Investments will be justified only when they contribute to the creation of new value for the owner of capital. In this case, the cost of these values is determined, which exceeds the cost of their acquisition. Of course, the question arises as to whether it is possible to assess them more than their real value. This is available if the final result is more valuable in comparison with the total cost of the individual stages, the implementation of which made it possible to achieve this result. To understand this, you need to know what the net present value is and how it is calculated.

What is present value?

Present or present value is calculated based on the concept of money over time. It is an indicator of the potential of funds allocated to generate income. It allows you to understand how much the amount that is currently available will cost in the future. Carrying out an appropriate calculation is of great importance, since payments that are made in a different period can be compared only after they have been brought to the same time interval.

The present value is formed as a result of bringing to the initial period of future receipts and expenditures of funds. It depends on how the interest is calculated. For this, simple or compound interest, as well as annuity, are used.

What is Net Present Value?

Net present value NPV is the difference between the market price of a particular project and the cost of its implementation. The abbreviation that is used to designate it stands for Net Present Value.

Thus, the concept can also be defined as a measure of the added value of the project, which will be obtained as a result of its financing at the initial stage. The main challenge is to implement projects that have a positive net present value. However, first you need to learn how to define it, which will help you make the most profitable investments.

Basic rule of NPV

You should familiarize yourself with the basic rule that the net present value of investments has. It lies in the fact that the value of the indicator must be positive for the project to be considered. It should be rejected if a negative value is received.

It should be noted that the calculated value is rarely zero. However, upon obtaining such a value, it is also advisable for the investor to reject the project, since it will not make economic sense. This is due to the fact that the profit from the investment will not be received in the future.

Calculation accuracy

When calculating NPV, it is worth remembering that the discount rate and revenue projections have a significant impact on the present value. The end result may be inaccurate. This is due to the fact that a person cannot make a forecast for future profit with absolute accuracy. Therefore, the resulting figure is only a guess. He is not immune to fluctuations in different directions.

Of course, an investor needs to know how much profit he will receive even before investing. To keep variances as low as possible, the most accurate methods should be used to determine performance in conjunction with net present value. The general use of different methods will allow you to understand whether an investment in a particular project will be profitable. If the investor is confident in the correctness of his calculations, a decision can be made that will be reliable.

Calculation formula

When looking for programs to determine net present value, one may come across the concept of "net present value", which has a similar definition. It can be calculated using MS EXCEL, where it is found under the abbreviation NPV.

The formula used uses the following data:

- CFn - amount of money for period n;

- N is the number of periods;

- i - discount rate, which is calculated from the annual interest rate

In addition, cash flow for a certain period may be zero, which is equivalent to no cash flow at all. When determining income, the amount of money is recorded with a "+" sign, for expenses - with a "-" sign.

As a result, the calculation of the net present value leads to the possibility of assessing the effectiveness of investments. If NPV> 0, the investment will pay off.

Limitations in use

When trying to determine what the net present value of the NPV will be, using the proposed method, you should pay attention to some conditions and restrictions.

First of all, it is assumed that the indicators of the investment project will be stable throughout its implementation. However, the probability of this may approach zero, since a large number of factors affect the value of cash flows. After a certain time, the cost of capital allocated for financing may change. It should be noted that the figures obtained may change significantly in the future.

An equally important point is the choice of the discount rate. As it, you can apply the cost of capital attracted for investment. Taking into account the risk factor, the discount rate can be adjusted. A premium is added to it, so the net present value is reduced. This practice is not always justified.

The use of a risk premium means that only taking a loss is considered by the investor in the first place. He may mistakenly reject a lucrative project. The discount rate can also be the return on alternative investments. For example, if the capital used for investment will be invested in another case at a rate of 9%, it can be taken as the discount rate.

Benefits of using the technique

The net present value calculation has the following advantages:

- the indicator takes into account the discount factor;

- clear criteria are used when making a decision;

- the possibility of using it when calculating the risks of the project.

However, it should be borne in mind that this method has more than just advantages.

Disadvantages of using the technique

The net present value of an investment project has the following negative qualities:

- In some situations, it is quite problematic to correctly calculate the discount rate. This most often applies to multidisciplinary projects.

- Although cash flows are predicted, the formula cannot calculate the likelihood of an event occurring. The applied coefficient can take into account inflation, but basically it is the rate of return that is included in the calculation project.

After a detailed acquaintance with the concept of "net present value" and the calculation procedure, the investor can conclude whether it is worth using the method under consideration. To determine the effectiveness of investments, it is advisable to supplement it with other similar methods, which will allow you to get the most accurate result. However, there is no absolute probability that it will correspond to the actual receipt of profit or loss.

Not all investments carry the same risk. An office building project is more risky than an investment in government securities, but is likely to carry less risk than an investment in a biotech startup. Let's say, according to your estimates, the project is associated with the same risk as investments in the stock market (investments in stocks), and the profitability of the latter is predicted at the level of 12%. Then exactly 12% is a suitable value of the opportunity cost of raising capital. This is exactly the return that you give up by not investing in securities comparable in risk to your project. Now you can recalculate the NPV:

![]()

NPV = PV - $ 350,000 = $ 357,143 - $ 350,000 = $ 7143

If other investors agree with your income forecast of $ 400K. and with your estimate of its inherent risk, your property under construction should be worth $ 357,143. If you tried to sell it at a higher price, you would not find a buyer, because then the expected return on investment in real estate would be lower than the 12% that can be obtained on the stock market. The office building still provides a net increase in value, but it is much less than our previous calculations show.

The value of an office building depends on the timing of the cash flows and their inherent uncertainties. Income in the amount of 400 thousand dollars. would have cost exactly $ 400,000 if it could have been received immediately. If the construction of the office building is as reliable as the investment in government securities, a 1-year delay brings the cost down to $ 373,832. If it carries the same risk as investing in the stock market, uncertainty reduces the cost by another $ 16,689, to $ 357,143.

Unfortunately, estimating asset values over time and uncertainty is often more complex than our example suggests.

So, we have come to the conclusion that building an office building is a good thing, since its cost exceeds the associated costs, that is, it has a positive net present value. To calculate the cost, we figured out how much you need to pay in order to get the same return on investment directly in securities. The present value of the project is equal to the future proceeds from it, discounted by the yield of these securities.

The same can be expressed in a different way: our real estate project makes sense because its profitability exceeds the cost of capital. The return on investment is simply the ratio of the profit to the initial cost:

Capital costs (the cost of raising capital), we recall, are equal to the profitability missed due to the refusal to invest in securities. If building the office building in our example carries the same risk as investing in the stock market, then a 12% return is missed. Since the 14% return on an office building is greater than the 12% opportunity cost, you should start the project.

Here are two equivalent rules to follow when making investment decisions.

1. Rule of net present value: make investments that have a positive net present value.

2. Rule of profitability: make investments, the profitability of which exceeds their opportunity costs.

The opportunity cost of raising capital is such an important concept that it deserves additional attention and another example. Let's say you have the following opportunity: to invest today 100 thousand dollars so that at the end of the year, depending on the general state of the economy, you will receive a return in the amount of:

You reject the optimistic (rise) and pessimistic (bust) forecasts. This leaves you with an expected return of Q = 110,000 dollars. , that is, a 10% return on your investment (100 thousand dollars). But what is the correct discount rate?

You start looking for common stock with the same risk as your investment opportunity. The most suitable were the shares of X. Their price for the next year in a normal state of the economy is predicted at 110 dollars. In the event of an economic recovery, the price will be higher, in the event of a recession, it will be lower, but the proportion of changes is the same as that of your investment ($ 140 in a rise, $ 80 in a decline). In general, you conclude that X stock and your investment carry the same risk.

X's current share price is $ 95.65. per share, their expected yield is 15%:

This is the very expected return that you give up by investing in your project, instead of investing in the stock market. In other words, this is the opportunity cost of your project.

In order to estimate the cost of the project, it is necessary to discount the expected cash flow at these opportunity costs:

![]()

This is the amount that would have cost investors in the stock market to buy the expected cash flow of $ 110,000. (They could have gotten it by buying 1000 shares of X.) Therefore, this is exactly how much investors will be willing to pay you for your project.

We get the net present value of the project by subtracting the initial investment:

NPV = $ 95,650 - $ 100,000 = -4350 dollars

The project costs $ 4350. less than what was spent on it. There is no point in taking on it.

Note that you would come to the same conclusion by comparing the project's expected return with its inherent capital cost:

The expected return on the project, equal to 10%, is less than 15%, which investors expect to earn by investing in the stock market, so, whatever one may say, the project is useless.

Of course, in real life, the true state of the economy cannot be reduced to just a “recession,” “normal,” or “recovery.” In addition, we adopted another simplified premise, establishing an absolute correspondence between the return on 1000 shares of X and the proceeds from the investment project. However, the basic idea of this example is quite consistent with real life. Remember: the opportunity cost of raising capital (capital cost) for an investment project is equal to the expected return that investors are demanding from common stocks or other securities subject to the same risk as the project. Calculating the present value of a project, that is, discounting its cash flow at opportunity costs, you get the amount that investors (including shareholders of your own company) are willing to pay for the project. Whenever you find and launch a project with a positive net present value (that is, a project whose present value exceeds the required investment in it), you make your company's shareholders richer.

For example, the following circumstance can mislead you. Imagine that a banker comes to you and says: “Your company is a well-established, reliable company, and you have few debts. My bank is not averse to lending you 100 thousand dollars, necessary for the project, at 8% per annum. " Does this mean that the capital cost for the project is 8%? If so, your project is afloat: its present value at a rate of 8% is $ 110,000 / 1.08 = $ 101,852, that is, the net present value is $ 101,852. - $ 100,000 = +1852 dollars

But this is not true. First, the interest rate on the loan has nothing to do with the risk of the project: it only reflects the well-being of your current business. Second, regardless of whether you take out a loan or not, you still have to choose between a project with an expected return of only 10% and stocks, which are associated with an equivalent risk, but at the same time have an expected return of 15%. A financial manager who borrows money at 8% and invests it at 10% is not just stupid, but desperately stupid if a company or its shareholders have the opportunity to get a loan at 8%, and invest with the same risk, but with a return 15%. So it is the expected return on equity of 15% that represents the opportunity cost of raising capital for the project.

Rationale for the NPV Rule

Until now, our acquaintance with net present value has remained very superficial. The phrase "adding value" as a company's goal sounds quite reasonable. But the NPV rule is more than a mere common sense requirement. We need to understand what this rule is and why managers look to the bond and equity markets to determine the opportunity cost of raising capital.

In our previous example, only one person (you) invested 100% of the money in a new office building and received 100% of the return on it. But in corporations, investments are made on behalf of and at the expense of thousands of shareholders with different risk appetite and different preferences for choosing between current or future income (and therefore consumption). What if a project that is clearly positive net present value for Ms Smith will be deeply negative for Mr Jones? Could it be that the goal of maximizing the value of the firm will be unacceptable to some of them?

The answer to both questions is the same: no. Both Smith and Jones can always come to an agreement if they have unhindered access to the capital market. We will show this with another simple example.

Suppose you are able to anticipate your upcoming earnings in advance. Unable to make savings from current income or take out a loan against future income, you will be forced to postpone consumption until you receive it. And this business is very inconvenient, to say the least. If the bulk of the income that you owe in your life falls on some more or less distant future, then the result may be that today you are in danger of hunger, and tomorrow (or someday later) - excessive consumption. This is where the capital market comes in handy. Simply put, the capital market is a market in which people exchange current and future money among themselves. Thanks to him, you can eat normally now and in the future.

We will now show how a well-functioning capital market helps investors with different income “schedules” and different consumption patterns to agree on whether to take on a particular investment project. Let's imagine two investors with different tastes and aspirations. One of them is Ant, who prefers to save money for the future; the other is the Dragonfly, which with extraordinary ease squanders all its income, not at all caring about tomorrow. Now suppose they both had the same opportunity: to acquire a stake in an office building project worth $ 350,000, which at the end of the year will yield a guaranteed return of $ 400,000. (i.e. the yield is about 14%). The interest rate is 7%. At this rate, both Ant and Dragonfly can borrow or lend money in the capital market.

Undoubtedly Ant would gladly invest in an office building. Every hundred dollars invested in this project today will allow him to spend $ 114 at the end of the year, while the same hundred invested in the capital market will bring him only $ 107.

What would a Dragonfly do if she wants to spend money right now and not in a year? Perhaps she will neglect the investment opportunity and immediately squander all her cash? It is unlikely, since the capital market allows both borrowing and borrowing money. Every hundred dollars Dragonfly invests in an office building will bring her $ 114 at the end of the year. Any bank aware that the Dragonfly will have a guaranteed income at the end of the year will not hesitate to lend her $ 114 / 1.07 = $ 106.54 today. Therefore, if Dragonfly invests in an office building and then takes out a loan against future income, she will be able to spend not $ 100, but $ 106.54 today.

The figure clearly illustrates this example (our heroes are designated here M and C, respectively). The horizontal axis represents the amount of money that can be spent today; the vertical axis shows the expenses for the next year. Let's say that initially both the Ant and the Dragonfly have the same amounts - 100 dollars each. If each of them fully invests their 100 dollars. on the capital market, then at the end of the year both will receive $ 100 for expenses. x 1.07 = 107 dollars. The straight line connecting these two points (in the figure, this is the line located closer to the origin of coordinates), displays combinations of current and future consumption for the following possible options: when nothing is invested, when one or another part of the cash is invested, and when all available funds are invested on the capital market at 7% per annum. (The interest rate determines the slope of this straight line.) Any intermediate point of the straight line (between the points of intersection with the coordinate axes) is reached when one or another part of the cash 100 dollars. is spent today and the rest is invested in the capital market. Let's say someone might prefer to spend $ 50. today and $ 53.50. next year. But our Ant and Dragonfly unanimously rejected such intermediate ("residual") consumption patterns.

The straight line with the arrow (highlighted) in the figure denotes the investment proceeds of $ 100. to the project for the construction of an office building. The return on these investments is 14%, so today's $ 100. will turn into 114 dollars in a year.

Dragonfly (C) wants to consume right now, while Ant (M) wants to wait. But each of them is happy to invest. M prefers to invest not at 7, but at 14%, which raises the point of intersection of the straight line with the arrow (highlighted in blue) with the vertical axis. C also invests (at the same 14%), and then borrows money at 7%, thereby converting $ 100 intended for current consumption into $ 106.54. Thanks to his investment, C will have $ 114 in a year to pay off the debt. The net present value of this investment is $ 106.54. - 100 dollars. = + 6.54 dollars.

The oblique straight line to the right in the figure (the one that is located farther than the others from the origin) reflects the increase in the planned costs of the Ant and Dragonfly in the event that they decide to invest their $ 100. to the office building. The tight-fisted Ant, who does not intend to spend anything today, can invest 100 dollars. in the construction of an office building and at the end of the year to receive 114 dollars. for expenses. Muddy Dragonfly is also investing $ 100. in an office building, but at the same time occupies $ 114 / 1.07 = 106.54 dollars. for future income. It is quite clear that nothing stands in the way of these spending plans. Indeed, the right-hand line represents all the possible combinations of current and future spending available to an investor who invests $ 100. in the construction of an office building and at the same time takes out a loan for a certain part of future income.

It is easy to see from the figure that the present value of Dragonfly and Ant's participation in the office building project is $ 106.54, and the net present value is $ 6.54. (This is the difference between $ 106.54 of the present value and $ 100 of the initial investment). Despite the differences in tastes between Dragonfly and Ant, they both benefit from investing in an office building and then leveraging capital market opportunities to achieve the desired balance between today's consumption and year-end consumption. In fact, in making their investment decisions, both of them seem to willingly follow two equivalent rules, which we formulated rather superficially at the end of the section. We can now rephrase them as follows.

1. The rule of net present value: invest in any project with a positive net present value. The latter is the difference between the discounted, or present, value of future cash flow and the value of the initial investment.

2. Rule of profitability: invest in any project, the profitability of which exceeds the profitability of an equivalent investment in the capital market.

What would happen if the interest rate was not 7, but 14.3%? In this case, the net present value of the office building would be zero:

![]()

In addition, the profitability of the project, amounting to $ 400,000 / $ 350,000. - 1 = 0.143, or 14.3%, would be exactly equal to the capital market interest rate. In this case, both of our rules show that the project is balancing on the brink "between light and darkness," and therefore, investors should be indifferent to whether the company will undertake it or not.

As you can see, if the interest rate was 14.3%, neither Dragonfly nor Ant would benefit from an investment in an office building. At the end of the year, the ant would have had the same amount for expenses, regardless of how he initially disposed of his money - whether he invested it in an office building or invested in the capital market. Likewise, Dragonfly would not have received any benefit by investing in an office building with a yield of 14.3% and at the same time taking out a loan at the same 14.3%. She might as well have spent all of her original cash at once.

In our example, Dragonfly and Ant placed the same funds in an office building project and willingly took part in it. This unanimity is explained by their equal opportunities to borrow and lend money. Whenever a firm discounts its cash flow at a financial market rate, it assumes the implicit assumption that its shareholders have free and equal access to competitive capital markets.

It is easy to see that the absence of a well-functioning and well-functioning capital market undermines the logic of our NPV rule. For example, suppose that Dragonfly does not have the opportunity to take out a loan against future income, or, in principle, there is such an opportunity, but the price of the loan is too high to take advantage of it. In such a situation, Dragonfly will most likely prefer to immediately use up his cash, rather than invest it in an office building and wait for the end of the year to start spending money. If Dragonfly and Ant were shareholders of the same company, it would not be easy for a manager to reconcile their conflicting interests and goals.

No one would argue unconditionally that capital markets are perfectly competitive. When making financial decisions, you should consider taxes, transaction costs and other factors that limit perfect competition. But in general, capital markets work quite efficiently. And this is at least one of the compelling reasons why NPV should be relied upon in setting corporate goals. Another reason is that the NPV rule is simply common sense; in the future, we will see that it leads to obviously ridiculous results much less often than its main "competitors" - other common criteria for making investment decisions. In the meantime, having only casually touched upon the problems of market imperfections, we, like a shipwrecked economist, will simply assume that we have a life jacket, and, mentally dressing in it, we will calmly swim to the shore.

So far, our rationale for the NPV rule has been limited to two assumptions: that cash flow only extends over two periods of time, and that cash flow has certainty. However, the rule is also true for uncertain cash flows that continue into the distant future. This can be confirmed by the following arguments.

1. The financial manager must act in the best interests of the owners of the firm, that is, its shareholders. Every shareholder strives for three goals:

a) to be as rich as possible, that is, to maximize your real wealth;

b) to convert this wealth into some desirable for him (or for her) temporary consumption pattern;

c) have the freedom to choose the characteristics of the risk of this consumption pattern.

2. But shareholders do not need the help of a financial manager to achieve the best time consuming pattern. They can handle this on their own as long as they have unhindered access to competitive capital markets. In addition, they are free to choose the risk characteristics for their consumption model by investing in more or less risky securities.

3. How, then, is the financial manager able to help the shareholders of the firm? In only one way: by increasing the market value of each shareholder's share in the firm. To do this, he must use any investment opportunity that has a positive net present value.

Shareholders, although they have different preferences, show remarkable consensus about the amount they are willing to invest in real assets. On this basis, they can unite into one company and, without risking themselves, entrust the conduct of business to professional managers. Managers do not need to know anything about the tastes and preferences of shareholders, and they should not instill in them their own tastes and preferences. Their task is to maximize the net present value. Once they succeed, managers can sit back and relax with the confidence that they have done their best in the best interests of their shareholders.

This implies a fundamental condition for the successful functioning of the modern capitalist economy. Separating ownership from management is essential for most corporations, so delegation of management authority is essential. It's nice to know that all managers can be given one simple instruction: maximize net present value.

Sometimes managers say that their corporations set different goals for themselves. Thus, the manager may say that his job is to maximize profits. Well, that sounds pretty meaningful. After all, don't shareholders prefer a profitable company to a loss-making company? However, pure profit maximization is unwise to claim as a corporate goal. There are several reasons for this.

1. The task of "maximizing profit" immediately raises the question: "What year's profit?" Shareholders may not want the manager to build up next year's profits at the expense of later years' profits.

2. The company can increase future profits by reducing the payment of dividends and investing these funds in investment projects. But given the low profitability of such investments, this runs counter to the interests of shareholders.

3. Different accountants use different methods of calculating profits. You may find that a solution that improves profit margins, from the perspective of one accountant, degrades them from the perspective of another.

Principal consequence

We have shown that managers best serve the interests of shareholders by investing in projects with positive net present value. But that brings us back to the trust-agent problem. How can shareholders (trustees) make sure that managers (agents) do not pursue their own interests exclusively? Shareholders are unable to constantly monitor managers to see if they are skimping on their responsibilities or maximizing the value of their own wealth. Nevertheless, there are several organizational mechanisms that more or less ensure that the manager's heart will go to the shareholders' pocket.

Members of the company's board of directors are elected by the shareholders and, in theory, represent their interests. True, sometimes the board of directors is portrayed as a weak-willed crowd, always taking the side of management. However, when problems arise in a company's operations and managers do not come up with a viable revival plan, the board does its job. In recent years, at companies such as Eastman Kodak, General Motors, Xerox, Lucent, Ford Motors, Sunbeam, Lands End, senior executives have been forced to resign when profitability began to decline and the need for a renewed business strategy became evident. ...

Considering that the work of the corporation leaves much to be desired, and the members of the board of directors are not energetically calling managers to order, shareholders may try to change the board of directors in the next election. If successful, the new board of directors will recruit a new management team. However, such attempts to re-elect the board of directors are quite costly and ungrateful (rare of them are successful). Therefore, “dissident” shareholders usually do not engage in an unequal battle, but instead simply sell their shares.

However, the sale of shares in itself carries a very powerful message. If a stock is dumped by quite a few holders, the price of the stock goes down. This hurts the reputation of managers and their earnings. CEOs receive a portion of their compensation for labor in the form of earnings-related bonuses or stock options, which generate good returns when the stock price rises but loses all value when the price falls below a certain threshold. In theory, this should induce managers to increase profits and raise the price of shares.

Are managers upholding the interests of shareholders?

If company leaders fail to maximize value, they are always in danger of a hostile takeover. The lower the company's share price falls (as a result of talentless management or as a result of incorrect policies), the easier it is for another firm or group of investors to buy up a controlling stake in its shares. In a situation like this, the old management team is likely to be thrown overboard and replaced by new managers willing to make the changes needed to realize the company's true value.

These mechanisms largely ensure that there are few lazy or shareholder-disregarding managers in the top management of large American corporations. Moreover, these mechanisms contain strong incentives for managers to work hard.

We introduced managers as agents working for the shareholders of their firms. But perhaps it is worth asking the question: "Is it desirable for managers to act in the selfish interests of shareholders?" Does the focus on shareholder enrichment mean that managers should behave like greedy hucksters, brutally trampling on the weak and helpless? Do they not have broader responsibilities - to their employees, customers, suppliers, and to the community where the firm is located?

The bulk of this book focuses on financial policies that add value to the firm. None of these policies require that the weak and the helpless be infringed upon. In most cases, good deeds (value maximization) do not contradict good deeds in the least. If the firm is profitable, then it is one of those whose customers are satisfied and the employees are loyal; the same firms whose customers and employees are unhappy with them are more likely to experience a downturn in profits and a decline in stock prices.

Of course, in business, as in any area of life, ethical problems arise; and when we say that the goal of a firm is maximizing shareholder wealth, we do not mean that everything else should be left to chance. The laws are partly deterred from the apparently dishonorable behavior of managers, but for most managers it is not only the letter of the law or the provisions of formal labor contracts that are important. In business and finance, as in other daily activities, there are unwritten and unspoken rules of conduct. In order to work effectively together, we must trust each other. The largest financial transactions are often “formalized” with a simple handshake, and each of the parties knows that in the future, even with a bad turn of events, the other side will not break its word. Any incident that weakens this mutual trust damages us all.

Should managers defend the interests of shareholders?

In many financial transactions, one side is better informed than the other. It is very difficult to obtain complete and reliable information about the quality of the assets or services that you buy. This situation opens up a wide scope for dubious financial manipulations and illegal scams, and since unscrupulous businessmen jump from place to place much more often than respectable entrepreneurs, airport registration lists are full of traces of financial fraudsters.

Honest firms contrast this with a demonstrative commitment to long-term customer relationships, a good name in business, and financial integrity. Large banks and investment companies are well aware that their most valuable asset is their business reputation. They do not miss the opportunity to emphasize the long history of their existence and their consistently responsible behavior. Any event that undermines this reputation can cause enormous material damage to them.

Recall, for example, the Salomon Brothers stock exchange scandal that erupted in 1991. The company's trader tried to circumvent the rules restricting its participation in the Treasury bond auction; to do this, he submitted bids for tenders on behalf of several Salomon Brothers clients without notifying them or obtaining their consent. When the forgery was discovered, Salomon Brothers had to fork out pretty much to settle the case: almost 200 million dollars. spent on the payment of a fine and another 100 million dollars. - for the establishment of a special fund for the satisfaction of civil claims. In addition, the value of Salomon Brothers shares immediately fell by more than $ 300 million. In fact, the shares fell by almost a third, reducing the company's market value by $ 1.5 billion.

What explains such a dramatic decline in the value of Salomon Brothers? Mainly by the fears of investors who felt that the company's business would suffer from the loss of customers who had lost confidence in it. The damage Salomon Brothers suffered from its tarnished reputation was far greater than the apparent cost of the scandal, and hundreds or even thousands of times greater than the benefits a company could derive from illegal bidding.

In this chapter, we introduced the concept of present value as a tool for valuing assets. Calculating the present value (PV) is straightforward. You just need to discount the future cash flow at the appropriate rate r, usually called the opportunity cost of raising capital, or marginal return:

The net present value (NPV) is equal to the sum of the present value and the original cash flow:

![]()

Recall that C 0 is negative if the initial cash flow is an investment, that is, a cash outflow.

The discount rate is determined by the rate of return prevailing in the capital markets. If the future cash flow is absolutely reliable, the discount rate is equal to the interest rate on risk-free securities such as US government debt. If the amount of future cash flow is subject to uncertainty, then the expected cash flow should be discounted by the expected return on securities with the same risk.

Cash flows need to be discounted for two simple reasons: first, because the dollar is worth more today than the dollar tomorrow, and second, because a safe dollar is worth more than a risky one. The present value and net present value formulas express these ideas in terms of numbers. The capital market is a market where safe and risky future cash flows are bought and sold. This is why we look at the prevailing rates of return in capital markets to determine which discount rate to use given time and cash flow risk. By calculating the present value of assets, we are actually estimating how much people will pay for them, given that there are alternative investment opportunities in the capital markets.

The concept of net present value confirms the feasibility of separating ownership from management within a corporation. A manager who invests only in assets with positive net present value best serves the interests of each of the owners of the firm - despite their differences in wealth and tastes. This is possible thanks to the capital market, which allows each shareholder to form their own investment portfolio according to their needs. In particular, the firm does not need to adjust its investment policy so that subsequent cash flows correspond to the preferred temporary consumption patterns for shareholders. Shareholders themselves are perfectly free to move funds forward or backward in time as they please, as long as they have free access to competitive capital markets. In fact, their choice of a particular temporary consumption model is limited by only two circumstances: their personal wealth (or lack thereof) and the interest rate at which they can borrow or borrow money. The financial manager cannot influence the interest rate, but he can help increase the wealth of shareholders. This can be done by investing in assets with a positive net present value.

There are several organizational mechanisms that provide some assurance that managers are paying sufficient attention to the value of the firm:

- the work of managers is closely monitored by the board of directors;

- lazy and hacky people find it difficult to stay in their posts under the onslaught of more energetic managers. Such competition often arises within an individual company, but it also operates outside: poorly performing firms very often become objects of hostile takeovers; as a result, as a rule, the management team is completely renewed;

- managers are motivated by incentive schemes such as stock options, which generate good returns when the share price (and thus shareholder wealth) rises and is otherwise depreciated.

If managers seek to add value to shareholders, this does not mean that they are neglecting other, broader responsibilities to society. Managers act honestly and fairly with employees, customers and suppliers, partly because they see it as a common good, but partly because of pragmatic considerations: they are well aware that the most valuable asset of a firm is its reputation. Of course, there are ethical issues in finance, and whenever an unscrupulous manager abuses his position, we all begin to trust each other a little less.

First works on net present value:

I. Fisher. The Theory оf Interest. 1965 (reprint of the 1930 edition). J. Hirshleifer. On the Theory of Optimal Investment Decision // Journal of Political Economy. 66: 329-352. 1958. August.

For a more detailed exposition of the subject, see:

E. F. Fama and M. H. Miller. The Theory of Finance. New York: Holt, Rinehart and Winston, 1972.

For a deeper understanding of how managers can be motivated to maximize shareholder wealth, consider the following:

M. C. Jensen and W. H. Meckling. Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure // Journal of Financial Economics. 3: 305-360. 1976 October.

E. F. Fama. Agency Problems and the Theory of the Firm // Journal of Political Economy. 88: 288-307. 1980. April.

However, to be sure, there are some types of real estate, the value of which the appraiser is practically unable to determine; for example, no one knows the potential price at which the Taj Mahal, or the Parthenon, or Windsor Castle could be sold.

Hereinafter, abbreviations formed from English names are used as symbols in the text and formulas: PV - from the present value (present value), NPV - from the net present value (net present value), DF - from discount factor (coefficient discount), D - from debt (debt, debt), E - from equity (equity, or equity, capital), etc. (A complete list of terms in Russian and English, as well as the corresponding abbreviations (symbols) is contained in the Subject Index at the end of the book.) - Note. editor.

Let's check ourselves. If you invest 373 832 dollars. at 7% per annum, then at the end of the year your initial investment plus interest income in the amount of 0.07 x 373 832 dollars will be returned to you. = 26 168 dollars. The total amount you will receive is $ 373,832. + 26 168 dollars = 400,000 dollars. Pay attention to this: 373,832 x 1.07 = 400,000.

We’ll define “expected” more precisely in Chapter 9. For now, it is sufficient to understand that expected revenue reflects a realistic, not an optimistic or pessimistic forecast.

You can see for yourself that these rules are equivalent. Let us express them differently: if the profitability of 50,000/350,000 is greater than r, then the net present value -350,000 + 400,000 / (1 + r) must be greater than zero.

These rules can conflict with each other when cash flows last longer than two periods. We'll tackle this problem in Chapter 5.

We proceed from the assumption that recession and recovery are equally probable, that is, that the expected (average) outcome is 110 thousand dollars. Let, for example, the probabilities of decline, normal state and rise - that is, each of these probabilities - are equal to Y3. Then the expected return: Q = ($ 80,000 + $ 110,000 + + $ 140,000) / 3 = $ 110,000.

The exact relationship between current and future consumption that each person chooses depends on their individual preferences. Readers familiar with economics will know that such choices can be shown by overlapping indifference curves specific to each individual. The preferred combination will be at the intersection of the interest rate line and the individual's indifference curve. In other words, each individual will borrow or lend to the point where 1 plus the interest rate equals the marginal time preference rate (i.e., the slope of the indifference curve). For a more rigorous graphical analysis of investment decisions and choices between current and future consumption, see the Brailey-Myers website at www: //mhhe.com/bm/7e.

Some managers, for fear of upsetting any stakeholder group, deny altogether that they are profit-maximizing or value-maximizing. We recall one survey of businessmen in which they were asked to answer whether they are trying to maximize profits. Interviewees indignantly dismissed this assumption, arguing that their responsibility extends far beyond the narrow and selfish task of making a profit. But when the question was slightly modified and the businessmen were asked whether they can increase profits by raising or lowering the selling price of their products, they replied that none of these changes will lead to further increases in profits. (See: G. J. Stigler. The Theory of Price. 3rd ed. New York: Macmillan Company, 1966.)

Under US law, a contract may be effective even if it is not in writing. Of course, it is wiser to keep the necessary documentation, but an oral agreement is also valid if it can be proved that the parties have reached full and unconditional understanding and agreement. For example, in 1984, Getty Oil's management verbally agreed to a merger proposal for Pennzoil. Then Texaco came up with a better offer and interrupted the bidding. But Pennzoil sued, claiming that Texaco had breached a valid contract, and won the case.

For a more detailed discussion of this issue, see A. Schleifer and L. H. Summers. Breach of Trust in Corporate Takeovers // Corporate Takeovers: Causes and Consequences. Chicago: University of Chicago Press, 1988.

See: Clifford W. Smith, Jr. Economics and Ethics: The Case of Salomon Brothers // Journal of Applied Corporate Finance. 5. 1992. Summer. P. 23-28.

NPV (abbreviation, in English - Net Present Value), in Russian this indicator has several name variations, among them:

- net present value (abbreviated NPV) - the most common name and abbreviation, even the formula in Excel is called just that;

- net discounted income (abbreviated as NPV) - the name is due to the fact that cash flows are discounted and only then summed up;

- net present value (abbreviated as NPV) - the name is associated with the fact that all income and losses from activities due to discounting are, as it were, reduced to the current value of money (after all, from the point of view of the economy, if we earn 1,000 rubles and then actually get less than if we received the same amount, but now).

NPV is an indicator of the profit that the participants in the investment project will receive. Mathematically, this indicator is found by discounting the values of net cash flow (regardless of whether it is negative or positive).

Net discounted income can be found for any period of time of the project starting from its inception (for 5 years, for 7 years, for 10 years, and so on), depending on the need for calculation.

What is it needed for

NPV is one of the indicators of project efficiency, along with IRR, simple and discounted payback period. It is needed to:

- to understand what income the project will bring, whether it will pay off in principle or is it unprofitable, when it will be able to pay off and how much money it will bring at a particular point in time;

- to compare investment projects (if there are a number of projects, but there is not enough money for all, then projects with the greatest opportunity to earn, i.e., the largest NPV, are taken).

Calculation formula

The following formula is used to calculate the indicator:

- CF - the amount of net cash flow over a period of time (month, quarter, year, etc.);

- t is the period of time for which the net cash flow is taken;

- N - the number of periods for which the investment project is calculated;

- i is the discount rate taken into account in this project.

Calculation example

To consider an example of calculating the NPV indicator, let's take a simplified project for the construction of a small office building. According to the investment project, the following cash flows are planned (thousand rubles):

| Article | 1 year | 2 year | 3 year | 4 year | 5 year |

| Investment in the project | 100 000 | ||||

| Operating income | 35 000 | 37 000 | 38 000 | 40 000 | |

| Operating expenses | 4 000 | 4 500 | 5 000 | 5 500 | |

| Net cash flow | - 100 000 | 31 000 | 32 500 | 33 000 | 34 500 |

The project discount rate is 10%.

Substituting the values of the net cash flow for each period into the formula (where a negative cash flow is obtained, we put it with a minus sign) and adjusting them taking into account the discount rate, we get the following result:

NPV = - 100,000 / 1.1 + 31,000 / 1.1 2 + 32,500 / 1.1 3 + 33,000 / 1.1 4 + 34,500 / 1.1 5 = 3,089.70

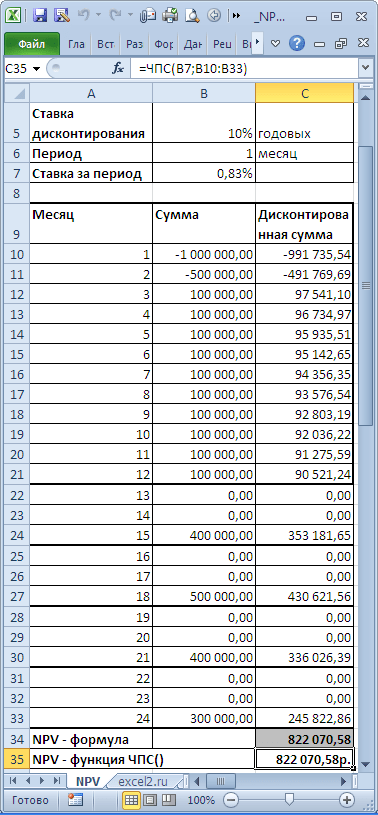

To illustrate how NPV is calculated in Excel, consider the previous example by putting it in tables. The calculation can be done in two ways

- Excel has an NPV formula that calculates NPV by specifying the discount rate (unsigned percent) and highlighting the net cash flow range. The type of formula is: = NPV (percentage; net cash flow range).

- You can create an additional table yourself, where you can discount the cash flow and sum it up.

In the figure below, we have shown both calculations (the first shows the formulas, the second shows the results of the calculations):

As you can see, both calculation methods lead to the same result, which means that depending on what is more convenient for you to use, you can use any of the presented calculation options.

Let's calculate the Net Present Value and Internal Rate of Return using the formulasMSEXCEL.

Let's start with the definition, more precisely, with the definitions.

Net present value (NPV) is called the sum of the discounted values of the flow of payments reduced to the present day(taken from Wikipedia).

Or like this: Net present value is the present value of the future cash flows of an investment project, calculated taking into account discounting, less investments (websitecfin.ru)

Or like this: Currentthe value of a security or investment project, determined by taking into account all current and future receipts and expenses at an appropriate interest rate. (Economy .

Explanatory dictionary . -

M .

: "

INFRA -

M ",

Publisher "

The whole world ".

J .

Black .)

Note1... Net Present Value is also often referred to as Net Present Value, Net Present Income (NPV). But since the corresponding MS EXCEL function is called NPV (), then we will adhere to this terminology. In addition, the term Net Present Value (NPV) clearly indicates a relationship with.

For our purposes (calculation in MS EXCEL) we define NPV as follows:

Net present value is the sum of cash flows, presented as payments of arbitrary size, made at regular intervals.

Advice: at the first acquaintance with the concept of Net Present Value, it makes sense to get acquainted with the materials of the article.

This is a more formalized definition without references to projects, investments and securities, since this method can be used to estimate cash flows of any nature (although, in fact, the NPV method is often used to assess the effectiveness of projects, including for comparing projects with different cash flows).

Also, the definition does not include the concept of discounting, since the discounting procedure is, in essence, the computation of the present value using the method.

As mentioned, in MS EXCEL, the NPV () function is used to calculate the Net Present Value (the English version is NPV ()). It is based on the formula:

CFn is the cash flow (amount of money) in period n. The total number of periods is N. To show whether the cash flow is an income or an expense (investment), it is written with a certain sign (+ for income, minus for expenses). The amount of cash flow in certain periods can be = 0, which is equivalent to no cash flow in a certain period (see note 2 below). i is the discount rate for the period (if an annual interest rate is set (let it be 10%), and the period is equal to a month, then i = 10% / 12).

Note2... Because cash flow may not be present in every period, then the definition of NPV can be clarified: Net present value is the present value of cash flows presented as payments of arbitrary size, made at intervals of time, multiples of a certain period (month, quarter or year)... For example, the initial investments were made in the 1st and 2nd quarters (indicated with a minus sign), there were no cash flows in the 3rd, 4th and 7th quarters, and in the 5-6th and 9th quarters the proceeds from the project have been received (indicated with a plus sign). For this case, NPV is calculated in the same way as for regular payments (amounts in the 3rd, 4th and 7th quarter must be specified = 0).

If the sum of the present cash flows representing income (those with a + sign) is greater than the sum of the present cash flows representing investments (expenses, with a minus sign), then NPV> 0 (the project / investment pays off). Otherwise NPV<0 и проект убыточен.

Selecting the discount period for the NPV () function

When choosing a discount period, you need to ask yourself the question: "If we forecast for 5 years ahead, can we predict cash flows with an accuracy of up to a month / up to a quarter / up to a year?"

In practice, as a rule, the first 1-2 years of receipts and payments can be predicted more accurately, say monthly, and in subsequent years the timing of cash flows can be determined, say, once a quarter.

Note3... Naturally, all projects are individual and no single rule for determining the period can exist. The project manager should determine the most likely dates for the receipt of amounts based on current realities.

Having decided on the timing of cash flows, for the NPV () function, you need to find the shortest period between cash flows. For example, if in the 1st year the receipts are planned monthly, and in the 2nd - quarterly, then the period should be chosen equal to 1 month. In the second year, the sums of cash flows in the first and second month of the quarters will be equal to 0 (see. example file, NPV sheet).

In the table, NPV is calculated in two ways: through the NPV () function and by formulas (calculating the present value of each amount). The table shows that already the first amount (investment) is discounted (-1,000,000 turned into -991,735.54). Suppose that the first amount (-1,000,000) was transferred on 01/31/2010, so its present value (-991,735.54 = -1,000,000 / (1 + 10% / 12)) was calculated as of 12/31/2009. (without much loss of accuracy, we can assume that as of 01.01.2010)

This means that all amounts are shown not as of the date of transfer of the first amount, but at an earlier date - at the beginning of the first month (period). Thus, the formula assumes that the first and all subsequent amounts are paid at the end of the period.

If you want all the amounts to be given as of the date of the first investment, then it does not need to be included in the arguments of the NPV () function, but you just need to add it to the resulting result (see the example file).

A comparison of the 2 discounting options is given in the example file, NPV sheet:

On the accuracy of calculating the discount rate

There are dozens of approaches to determining the discount rate. Many indicators are used for calculations: the weighted average cost of capital of the company; refinancing rate; average bank rate on a deposit; annual inflation rate; income tax rate; country risk-free rate; project risk premium and many others, as well as their combinations. It is not surprising that in some cases the calculations can be quite laborious. The choice of the necessary approach depends on the specific task, we will not consider them. We only note one thing: the accuracy of calculating the discount rate should correspond to the accuracy of determining the dates and amounts of cash flows. Let's show the existing dependence (see. example file, sheet Accuracy).

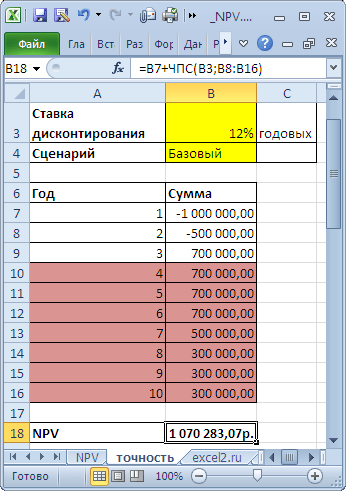

Let there be a project: the implementation period is 10 years, the discount rate is 12%, the cash flow period is 1 year.

NPV was 1,070,283.07 (Discounted at the date of the first payment).

Because the project is long, then everyone understands that the amounts in 4-10 years are not determined precisely, but with some acceptable accuracy, say +/- 100,000.0. Thus, we have 3 scenarios: Baseline (the average (most "probable") value is indicated), Pessimistic (minus 100,000.0 from the baseline) and optimistic (plus 100,000.0 to the baseline). It should be understood that if the base amount is 700,000.0, then the amounts 800,000.0 and 600,000.0 are no less accurate.

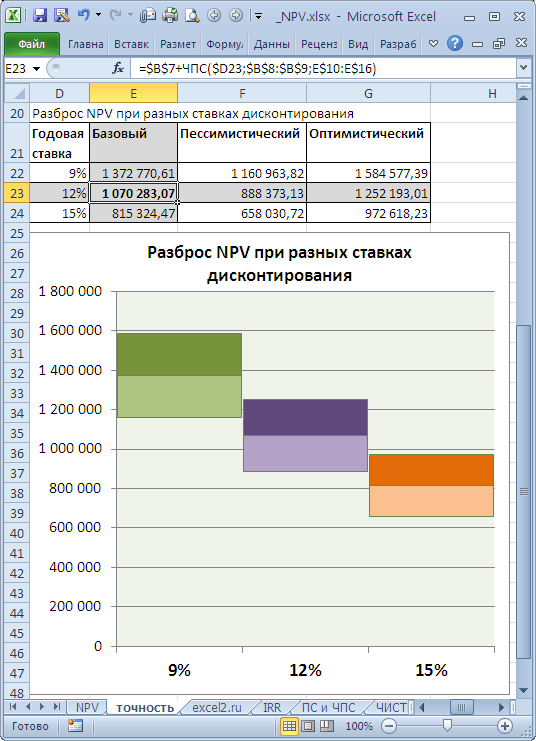

Let's see how NPV reacts when the discount rate changes by +/- 2% (from 10% to 14%):

Consider a 2% rate increase. It is clear that with an increase in the discount rate, NPV decreases. If we compare the ranges of the NPV scatter at 12% and 14%, it can be seen that they overlap by 71%.

Is it a lot or a little? Cash flow in 4-6 years is predicted with an accuracy of 14% (100,000/700,000), which is quite accurate. The change in the discount rate by 2% led to a decrease in NPV by 16% (when compared with the base case). Taking into account that the ranges of NPV scatter overlap significantly due to the accuracy of determining the amounts of cash income, an increase of 2% in the rate did not have a significant effect on the NPV of the project (taking into account the accuracy of determining the amounts of cash flows). Of course, this cannot be a recommendation for all projects. These calculations are given as an example.

Thus, using the above approach, the project manager must estimate the costs of additional calculations for a more accurate discount rate, and decide how much they will improve the NPV estimate.

We have a completely different situation for the same project, if the Discount rate is known to us with less accuracy, say +/- 3%, and future flows are known with a higher accuracy +/- 50,000.0

A 3% increase in the discount rate resulted in a 24% decrease in NPV (compared to the base case). If we compare the ranges of the NPV scatter at 12% and 15%, it can be seen that they intersect only 23%.

Thus, the project manager, having analyzed the sensitivity of NPV to the value of the discount rate, should understand whether the calculation of NPV will be significantly improved after calculating the discount rate using a more accurate method.

After determining the amounts and timing of cash flows, the project manager can estimate what the maximum discount rate the project can withstand (criterion NPV = 0). The next section discusses the Internal Rate of Return - IRR.

Internal rate of returnIRR(VSD)

Internal rate of return (eng. internal rate of return, IRR (IRR)) is the discount rate at which the Net Present Value (NPV) is equal to 0. The term Internal Rate of Return (IRR) is also used (see. example file, IRR sheet).

The advantage of IRR is that in addition to determining the level of return on investment, it is possible to compare projects of different sizes and durations.

To calculate the IRR, the IRR () function is used (the English version is IRR ()). This function is closely related to the NPV () function. For the same cash flows (B5: B14) The rate of return calculated by the IRR () function always results in zero NPV. The relationship of functions is reflected in the following formula:

= NPV (IRR (B5: B14); B5: B14)

Note4... IRR can be calculated without the IRR () function: it is enough to have the NPV () function. To do this, you need to use a tool (the "Set in a cell" field must refer to the formula with NPV (), set the "Value" field to 0, the "Changing the cell value" field must contain a link to the cell with the rate).

Calculating NPV at constant cash flows using the PS () function

Internal rate of return PIR ()

By analogy with NPV (), which has a related function, IRR (), NETWORK () has a NETWORK () function that calculates the annual discount rate at which NETWORK () returns 0.

Calculations in the PERFORMANCE function () are made according to the formula:

Where, Pi = i-th amount of cash flow; di = date of the i-th amount; d1 = date of 1st amount (starting date on which all amounts are discounted).

Note5... The CLEAR () function is used for.

They play a crucial role in the development of the economy, increasing its competitiveness. The problem of giving them a dynamic and uncontested character is very urgent for modern Russia. With the help of them, a qualitatively new level of means of production is achieved, an increase in its volume, the development of innovative technologies.

Is the topic of investment relevant for Russia? Perhaps the answer to this question will be information from Rosstat for 2013, indicating that the annual flow of foreign investment in the country's economy, compared to last year, increased by 40%. In general, the accumulated foreign capital in the Russian economy at the end of last year amounted to 384.1 billion US dollars. Most of the investments (38%) are in the manufacturing industry. 18% of their volume is invested in trade and repairs, almost the same (17%) - in the extractive industry.

According to statistics, since 2012, economic observers have determined that Russia ranks sixth in the world in terms of its investment attractiveness and at the same time is the leader among the CIS countries in this indicator. In the same 2012, foreign direct investment in the Russian market covered 128 large objects. The dynamics of the process is obvious. Already in 2013, according to Rosstat, only the volume of foreign direct investment in the Russian economy increased by 10.1% and reached the amount of $ 170.18 billion.

There is no doubt that all these investments are being made meaningfully. The investor preliminarily, before investing his funds, of course, assesses the attractiveness of the project commercially, financially, technically, and socially.

Investment attractiveness

The above statistics also have a "technical" side. This process is deeply comprehended according to the well-known principle, according to which one should first measure seven times. The essence of investment attractiveness as an economic category lies in the pre-determined benefit by the investor immediately before investing his capital in a particular company or project. When making investments, attention is paid to the solvency and financial stability of the startup at all stages of the development of the funds invested in it. Therefore, the structure of the investment itself, as well as its flows, must, in turn, be optimized.

This is achievable if the company making such an investment of funds systematically carries out strategic management of investments in the startup. The latter consists in:

- a sober analysis of the promising goals of its development;

- the formation of an adequate investment policy;

- its implementation in compliance with the necessary control with a constant cost correction in relation to market conditions.

The previous volume of the startup is being studied, the possibility of reducing current costs, increasing the technological level of production is being considered as a priority.

When forming a strategy, the legal conditions for its implementation must be taken into account, the level of corruption in the segment of the economy is assessed, the forecast of the situation is carried out.

Methods for assessing investment attractiveness

They are categorized as static and dynamic. When using static methods, a significant simplification is allowed - the cost of capital is constant over time. The effectiveness of static investments is determined by the payback period and the efficiency ratio. However, such academic indicators are of little use in practice.

In the real economy, dynamic indicators are often used to assess investments. The topic of this article will be one of them - net present value (NPV, also known as NPV). It should be noted that, in addition to it, such dynamic parameters as:

But nevertheless, among the above indicators, in practice, the central place remains for net discounted income. Perhaps the reason is that this parameter allows you to correlate the cause and effect - investments with the amount of cash flows generated by them. The feedback contained in its content has led to the fact that NPV is perceived as the standard investment criterion. What does this indicator still underestimate? We will consider these questions in the article as well.

Fundamental formula for determining NPV

Refers to methods of discounting cash flows or DCF-methods. Its economic sense is based on a comparison of IC investment costs and adjusted future cash flows. In principle, NPV is calculated as follows (see formula 1): NPV = PV - Io, where:

- PV is the current value of the cash flow;

- Io is the initial investment.

The above NPV formula shows monetary income in a simplified way.

Formula taking into account discount and one-off investment

Of course, the above formula (1) should be complicated, if only to show the discounting mechanism in it. Since the inflow of funds is distributed over time, it is discounted using a special coefficient r, which depends on the cost of investment. By discounting the parameter, a comparison of cash flows different in time of occurrence is achieved (see formula 2), where:

The NPV-formula should take into account the adjusted discount (coefficient r), determined by the investor's analysts in such a way that the investment project takes into account both cash inflow and outflow in real time.

According to the above methodology, the relationship between investment efficiency parameters can be represented mathematically. What pattern does the formula defining the essence of NPV express? That this indicator reflects the cash flow received by the investor after the implementation of the investment project and the recoupment of the costs provided for in it (see formula 3), where:

- CF t - investment payments over t years;

- Io is the initial investment;

- r - discount .

Above) is calculated as the difference between the total cash receipts updated at a certain point in time in terms of risks and the initial investment. Therefore, its economic content (meaning the current version of the formula) is the profit received by the investor with a powerful one-time initial investment, that is, the added value of the project.

In this case, we are talking about the NPV criterion. Formula (3) is already a more realistic instrument of a capital investor, considering the possibility of making an investment by him in terms of subsequent benefits. Operating with up-to-date cash flows, it is an indicator of benefits for the investor. The analysis of its results really influences his decision: to make investments or to refuse them.

What do negative NPV values tell an investor? That this project is unprofitable, and investments in it are unprofitable. He has the opposite situation with a positive NPV. In this case, the investment attractiveness of the project is high, and, accordingly, such an investment business is profitable. However, a situation is possible when the net present value is zero. Curiously, under such circumstances, investments are made. What does such an NPV testify to an investor? That his investment will expand the company's market share. It will not bring profit, but it will strengthen the state of the business.

Net Present Income for a Multi-Step Investment Strategy

Investment strategies are changing the world around us. Well-known American writer and businessman Robert Kiyosaki said well on this topic that it is not the investment itself that is risky, but the lack of its management. At the same time, the constantly progressing material and technical base forces investors not to one-time, but to periodic investments. NPV of the investment project in this case will be determined by the following formula (3), where m is the number of years during which the investment activity will be carried out, I is the inflation rate.

Practical use of the formula

It is obvious that making calculations according to formula (4) without using auxiliary tools is a rather laborious task. Therefore, the practice of calculating indicators of return on investment using table processors created by specialists (for example, implemented in Excel) is quite common. It is characteristic that to estimate the NPV of an investment project, several investment flows should be taken into account. At the same time, the investor analyzes several strategies at once in order to finally understand three questions:

- -what volume of investment is required and in how many stages;

- -where to find additional sources of financing, lending, if necessary;

- - whether the amount of projected receipts exceeds the costs associated with the investment.

The most common way - to practically calculate the real viability of an investment project - is to determine its parameters NPV 0 at (NPV = 0). The tabular form allows investors, without unnecessary waste of time, without resorting to the help of specialists, in the shortest time possible to visually present various strategies and, as a result, choose the option of the investment process that is optimal in terms of efficiency.

Using Excel to determine NPV

How do investors predict NPV in Excel in practice? We will present an example of such a calculation below. Methodological support of the very possibility of determining the efficiency of the investment process is based on the specialized built-in function NPV (). This is a complex function that takes several arguments typical of the formula for determining net present value. Let's demonstrate the syntax of this function:

NPV (r; Io; C4: C11), where (5) r is the discount rate; Io - initial investment

CF1: CF9 - project cash flow for 8 periods.

Investment project stage CF | Cash flow (thousand rubles) | Discount | Net Present Value NPV |

186.39 thousand rubles |

|||

In general, based on the initial investment of 2.0 million rubles. and subsequent cash flows at nine stages of the investment project and a discount rate of 10%, net present value NPV will amount to 186.39 thousand rubles. The dynamics of cash flows can be presented in the form of the following diagram (see diagram 1).

Diagram 1. Cash flows of an investment project

Thus, we can conclude about the profitability and prospects of the investment shown in this example.

Net Present Income Chart

A modern investment project (IP) is now considered by economic theory in the form of a long-term capital investment calendar. At each of its time stages, it is characterized by certain income and costs. The main item of income is proceeds from the sale of goods and services, which are the main purpose of such an investment.

To construct an NPV-graph, one should consider how this function behaves (the materiality of cash flows) depending on the argument - the duration of investments of various NPV values. If for the above example, then at its ninth stage we get the aggregate value of the private discounted income of 185.39 thousand rubles, then, limiting it to eight stages (say, selling the business), we will reach the NPV of 440.85 thousand rubles. The family - we will enter a loss (-72.31 thousand rubles), six - the loss will become more significant (-503.36 thousand rubles), five - (-796.89 thousand rubles), four - ( -345.60 thousand rubles), three - (-405.71 thousand rubles), limiting ourselves to two stages - (-1157.02 thousand rubles). The indicated dynamics shows that the NPV of the project tends to increase in the long term. On the one hand, this investment is profitable, on the other hand, the investor's stable profit is expected from about the seventh stage (see diagram 2).

Diagram 2. NPV schedule

Choosing an investment project option

An analysis of Chart 2 reveals two alternative options for a possible investor strategy. Their essence can be interpreted very simply: "What to choose - less profit, but immediately, or more, but later?" Judging by the graph, NPV (net present value) temporarily reaches a positive value at the fourth stage of the investment project, however, subject to a longer investment strategy, we enter a phase of sustainable profitability.

In addition, we note that the NPV value depends on the discount rate.

What does the discount rate take into account?

One of the components of formulas (3) and (4), by which the NPV of the project is calculated, is a certain discount percentage, the so-called rate. What does it show? Mainly the expected inflation index. In a steadily developing society, it is 6-12%. Let's say more: the discount rate directly depends on the inflation index. Let us recall a well-known fact: in a country where it exceeds 15%, investments become unprofitable.

We have the opportunity to check this in practice (we have an example of calculating the NPV using Excel). Recall that the NPV indicator calculated by us at a discount rate of 10% at the ninth stage of the investment project is 186.39 thousand rubles, which demonstrates profit and interests the investor. Let's replace the discount rate by 15% in the Excel spreadsheet. What will the NPV () function show us? Loss (and this is at the end after the completion of the nine-stage in 32.4 thousand rubles. Will the investor agree to the project with such a discount rate?

If we conditionally reduce the discount to 8% before calculating NPV, then the picture will change to the opposite: net present value will increase to 296.08 thousand rubles.

Thus, there is a demonstration of the advantages of a stable economy with low inflation for successful investment activities.

Largest Russian Investors and NPV

What is the result of successful accounting for winning strategies by investors? The answer is simple - to success! Let us present the rating of the largest Russian private investors based on the results of the last year. The first position is taken by Yuri Milner, co-owner of Mail.ru Group, who founded the DTS fund. He successfully invests in Facebook, Groupon Zygna. The scale of his investment is adequate to the modern world one. Perhaps that is why it is ranked 35th in the world ranking, the so-called Midas List.

The second position belongs to Viktor Remsha, who made a brilliant deal in 2012 to sell 49.9% of the Begun service.

The third position is taken by the co-owner of about 29 Internet companies, including the Ozon.ru megamarket. As you can see, the three largest domestic private investors invest in Internet technologies, i.e., in the sphere of intangible production.

Is this specialization an accident? Using the NPV definition toolkit, let's try to find the answer. The above investors, due to the specifics of the Internet technology market, automatically enter the market with a lower discount, maximizing their benefits.

Output

Modern business planning in terms of calculating the return on investment and the criticality to changes in expenditure now widely uses preliminary analysis of efficiency, including the determination of net present value. For investors, it is of great importance to determine the stability of the indicators of the basic variant of the investment project.

The versatility of NPV makes it possible to do this by analyzing the change in the parameters of an investment project at its zero value. In addition, it is a fairly sophisticated tool implemented for a wide range of users in standard spreadsheet processors using built-in functions.

It is so popular that online calculators are even placed on the Russian-speaking Internet to determine it. However, the Excel toolkit allows you to analyze more options for an investment strategy.