Almost every citizen has a bank card on which he receives a salary, keeps his savings there, or simply takes advantage of revolving credit lines.

This can provoke fraudsters to try in every possible way to deceive their personal data in order to gain access to the account.

Therefore, it is very important to immediately notify the bank about the loss of a plastic card in order to further block the account. This will help save money and prevent fraudsters from cashing out.

Experts have created several services that will allow you to quickly carry out temporary freezing. Professionals will tell you how to block a Raiffeisenbank card while a client is looking for it and has already decided to issue a new one. In any case, you will have to immediately notify the bank using one of these methods.

Online card blocking questionnaire

In order not to disturb the operators and not burden the bank branches, it was decided to create a special service that is aimed at solving only such issues.

It can be found either through the main menu on the Raiffeisenbank website, or immediately insert the link into the address bar of the browser www.raiffeisen.ru/retail/cards/lost_lock.

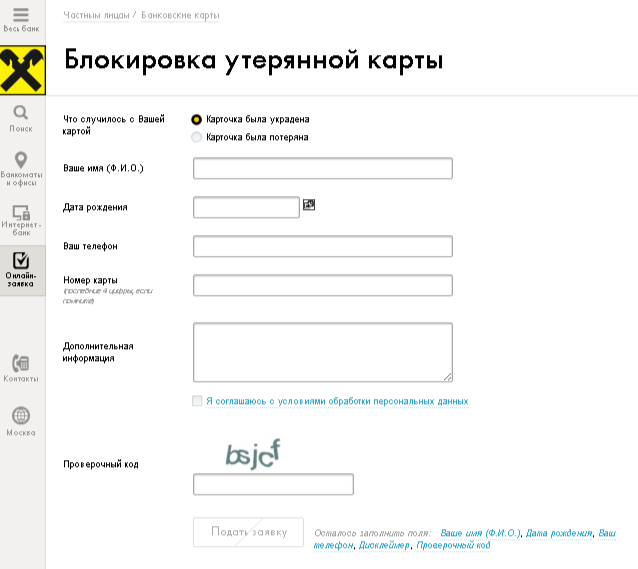

The user will see a menu in which they need to fill in the required fields:

- what happened to the map. Here you need to choose one of two points: it is either lost or stolen by a thief. Depends on it blocking time;

- full name of the owner of the lost card;

- the next field is the date of birth;

- mobile phone. Here it is advisable to indicate the valid financial number that was attached to the card;

- the last four digits of the plastic card;

- in the field "Additional information" the client needs to indicate under what circumstances he discovered the loss and when he last saw the plastic. If there were any strange situations, then they also need to be described.

A bank card is a convenient way to store savings, receive wages, pay for loans, purchases, utilities and cellular communications. Many, being the owners of a plastic card of the famous Raiffeisenbank, fall into a real panic, suspecting its theft or loss. So, how to block , and what methods exist for this.

The owner of a bank card, if it was lost, lost or stolen, must first of all take care of its blocking. This can be done using the available methods. In addition to visiting a bank branch, blocking is carried out remotely, using the phone or online, after which unauthorized access to the card will be excluded.

Contacting a bank branch

The most traditional way for many citizens is a personal visit to the nearest branch. You will need to fill out a written application and provide a passport for identification, as well as write another application for card reissue.

An unnamed bank card will be issued almost after the application is signed. A slightly longer period will be required for the issuance of personalized cards. Timing can vary significantly in different departments, on average, averaging 10 working days. A lost card will require payment of a commission.

Blocking by SMS

In order to block your bank card using and SMS, you need to send the following message to 7722: BLOCK XXXX, where XXXX are the last digits of the card. When you activate the SMS Banking service, a message in the same format is sent to 7243.

Blocking via Teleinfo

A customer support service called Teleinfo from Raiffeisen Bank is quite an effective tool for blocking lost or stolen cards. The service number can change, but the sequence of actions remains the same.

- First of all, you should call the hotline suitable for your locality:

- 1 Number 8-800-700-91-00 is intended for residents of Moscow;

- 2 Number 8-800-700-17-17 (subdivision "A");

- 3 Number 8-800-700-88-55 (subdivision "B").

- In the voice menu, you should listen to all the items, finally clicking on the desired one.

- Then the caller will be redirected to a specialist who should help in resolving the issue.

In this case, it is imperative to voice personal data and the reason for blocking the bank card to the operator of the support service. Getting help in Teleinfo is provided around the clock

Online blocking

The service is available using the main menu of the Raiffeisenbank website or following this link: www.raiffeisen.ru/retail/cards/lost_lock.

The user will need to enter the reason for blocking (loss, theft), which will directly affect its timing, name, date of birth, valid cell phone number associated with the card, circumstances of detection and when the card was last seen. After checking the data, you should confirm with a tick and then enter the verification code. After processing the application, the card will be blocked.

Blocking with R-Connect (internet banking)

For Raiffeisen Connect Internet banking users, blocking of a lost or stolen card is available in the "Card Blocking" menu in their personal account. Then you just need to follow the instructions of the system.

Locking with R-Mobile

The R-Mobile application can be effectively used to block a lost or stolen Raiffeisenbank card. You will need to send a request in the form of an SMS to 7243, which should contain the text NNNN (NNNN means the last digits of the blocked card).

Important!

If it is suddenly discovered that a Raiffeisenbank plastic bank card has been lost or stolen, you must immediately notify the bank so that it can promptly block the account. This measure will save money and prevent attackers from reaching them. For this, the above methods are used: a personal appeal to the bank, a call to the hotline or online methods. It is important to understand that after blocking the card it will become impossible to use it, it will need to be reissued.

In the self-service terminal, you must select the item "Request the balance" (the service is free).

- In the information center

You should contact the bank operator by phone +7 495 721 9100 (in Moscow) or 8 800 700 9100 (in other cities).

- At the bank branch

- Via SMS notification

It is required to send an SMS request with the text Balance NNNN (where NNNN is the last digits of the BOD number) to 7243. This is possible if the “SMS-notifications” service is connected to this card.

- Through the Raiffeisen Teleinfo service

You must enter the system by calling +7 495 777 1717 (in Moscow) or 8 800 700 1717 (in other cities). Follow the voice prompts of the system by dialing “2” (Card Information) - “1” (Balance and recent operations) - “1” (Balance) in tone mode.

- Through mobile banking

- With a monthly statement

Such a statement is generated every month on a specific date and is sent by the bank by mail or by e-mail. The service is provided free of charge.

3. Credit card top-up

You can pay off the debt on a Raiffeisenbank credit card in any of the following ways:

- Cash-in ATMs with the option to deposit cash

Such terminals can be found in almost all branches of the bank. After depositing the funds are immediately available for BOD operations. In addition, all Raiffeisenbank ATMs allow cashless transfers between cards.

- With a standing order

PPP is a convenient way to pay off debts if the client has two accounts in the bank (credit and salary, for example). In this case, you can issue an order, according to which funds will be transferred from the salary account on a monthly basis to repay the loan. You can issue an RFP at a bank branch by presenting your passport.

- Via internet bank

The Raiffeisen Connect service allows you to pay off credit card debt, make transfers between accounts and use the service of instant transfers from one BPC to another. To replenish a credit card, select the section "Credit Cards" - "Top Up Card" or "Instant Transfer Between BPC" in the menu. Then follow the prompts of the system.

- By depositing funds through the cashier of Raiffeisenbank

You should contact the manager for work with individuals with your passport, who will issue a cash receipt. After that, it will be possible to deposit the required amount of cash through the cashier.

- Through payment terminals QIWI

To carry out an operation using the payment system terminal, you need to know the account number / BOD number issued to the account. The term for crediting to the account is 3 working days, the QIWI commission is 1.5% (min 50 rubles).

- At the Russian Post office

To pay off the debt at the post office, it is enough to know the account number in Raiffeisenbank for crediting. The term for receipt of funds is up to 3 working days, the commission of the Russian Post is 1.3% (min 25 rubles).

- By depositing funds through the cashier of a third-party bank

Knowing the number of your credit account with Raiffeisenbank, you can pay off your credit card debt at the cash desk of any Russian bank that works with individuals. The term for the transfer of funds and the commission for the transfer are set by each financial institution individually.

4. Increasing the credit limit

To increase the credit limit, you must fill out an application and provide Raiffeisenbank with a 2-NDFL certificate or a certificate certified by the employer in the form established by the credit institution. At the time of application, your card must not be blocked.

Increasing the limit is possible if the following parameters are the same:

- an increase in the client's official income, which is confirmed by the 2-NDFL form (it indicates the income for the last four months, the "salary workers" of the bank may not provide such a certificate);

- the term of using the credit card exceeds 3 months;

- the last time the credit limit was increased more than half a year ago.

The bank has the right to refuse the client to increase the limit without giving the reasons for such a decision.

5. How to block the card

If you lose your credit card, you should immediately block it. To do this, you need to do one of the following:

- contact the support service at 8800 7001 717 (for customers of subdivisions "A") or 8 800 7008 855 (for customers of subdivisions "B") and inform the reason for blocking;

- independently via the Internet bank (in the "Credit cards" section, select the "Card blocking" item and follow the instructions of the system);

- write an Application for blocking the BOD on the Raiffeisenbank website, where you will need to indicate the personal data of the cardholder (the reason for blocking, full name, secret word and code number, card number, date and time of loss / theft and other details);

- customers connected to "SMS-Bank" / "Raiffeisen Mobile SMS-notifications" must send an SMS-request to 7243 to block the card with the text Block NNNN (where NNNN is the last digits of the BOD number);

- contact the nearest branch of the bank.

Having found a lost card, you must immediately inform the bank about it.

6. How to change the PIN code

The PIN-code is issued to the client in a sealed envelope in the selected bank branch or is given by an authorized representative of the bank upon delivery to the client, or is created by the individual independently in the Raiffeisen Teleinfo System (for certain types of cards) or through the bank terminal installed in the branch (if the terminal has such a technical possibilities).

The Bank grants the right to change the PIN code at ATMs with this function. When creating / changing the secret password, the client does not have the right to use PIN-codes consisting of four identical numbers (“0000”, “2222”), as well as of consecutive numbers (“1234”, “9876”). Change your PIN at least once a month. Use the rule known only to you for forming a digital combination.

7. How to close the map

You can close a Raiffeisenbank credit card according to the standard procedure:

- call +7 495 721 9100 to inquire about your credit card debt;

- pay off debt;

- write an application to close the card account at the bank branch;

- get a certificate of absence of debt;

- hand over the card.

The card account will be closed within 45 days.

Before answering the question "How to unblock a card?", You need to look back and find out why the payment instrument was blocked. This fact matters.

A credit card can be blocked for the following reasons:

- Its validity period has expired;

- You made a mistake three times when entering the PIN code at the ATM;

- You have blocked the card yourself;

- The payment instrument has been suspended by the bank.

There aren't many options. Let's consider each of them.

Card blocked due to expired

Perhaps the simplest situation. By the way, such a nuisance will not take you by surprise if you are connected to the services of SMS-informing and Internet banking. In this case, you will be promptly warned about the imminent expiration of the card and will be able to initiate the extension of the "plastic".

If you do not know that the card has expired, the ATM will either take it away from you or write on the screen “The card has expired. Contact the bank. " Actually, this is what you need to do. Nowadays, many banks reissue cards automatically (especially credit cards), so there will be no problems with obtaining a new means of payment.

Naturally, in most cases you will have to pay a reissue and service commission for a new term.

Card blocking due to incorrect PIN entry

If you make a mistake 3 times (sometimes more) in the code while standing at the ATM, then the machine withdraws the "plastic", which is automatically blocked. This does not happen in ATMs of some institutions - the card remains in your hands, and the device simply informs you that the payment instrument is blocked.

In most banks, such a block is removed automatically in a day or after 24:00 on the day of withdrawal and without charging a commission.

And here is the client OTP Bank The operation of unblocking the card in case of entering the wrong code is also carried out free of charge, but for this you must either go to the bank branch and submit an application, or call the customer support service.

The card is blocked at the initiative of the client

In such a situation, the reason why you blocked the card is crucial. If you did it for personal reasons (and did not announce them to the bank) - this is one thing, if because of the loss or theft of "plastic" - another. In the first case, almost all credit institutions are allowed to unblock the means of payment, in the second - only a few.

For example, a client Raiffeisenbank who blocked the card due to loss, may not look for a "credit card", because you simply cannot unlock it. The bank automatically re-issues the plastic card. Having received a new "plastic", you will have to call the support service in order to unblock it.

Similar orders for Baltic Bank and Home Credit Bank ... If your card was stolen and you blocked it, then the reverse process is impossible. Only in this case, the card is not automatically reissued - you must definitely go to the department. However, you can unblock the card if you blocked it for personal, so to speak, reasons (not theft and loss). Again, you should go to the bank and write a statement. There is no commission for unblocking the card for Home Credit Bank clients. Baltic Bank for the resumption of operations that were suspended due to the loss of the PIN code, charges 100 rubles.

Bank VTB 24 also does not charge a fee for unlocking "plastic". But the institution does not perform such an operation over the phone - the personal presence of the client is required. However, only if you have blocked the card by calling. If you confirmed this fact with a written statement, and then found the loss, then nothing can be done - the mechanism is running, such a card cannot be unlocked. The same is with Sberbank.

The card is blocked by the bank

Here again we have several options. At first, a financial institution may suspend an account on suspicion of fraudulent transactions. For example, if you have withdrawn money several times from different ATMs within a short period of time. You need to call the bank and confirm that you made the transactions. And the card will be unblocked.

Secondly, all actions on the card may be suspended due to your default on credit obligations. Simply put - you are late in payment. Under such circumstances, you need to pay the debt to unblock the card (which is logical). In this case VTB 24 , for example, will remove the ban on transactions the very next day after the receipt of funds. And here Baltic Bank requires not only the fulfillment of obligations, but also the personal appearance of the client at the branch, where he fills out an application for the restoration of the credit limit.

Besides, you will have to pay a penalty for missing a mandatory payment. Other institutions (for example, Sberbank ) in case of delay, they are not fined, but the interest rate is increased. Keep in mind that the bank has the right to refuse to unblock your card altogether and demand full repayment of the loan.

Before unblocking your card, remember that the security of your funds is in your hands. If you forgot your card in a store, or just someone found it on the street and returned it to the bank (sometimes it happens), then unblocking the card and not paying money for its reissue is, of course, a temptation. But it's better to step on his throat. The card has been in the wrong hands, so it's better to play it safe and order a new one!

P.S. Read how to block a card of a specific bank.

If a Raiffeisenbank bank card is lost, forgotten at an ATM or terminal, it can easily fall into the hands of intruders. Having picked up the password, they will withdraw your money or conduct other dubious financial transactions. To prevent this from happening, you definitely need to quickly block your Raiffeisenbank card by phone or through your personal account on the Internet. Unauthorized access to the account is limited within a few minutes after the client's request; it will be impossible to withdraw money, even if you know the PIN code.

Raiffeisenbank card blocking instructions

For many people, the best option to block a lost or stolen Raiffeisenbank card is still going to a bank. To do this, you will need to find the nearest branch and write a written application. Non-personalized cards, that is, those that do not indicate the name and surname of the owner, are immediately reissued. The situation is more complicated with registered ones - on average, it takes 10 days to reissue. But even if the card is simple, it takes some time to go to the bank branch, wait for a specialist in the queue, write a statement about the loss and send a request to restore the account. It is clear that during this time someone can find the card and use it. Eliminates the risks of instant blocking, carried out immediately after you have discovered the loss. Raiffeisenbank has developed several blocking methods, which require a mobile phone or access to Internet banking, where financial transactions were carried out.

How to block by phone

Raiffeisen recently introduced a service that allows you to block your card via SMS. You must have access to the linked mobile number, as well as know the last four digits of the plastic. Without hesitation for a long time about what to do if you lost your card, dial from your phone:

- word BLOCK;

- separated by a space XXXX - the last numbers of the number.

The message is sent to number 7722.

Blocking occurs instantly. There is one nuance here - the mandatory use of a phone that is tied to a Raiffeisenbank card. And access to it may not be possible if, for example, the card was not lost, but its owner was robbed, at the same time taking other valuable things.

If there is no access to your cell phone, contact the managers at the hotline number. This can be done from any mobile or landline phone. Please note that phones for:

- Muscovites - 8 800 700 91 00;

- residents of other cities - 8 800 700 17 17 or 8 800 700 88 55.

Blocking a Raiffeisenbank card by phone in this way will not work as quickly as possible. First, you get to the voice menu, following the prompts and pressing numbers, and after you will be redirected to a specialist. Usually the process takes 3 to 5 minutes if there are free operator lines.

The bank has the right to close the card only after confirming the identity of the owner. What are your passport details and the reason for blocking. You may need information about the last received or sent payments, number and the like. Raiffeisenbank's support service operates around the clock.

Blocking through the Personal Account

Only Internet banking owners can block the card through their personal account.

Log in with your username and password to the raiffeisen application, find the item "Individuals", then "Bank cards". In order to close your card via the Internet, you will need to specify:

- item "Blocking";

- the reason for blocking (stolen or lost);

- surname, name and patronymic of the owner;

- date of birth;

- mobile number;

- card number;

- Additional information;

- verification code.

After that, you need to verify the specified data and agree to the terms of processing personal information.

IMPORTANT! Consideration of an application usually takes no more than 10 minutes. After confirmation, the card is blocked, it will be impossible to enter Internet banking using the same username and password.

How to unblock the card again

You can only unblock your Raiffeisenbank card if it has been lost and not stolen. This item is indicated when filling out the application for blocking. Such measures are necessary in order to ensure maximum user safety.

Since the entrance to Internet banking is not carried out after the processing of the application by the operator, there is no way to start recovering from it. Plastic can be made active only in a branch of a financial organization or an information center. In this case, a handwritten application and passport are provided. The same procedure is relevant if the cardholder accidentally entered the password incorrectly three times, and the ATM (terminal) took the payment instrument.

In some cases, the cardholder himself blocks it when it is not stolen or lost. The issue of unlocking is considered in each case individually, it all depends on the reason for the lock. If the owner's identity is confirmed, the reason is clear, then after approval by the bank's specialists, the card will work again, all functionality will become available.

A blocking that occurred by the decision of a financial institution, for example, if a person was under investigation for money fraud, can only be canceled by a court decision. The bank does not have the right to lift the restriction until a corresponding order is received.

Unblocking a bank card is a rather lengthy process; the chances of a successful result are not always great. Even if the owner of the card did not do anything illegal, for example, he simply forgot the card at home, but thought that it had been stolen, and immediately reported this fact to the bank's employees via the hotline, they would hardly agree to unblock it. It's much easier to re-release plastic. When the card is not personalized, it will take about 10 minutes, you only need to provide your passport. The registration of personalized instruments takes a little longer.

Card closing procedure

You can bring plastic to any bank branch in your city. It is not necessary that the Raiffeisenbank branch coincides with the place where the card was issued. However, the delivery of plastic does not mean that the account will be blocked.

Closing a card and, along with it, your line of credit in a financial institution is a rather lengthy process. Bank employees must first verify the identity of the plastic holder, and then the movement of funds in his account. If the card is a credit card and has been actively used, the process can take several weeks.

Clients can block a Raiffeisenbank card in various ways. The easiest method is to send SMS, but in this case, access to the cell phone to which the card is linked is required. Other methods (by phone number, online banking) are also effective, but they will take more time.