document:

Let's look at the accounting wiring, which formed us program 1C:

We are convinced that expenses were received at the expense of 97.21 and will be taken into account until it is taken into account. A residue to write off can always be seen by forming a reverse balance of the account.

Write off the spending of future periods in the postings when closing the month

The logic of reflection of expenditures of future periods is maintained for several versions, so the instruction will be valid for "and earlier releases.

Accounting for future periods is needed in order to reflect the costs of rapid returns in accounting. For example, you have passed building materials for construction, which will be started after a while, or acquired original software. As a result of such expenses, receiving income on them.

In the program 1C, it is possible to write off the RBR with several options:

at the same time;

daily;

monthly.

You can set these parameters in the relevant reference book "Expenses of future periods". Let's look at its structure. The directory is located on the "Directories" menu tab in the "Future Expenditure" section.

Fields are filled here:

Name. Based on the existing example, we enter the name of the new element.

View for well - indicate "Other".

The type of asset in the balance sheet - we indicate "Other current assets".

The amount is indicated for the year.

Recognition of expenses is the periodicity of write-off. We specify a preferred period, for example, "by month."

The beginning of the write-off and ending - the dates are indicated, for which the full cost of costs should be written off.

Cost account - indicate what article the expense.

Article costs - indicate "Other costs".

After entering all the information, write and closes. We will take into account the RBP. Go to the "Shopping" menu tab and click on the link "Receipt of goods and services".

Through the "arrival" we create a new document. Filling in the header standard. The table part add a nomenclature unit, quantity and cost. Attention should be given to the account of the Account Account. Here it is necessary to change the data proposed by the program to the other:

Cost account in bu and well - 97.21;

Expenditure of future periods - in both cases the same values \u200b\u200bthat choose from the RBP reference book;

Cost division - which category refers;

Accounting account VAT - Leave 19.04.

We carry out and check the movement of the document of receipt:

The receipt is issued correctly, and the expense was received at the expense of 97.21, where it will be listed after writing off the entire cost. Through the report, the "Reverse Sald Body", if necessary, you can check the residual amount.

They are written off the RBP processing "Closing the Month":

If everything is performed correctly, in the closing wiring you can see a partial write-off of the amount on the Accounting and Tax Accounting tab. And on the "Calculation of the Writing Office of Future Expenditure" tab, you can view the detail.

At the end of each month, the accountant performs the so-called "regulatory transactions of the closure of the month." One such operation is to determine the amount of expenditure of future periods to be included in the costs of the current period. How to fulfill these calculations using the program "1C: Accounting 8" and get the necessary accounting certificates on the results of the calculation, says S.A. Haritons, Professor of the Financial Academy under the Government of the Russian Federation.

Expenditures related to future periods

In the process of carrying out commercial activities of the Organization, expenses are made, which for one or another considerations cannot be included in the cost of the current period both in accounting and tax purposes.

In accounting, such expenses are called expenditures of future periods. For their accounting, 97 "expenditure of future periods" is intended. In Chapter 25 of the Tax Code of the Russian Federation "The Income Tax" The term "expenditure of future periods" is not used, but, based on the procedure for recognition for tax purposes, certain types of expenses are considered as follows.

The first question that accountants are often asked: what expenses are the categories of expenditure of future periods?

For a response to this question, we turn, first of all, to the accounting account of the financial and economic activities of organizations and instructions for its application, approved by the Order of the Ministry of Finance of Russia from 31.10.2000 No. 94n. An exemplary list of such expenses is contained in the account characterization of 97 "Expenses of future periods", according to which the costs associated with future reporting period be considered in the current reporting period, can be considered expenses related to:

- with mining and preparatory work;

- with preparatory work in connection with their seasonal character;

- with the development of new industries, installations and aggregates;

- with land reclamation and other environmental activities;

- with unevenly produced during the year repair of fixed assets (when the organization does not create an appropriate reserve or fund), etc.

Immediately note that this list is not exhaustive (i.e. closed), it can be expanded, supplemented by the organization on its own. For example, the expenditures of future periods recognize the amount of salary for the vacation period in the part of them, which falls on the following months after a month; The costs of acquiring non-exclusive rights to computer programs for which the contract with the copyright holder or order of the head has been established for useful life, and so on.

In recent years, accountants in the qualification of costs as expenses relating to future periods are increasingly guided by the norms of chapter 25 of the Tax Code of the Russian Federation. On the one hand, this makes it possible to reduce the risk of incurring the tax base and, as a result, the amount of income tax payable to the budget. On the other hand, the accounting of accounting of expenditures of future periods according to the rules of tax accounting eliminates the occurrence of differences and reduce the complexity of accounting work. However, it should be borne in mind that this approach is applicable only to those costs that are recognized by the expenditures of future periods not only for income tax purposes, but also for accounting purposes. For example, the expenditures on the development of natural resources can be taken into account as expenses of future periods, and the costs of research, experimental and technological work, which have given a positive result - no, because in accounting such expenses are taken into account in the manner prescribed for intangible assets, with Application of account 04 (subaccount 2).

Accountants often allow mistakes when they qualify individual payments to counterparties as expenses of future periods.

As typical, it is possible to recognize the costs of future costs to pay for periodic publications (including the ITS disc), advertising in the media, the annual subscription service for the provision of consulting services, Internet access, mobile services, etc. P. In fact, in all cases listed above, there is a preliminary payment (advance) at the expense of the upcoming supply of values \u200b\u200band providing services, which, in accordance with paragraph 3 of PBU, 10/99, is not recognized.

The fact is that the main condition for the qualification of these operations as leading to recognition of the consumption should be complete confidence that as a result of its commission there will be a decrease in the economic benefits of the organization (the third condition provided for by paragraph 16 of PBU 10/99). So the payment forward does not mean that the organization will receive what has listed funds, since under certain conditions they can be returned to the payer. For example, according to paragraph 12 of the rules for the dissemination of periodic print publications on a subscription (approved. Decree of the Government of the Russian Federation of 01.11.2001 No. 759) the subscriber may refuse to execute the subscription agreement before the transmission of the next copy (specimens) of the periodic printing. In this case, the subscriber is paid the price of a subscription of affected instances.

A similar procedure is provided for by clause 62 of the Rules for the provision of local, intrazone, long-distance and international telephone services (appliance. Decree of the Government of the Russian Federation of 05/18/2005 No. 310), according to which the Subscriber may unilaterally refuse to fulfill the execution of the Treaty, provided that payment is actually incurred Cost Operator.

Thus, payments on the account of the upcoming supplies of values, performance of work should be taken into account in the composition of receivables, rather than expenses of future periods.

Accounting for future periods in "1C: Accounting 8"

To summarize information on the presence and movement of expenditure of future periods, 97 "Expenses of future periods" is intended. Its use in the program "1C: Accounting 8" has a number of features. They are due to the fact that accounting is both accounting and tax accounting on income tax, but using different account plans. In this regard, the account 97 is in each of these account plans, but there are differences in their configuration.

In terms of accounting accounts 97, two subaccounts 97.01 and 97.21 are open (see Fig. 1).

Fig. one

Subaccount 97.01 "The cost of paying for future periods" is intended to summarize information on labor costs accrued in the current reporting period, but related to the following reporting periods (for example, vacation amounts). Analytical accounting on this sub-SCHET is conducted in the context of costs of expenses (reference book "The expenses of future periods") and specific employees (Handbook "Individuals").

Subaccount 97.21 "Other expenses of future periods" is intended to summarize information about all other expenditure of future periods. Analytical accounting on this subaccount is conducted on the items of expenditure of future periods.

In terms of tax accounting accounts (for income tax), 6 subaccounts are open to the account 97 (Fig. 2).

Purpose of sub-accounts 97.01 and 97.21 Similar to the subaccounts of accounting accounts plan to the same name. The difference consists only that on subaccount 97.01 Analytical accounting is carried out additionally in the context of the types of charges in accordance with Article 255 of the Tax Code of the Russian Federation (transfer "Types of accrual for labor payments under Art. 255 NK"). The remaining subaccounts are specific. The peculiarity is that the information that is generalized on them is not reflected in accounting.

Except is subaccount 97.02 "Expenses of future periods for voluntary insurance of workers."

Information, generalized on this subaccount of a tax accounting account plan, is recorded in accounting on subaccount 76.01.2 "Payments (contributions) for voluntary insurance of workers."

On account 97.03 "A negative result from the implementation of amortized property" charges are taken into account amounts of losses for the implementation of depreciable property, which the organization may include in expenses that reduce the tax base in future periods in the manner prescribed by Article 268 of the Tax Code of the Russian Federation.

On account 97.11 "Losses of the past years" accounts are taken into account amounts of losses that the organization can take into account when determining the tax base in future periods in the manner prescribed by Article 283 of the Tax Code of the Russian Federation.

On account 97.12 "Losses of past years of serving industries and farms" charges are taken into account amounts of losses defined and taken into account in accordance with Article 275.1 of the Tax Code of the Russian Federation.

In the system of analytical accounting of expenditures of future periods under the costs of expenses, an important place is made by the reference book "Expenses of future periods" (Fig. 3), so it is important to learn how to use it correctly.

For the tax accounting of expenses of future periods, another feature is characterized: For the purposes of PBU 18/02, the cost accounting is carried out in the context of the types of accounting "Well" (tax assessment of the consumption), "BP" (temporary difference in consumption assessment) and "PR" (constant difference in the consumption assessment).

The directory is configured as a hierarchical, i.e. separate articles can be combined into groups, which makes it possible to simplify work with the reference book with a significant nomenclature of costs of costs or when working with the directory of different users.

Each cost of expenses is described by a set of details necessary for automated write-off in various types of accounting. Consider their purpose more.

In the requisite "Type of RBP" indicates a sign of consumption for tax accounting purposes. The value of the props is selected from the list:

- development of natural resources;

- voluntary life insurance;

- insurance for medical expenses;

- insurance in case of death of an employee or disability;

- negative result from the sale of amortized property;

- others.

In the details of the "way of writing the costs", it is indicated using which algorithm is the expense of expense: "by months", "by days" or "in a special order".

The basis of the method of write-off "by month" is counting the total number of months of write-off. At the same time, the amount of expenses to write off in the current month is defined as a product of the individual from dividing the amount of the inconsisons for the remaining period of write-off (in months) on the duration of the write-off in the current month (in months).

At the heart of the way of write-off "by day" lies counting the total number of discriting days. At the same time, the amount of expenses for write-off in the current month is defined as a product of private from dividing the sum of the inconsisons for the remaining period of write-off (in days) on the duration of the write-off in the current month (in days).

The difference in write-off algorithms will illustrate the following example.

Example 1.

To account, the consumption of future periods in the amount of 1,000 rubles was adopted. The period of debiting expenses is from February 15 to May 14, 2007. It is necessary to calculate the amount to be written off in each month of the period.

Writing offering "by month"

The total number of the weeks of write-off is: February (28 - 15 + 1) / 28 + March 1 + April 1 + May 14/31 \u003d 0.5 + 1 + 1 + 0.451613 \u003d 2.951613.

The amount to write-off for the full month (for reference): 1 000 rubles. / 2,951613 \u003d 338.80 rub.

The sum of the inconsisons of future periods is 1,000 rubles;

- the remaining period of write-off - 2,951613 months;

- the duration of the write-off in the current month is 0.5 months;

- The amount of RPB to be debited in the current month is: 1,000 rubles. / 2,951613 months x 0.5 months \u003d 169.40 rubles.

The sum of the submitted expenses of future periods - 1,000 - 169.40 \u003d 830.60 rubles;

- the remaining period of write-off - 2,451613 months;

- Duration of write-off in the current month - 1 month;

- The amount of RPB to be debited in the current month is: 830.60 rubles. / 2,451613 months x 1 month. \u003d 338.80 rub.

The sum of the submitted expenses of future periods - 1 000 - 169.40 - 338.80 \u003d 491.80 rubles;

- the remaining period of write-off - 1,451613 months;

- Duration of write-off in the current month - 1 month;

- The amount of RPB to be debited in the current month is: 491.80 rubles. / 1,451613 months x 1 month. \u003d 338.80 rub.

The sum of the submitted expenses of future periods 1 000 - 169.40 - 338.80 - 338, 80 \u003d 153.00 rubles;

- the remaining period of write-off - 0,451613 months;

- Duration of write-off in the current month - 0.451613 months;

- The amount of RPB to be debited in the current month is: 153.00 rubles. / 0,451613 months x 0,451613 months \u003d 153.00 rubles.

Total amount of responsible expenses: 169,40 + 338.80 + + 338.80 + 153.00 \u003d 1 000 rub.

The way to write off "by day"

The amount to write-off in one day (for reference): 1 000 rubles. / 89 \u003d 11,235955 rub.

The sum of the inconsisons of future periods is 1,000 rubles;

- the remaining period of write-off - 89 days;

- The amount of RPB to be debited in the current month is: 1,000 rubles. / 89 days x 14 days \u003d 157,30 rub.

The sum of the submitted expenses of future periods 1 000 - 157.30 \u003d 842.70 rubles;

- the remaining period of write-off - 75 days;

- Duration of write-off in the current month - 31 days;

- The amount of RPB to be debited in the current month is: 842.70 rubles. / 75 days x 31 day \u003d 348,32 rub.

The sum of the submitted expenses of future periods 1 000 - 157.30 - 348.32 \u003d 494.38 rubles;

- the remaining period of write-off - 44 days;

- the duration of write-off in the current month is 30 days;

- The amount of RPB to be debited in the current month is: 494.38 rubles. / 44 days x 30 days \u003d 337,08 руб.

The sum of the submitted expenses of future periods 1 000 - 157.30 - 348.32 - 337.08 \u003d 157.30 rubles;

- the remaining period of writing off - 14 days;

- Duration of write-off in the current month - 14 days;

- The amount of RPB to be debited in the current month is: 157.30 rubles. / 14 days x 14 days \u003d 157,30 rub.

Total amount of reconnected expenses: 157.30 + 348.32 + 337.08 + 157.30 \u003d 1 000 rub.

It is easy to see that with the same total amount of expenses and the duration of debiting the amount written off in each of the months in different ways, differ. According to the developers of the program "1C: Accounting 8", the method of write-off "by months" is more versatile, it provides for the same calculation scheme if the overall duration of the write-off is a multiple or non-defective number of months, therefore it is proposed by default as a way to write off costs When entering a new element in the Handbook "Expenses of future periods". At the same time, we draw attention to the fact that only the way of writing off "by day" prescribes in relation to certain types of expenses of the Tax Code of the Russian Federation. In particular, in this order, it is necessary to write off the costs of compulsory and voluntary insurance, since this is directly established in paragraph 6 of Article 272 of the Tax Code of the Russian Federation.

The way of writing off "in a special order" is intended only for predetermined articles of expenses with the name "RBP for labor payment", "RBP for the ESN", "RBP on insurance premiums for compulsory pension insurance of the FIU" and "RBP for contributions to the FSS from accidents At the production and occupational diseases, "as well as for such expenses of future periods, whose write-off of which an accountant wants to produce manually. At the same time, all these predefined elements are intended exclusively for the use of the program "1C: Accounting 8" together with the program "1C: salary and personnel management 8".

In the details "sum" indicates the magnitude of the expenditure of future periods, and in the details of the "Start of write-off" and "End of write-off" - indicators that define the duration of the write-off of consumption.

To automatically form the wiring in the details of the "Account" account and "account,", "subconto 1 (bu)", "subconto 2 (bu)", "subconto 3 (bu)" and "subconto 1 (well)", "subconto 2 (Well) "," subconto 3 (well) "(in the group of requisites" Analysis ") the score and analytical signs are indicated to write off the expenditure of future periods, respectively, in accounting and tax accounting.

In the use of the reference book "The expenses of future periods" for analytical accounting on subaccounts 97.03, 97.11 and 97.12 Plan of tax accounting accounts are features. They are due to the fact that in accounting losses, information about which is generalized on these subaccounts, are not particularly reflected. In this regard, the fields with information about the account and analytics of write-off for the purposes of accounting in such an element of the reference book are not filled.

In addition, when reflecting losses on the debit of sub-accounts 97.03, 97.11 and 97.12, it is necessary to introduce two entries: one according to the type of accounting "Well", the second - on the same amount, but with a minus sign and according to the type of accounting "BP". These wiring must be entered before execution using the "closing of the month" document of the amount of income taxes in order for the Program Differentity to reflect the deferred tax assets in accounting by the debit of account 09 "Deferred Tax Assets" and the account loan 68.04.2 " Calculation of income tax. "

Completion and certificate compilation

Monthly calculation and writing off the expenditure of future periods in the program "1C: Accounting 8" are automatically produced using the "Closing of the Month" document. At the same time, to write off the costs taken into account on the subaccount 97.21 of accounting accounts plan (on subaccounts 97.03 and 97.21 of tax accounting accounts on income tax), it is necessary to set flags in the columns "bu" and "well" for action "Write off the spending expenses of future periods" , and to write off the expenses of future voluntary insurance costs (from subaccount 76.01.2 of accounting accounts and subaccount accounts 97.02 Plan of tax accounting accounts) - checkboxes for the "Calculation of insurance costs".

All operations to be accounting and tax accounting must be documented. When performing calculations, such documents is a certificate of an accountant that can be compiled in the form of a certificate form. To compile a certificate-calculation to write off the expenditures of future periods, it is necessary to open the "Print" submenu at the bottom of the document form and select the item "Write-off of future periods' expenditure".

The certificate calculation explains how the sum of the expenditure of future periods was calculated, written off in the current period, which wiring off the cost of expenses is reflected in accounting.

In particular, the certificate presented in Figure 4 substantiates calculations to write off the expenses of future periods for February 2007 in relation to the above example 1.

The certificate calculation is compiled separately for accounting purposes, tax accounting for income tax, as well as for the purposes of PBU 18/02. The selection of the output data is made in the form setting of the report parameters opened by the "Settings" button toolbar (Fig. 5).

Example 2.

In February 2007, the organization performed the repair of the facility of fixed assets using for the repair of products of its own production. The cost of products according to accounting data is 10,000 rubles. According to tax accounting, the cost of products is 9,000 rubles.

The difference in the assessment is a temporary difference in the amount of 600 rubles. and a constant difference in the amount of 400 rubles.

According to the management of the head, repairs are subject to inclusion in expenses within 6 months, starting from March 2007.

Figure 6 presents a certificate of calculating the debiting of the expenditures of future periods for March 2007, containing data for the purposes of PBU 18/02.

Fig. 6.It can be seen that in addition to tax accounting data, the certificates on the calculations on temporary and constant differences in the cost estimate are included.

Completed Calculations The program saves in special registers, so you can make help on the results of the calculation, it is possible not only at the time of direct work with the document closing document, but later by selecting the appropriate item in the "Help-calculation" menu of the "Reports" menu of the main menu of the program.

All expenses of future periods are taken into account by 97 accounts in accordance with the instructions for the application of the accounts plan. We can see the same information in the 1C 8.3 program:

Go to B. Account description:

In 1C 8.3, the account description is displayed:

Where reflects the expenses of future periods in 1C 8.3

In the program 1C 8.3 Accounting 3.0, a special directory was created for reflection of certain RBS:

In this directory, cards of already created RBP are stored, and there is also an opportunity:

- Create a new type of RBP;

- Grouped by "folders" (groups) already available cards;

- Or find the necessary RFB:

How to reflect the costs of future periods in 1C 8.3 - step by step

Step 1

For example, we will create a card of this type of RBP as "Program 1C Accounting Enterprise" and put it and other software products in the Software Group. To do this, create a group Software:

Step 2.

After that, we postpone into this group already available in the RBP list. This can be done in several ways:

- Drag and drop each card RBP in the group holding the left mouse cursor:

- Having selecting several cards with the left mouse button with the Ctrl button and dragging them into the required group:

- Having selecting a few cards with the left mouse button with the Ctrl button by calling the context menu, select Move to group and select the desired group:

Choose a group of expenses of future periods:

Step 3.

After this operation, it is better to change the help mode of the directory on the tree view so that it is possible to see RBP in the Software group and other RBP cards:

The composition of the Software Group is reflected:

Either other RBP cards:

Step 4.

We enter the data in the name field and group:

After that, we start filling the RBP card. We choose a view for tax accounting. In our case - Others:

We choose the type of asset in the balance sheet. In our case - other current assets:

After that, we begin to fill in the write-off parameters of the RBP and select the procedure for recognizing costs:

- For months;

- On calendar days;

- In a special order:

In the event that there is no suitable in the directory of costs of costs, then in 1C 8.3 you can create it without leaving the RBP directory:

Install the flow type:

After that, we see the result in the RBP card:

Step 5.

With primary gaining information about RBP in 1C 8.3, you can fill directly from the receipt document. For example, get an electronic digital signature and printing. Since this is, he will be credited with the help of a document receipt of services - Act:

In the document that opens, fill in the service provider, number and date, and then proceed to fill out the tabular part of the document:

If the nomenclature has already created a card of the acquired goods or service, you can use the selection button, which will allow you to select the desired product / service from the required group:

We indicate the number of purchased services / goods:

After that, at the bottom of the selection of the nomenclature, we see the selected element of the nomenclature, said quantity and cost of the unit of the acquired service:

Step 6.

If the organization first acquires the service, then it must be created in the nomenclature. To do this, press the Add button to add and fill out the output of the nomenclature card:

The name of the nomenclature in the program 1C 8.3 is to search for goods / services. It is more convenient to make it brief and informative to make it easier to use the fast search in the program. And the full name is the name of the nomenclature from the receipt document. Both of these names may coincide (then choose the name from the receipt document):

It is very important for the integrity of the accounting of 1C 8.3 Accounting 3.0 to create one card for one type of nomenclature. That is why creating a new type of product / services more correctly use typical / established names, or adopted at the enterprise.

Also, special attention should be paid to such a parameter as a view of the nomenclature, since it is it that it serves to configure automated accounting wiring in 1C 8.3 and for the correct reflection of purchased / sold goods, works or services in accounting:

After filling out the nomenclature card to save data and transfer them to the document, click the Write and Close button.

How the nomenclature position of the type of service is completed in 1C 8.2 (8.3) See in our video lesson:

Step 7.

In the document receipt of services: Act we see purchased RBP, indicate its quantity. And in order to correctly reflect the price, you should pay attention to the right upper corner of the document:

Depending on how the attendance is available on the hand (the price is "with VAT", or "without VAT, or" including VAT ") and the choice depends:

- If the price of the purchased labor in the document is already indicated with VAT, then must select the price parameters of the document VAT in sum In order for the program 1C 8.3 re-accrued VAT for the cost of labor.

- If the prices are specified in the receipt document without VAT, but the supplier and your organization - VAT payers, should choose VAT from aboveSo that the program 1C 8.3 automatically accrued VAT for the cost of labor.

- If you get the goods without VAT, in the price of the document there is no need to go. VAT can be removed as in the most profitable document:

So in the nomenclature card - provided that the data is always released from VAT:

Step 8.

We now turn to one of the most important points when purchasing RBP accounting accounts:

To correctly reflect RBP's posting, as well as to automatically write off, it is necessary to change the account of the account on 97:

Fill the expenses of future periods:

After that, if the RBP card has already been created in the 1C 8.3 program, select it from the directory. If you get a new type of RBP, then you need to create its card (it is discussed in detail at the beginning of the article). Indicate the cost division on which monthly RBP will be written off and the account of VAT (in our case - 19.04):

After the document in 1C 8.3, you can see accounting wiring:

Write off the spending of future periods in 1C 8.3

Write off the value of the RBP in 1C 8.3 occurs automatically when the month is closed:

Assistant closing a month in 1C 8.3 allows you to immediately do all the necessary regulatory transactions on closing the month.

To start the assistant, press the Follow the Closure button, after which the 1c accounting program 3.0 (8.3) consistently performs all the necessary closing operations:

In case of detecting any errors in accounting, the program 1C 8.3 will issue an informational message about the content of the error and document in which it is made:

also the way to quickly open the document and its corrections:

Typical errors in 1C 8.3 Accounting 3.0, how to find them and correct when the closing procedure is considered.

After fixing errors in accounting, you must once again perform the closure of the month in 1C 8.3.

After completing the closure of the month in 1C 8.3: