A tax return, which reflects information on property tax, must be provided by all companies (legal entities) that have at their disposal any fixed assets (real or movable property) that are objects of taxation. Moreover, the declaration is filled out even for property that has zero residual value. A zero declaration is submitted for such OS. Anyone who is obliged to pay property tax must know the deadlines for submitting the declaration in 2016. They are regulated by Chapter 30 of the Tax Code of the Russian Federation.

When do you need to report property taxes?

All companies that pay property taxes must report to the Federal Tax Service based on the results of each reporting period. In the case of providing advance calculations for property taxation, this is the 1st, 2nd, 3rd quarter. In this case, the documents must be sent to the Tax Service no later than 30 days after the expiration of each of the specified periods. As for the provision of a tax return containing information on the taxation of property, it must be provided after the entire tax period (year).

All tax contributions for the property of organizations are directed to the benefit of regional budgets (replenish them). In this regard, the right to establish the amount of tax collected (tax rate), as well as to determine the need to make advance payments based on the results of each quarter, is within the competence of local authorities. But the tax rate approved by law should not exceed 2.2%.

At the same time, the tax return is not necessarily submitted to the Federal Tax Service at the place of registration of the company. In some cases, the corresponding reports are submitted to the Inspectorate, in whose department the area where the real estate of the taxpayer is actually located is located. Another exception is separate divisions of companies that have a separate balance sheet on which their property is listed.

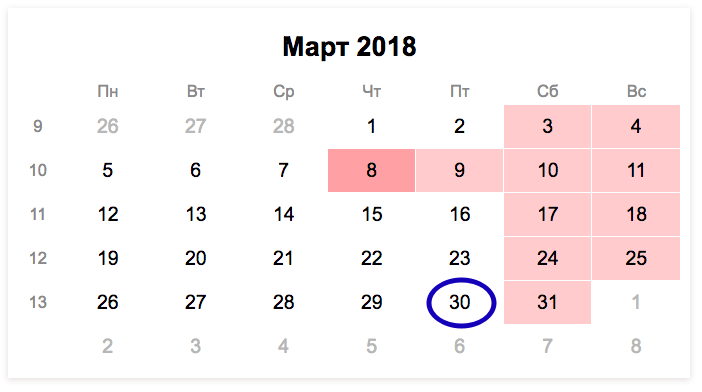

That is, if a company submits reporting documentation for 2015, then it must do this before March 30, 2016.

How to submit a property declaration

The declaration can be submitted to the Tax Office on paper or sent via the Internet in electronic form. Electronic document flow between taxpayer companies and the Federal Tax Service is carried out with the involvement of special operators who have a valid license to carry out their activities. You can also send an electronic declaration on the Inspectorate website.

In paper form, the declaration is handed over directly to a Federal Tax Service employee during a personal visit or sent to the Tax Inspectorate by mail. In the first case, a company representative (acting on the basis of a power of attorney) or an authorized person submits two copies of documents to the Federal Tax Service. After verification, one of them is returned to the taxpayer with a note that the declaration has been accepted.

In the second case, reporting documents should be sent by registered mail with notification and inventory. Then confirmation of submission of reports will be a postal receipt. To avoid controversial issues, it must be preserved so that, if necessary, you can prove the timely submission of reports and avoid possible punitive measures for delay.

The fine for late submission or failure to submit a property declaration is 5% of the amount of tax payable for each overdue month, but not less than 1000 rubles and not more than 30% of this tax. Let us remind you that the property declaration for the tax period must be submitted no later than March 30 of the following reporting year.

The updated tax return for the property tax of organizations was put into effect by the Federal Tax Service in Order No. ММВ-7-21/271@ dated March 31, 2017. The same legal document approved the calculation of advance payments, the procedure for drawing up reports and the format of electronic submission. Let's figure out what has changed and when it is necessary to use new forms. Submission deadlines and forms for downloading are provided separately.

The 2017 corporate property tax declaration is submitted at the end of the calendar year by those legal entities that have the appropriate taxable objects (clause 1 of Article 373 of the Tax Code). At the same time, what kind of property is subject to taxation is given in the stat. 374. For Russian legal entities this is, in particular:

- Movable objects accepted for balance sheet accounting.

- Immovable objects accepted for balance sheet accounting.

- Objects transferred to the trust, temporary possession, disposal, use, etc. based on contracts.

Note! Land, water resources and other objects are not taken into account for taxation under clause 4 of the statute. 374 NK.

If an enterprise does not have the appropriate facilities, there is no obligation to file a property tax return. But in cases where there is no need to pay tax due to full depreciation of fixed assets or the presence of preferential objects on the balance sheet, it is necessary to submit a zero property tax return for 2017.

Where exactly to file a property tax return?

To correctly submit the declaration, you should be guided by the norms of stat. 386 of the Tax Code, where it is determined that reports are submitted to the Federal Tax Service based on the results of tax (year) and reporting (quarter, half-year, 9 months) periods. If payments are determined based on cadastral value data, quarters 1, 2, 3 are recognized as reporting periods. In accordance with clause 1 of Stat. 386 declaration is submitted:

- At the location of the company.

- The location of the subdivisions (separate divisions) that have a separate balance sheet.

- The location of those objects for which the tax is calculated in a special manner.

- Location of facilities included in the UGSS (unified gas supply system).

- The place of registration in the status of the largest taxpayer is only for taxpayers who meet the criteria for classification as the largest (Article 83 of the Tax Code).

Note! Reporting on property is submitted in accordance with those established in clauses 2 and 3 of Art. 386 terms - details below.

Deadline for filing a property tax return:

- For 1 sq. 2017 – no later than 05/02/17

- For the first half of 2017 – no later than 08/31/17.

- In 9 months 2017 – no later than October 30, 2017

- For the year 2017 – no later than March 30, 2018.

Note! The official deadlines are given taking into account the current rules for postponing weekends and holidays.

What has changed in the new property tax return?

The updated annual reporting form should be used starting with the submission of the declaration for 2017. Accordingly, a new advance calculation must be submitted for the first time in the 1st quarter. 2018. However, according to the explanations of the Federal Tax Service in Letter No. BS-4-21/7139@ dated April 14, 2017, for the convenience of taxpayers, it is possible to report using new forms earlier, for 1 quarter. 17

What has changed in the current forms? First of all, the barcodes in all sheets have been adjusted, and the line with the TIN has been reduced from 12 positions to 10. Section 2.1 has been added on data on real estate, the tax on which is calculated based on the average annual cost. The list of innovations includes:

- Title page – OKVED code has been deleted, the coding of reporting periods has been changed, the MP sign for stamping has been removed, the procedure for filling out the contact telephone number has been clarified.

- Section 2 – the encoding of page 001 for the type of property objects has changed, subsection has been added. 2.1, which is formed only by taxpayers who use the average annual cost in their calculations.

- Section 3 – the encoding of page 001 has also changed, pages 020, 030 have been renamed, the codes of page 040 have been adjusted in terms of tax benefits.

Some innovations also affected the calculation of advance amounts for corporate property tax. In general, the changes are similar to the above adjustments to the annual form.

How are declarations submitted?

The reporting format, including the property tax return for 2017, can be either electronic or on paper. For certain categories of taxpayers, there is an obligation to submit reports only in electronic form. So, according to paragraph 3 of Art. 80 declaration must be submitted electronically:

- Taxpayers with an average number of personnel for the last year of 100 people.

- Newly created, incl. as a result of reorganization measures, taxpayers with an average number of personnel of 100 people.

Note! Property tax for individuals is paid to the budget in accordance with notifications from the tax inspectorate. In this case, taxpayers are citizens who legally own property.

Property tax declaration for 2017 – instructions for filling out

The exact and detailed procedure for providing data in reporting is contained in Order No. ММВ-7-21/271@ dated March 31, 2017. The general requirements for filling out information and the algorithm for forming individual sections are indicated here; line encodings are given separately in the Appendices.

Current requirements for filling out the declaration:

- The document is formed at the end of the year.

- Cost values are entered only in full rubles according to the rules of mathematical rounding (indicators from 50 kopecks are rounded, up to 50 kopecks are discarded).

- The numbering of sheets begins with the title page, the indicators are recorded starting from “001” from left to right.

- Double-sided printing is prohibited, as is the use of putty correctors.

- If the document is generated “on paper”, it is allowed to fill the lines with blue, purple or black ink in capital block letters.

- All lines are filled only from left to right, and not vice versa.

- A separate field is allocated for each indicator.

- If the document is generated on a computer using software, all numerical indicators should be aligned to the last familiarity.

- If there is no indicator to fill in, the field is crossed out.

- The OKTMO code is entered from left to right, the remaining cells are filled in with dashes.

- Title page - data is entered on the basis of registration documents when registering with the Federal Tax Service. Submission of the primary report is indicated by the code “0–” in the number of adjustments, clarifying ones – by the number of adjustments, starting with “1–”.

- Certification of the accuracy of the specified data is carried out by signing the document - by the responsible official of the taxpayer or representative.

- The document can be submitted either by the taxpayer personally or by his representative. In the latter case, a notarized power of attorney is required.

- It is allowed to send the document by mail (by a valuable letter with a list of attachments) or via TKS by signing an electronic digital signature.

- A zero property tax return is not submitted if the legal entity does not have the corresponding fixed assets on its balance sheet. In this case, only transport tax is charged on the car, and not property tax, provided that the object is assigned to depreciation groups 1 or 2 according to the OS Classification (subclause 8, clause 4, article 374).

Responsibility for late submission of a declaration

Failure to submit an annual declaration within the deadlines approved at the federal level entails the collection of penalties under clause 1 of the article. 119 NK. This is 5% of the unpaid amount of tax due on the basis of an unfiled return. Each month of non-payment is taken into account for the billing month, but the maximum amount of sanctions should not exceed 30% of the indicated amount. The minimum is 1000 rubles. and is charged if a zero report is not submitted.

If the taxpayer violated the legislative norms regarding the submission of advance payments, liability is applied according to stat. 126 NK. According to clause 1, 200 rubles will be charged for each payment submitted late. A decision by control authorities to hold a legal entity liable is possible only after inspection activities have been carried out. In particular, these are desk inspections or on-site inspections according to statistics. 88, 89 NK. And based on the decision, the taxpayer is required to pay a fine.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Organizations that pay property tax must report to the Federal Tax Service on the results of reporting periods, as well as on the results of the year (Article 386 of the Tax Code of the Russian Federation).

Property tax: reporting in 2017

Based on the results of the reporting periods, organizations must submit calculations for advance payments (Appendix No. 4 to Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895). And at the end of the year - a declaration.

By the way, the tax service approved new forms of declaration and calculation (Order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/271@). The declaration using the new form must be submitted based on the results of 2017, and the calculation – based on the results of the first quarter of 2018. However, the updated calculation can be used now (Letter of the Federal Tax Service dated April 14, 2017 No. BS-4-21/7139@).

Tax period for property tax

The tax period for corporate property tax is a calendar year (Clause 1, Article 379 of the Tax Code of the Russian Federation).

Reporting period for corporate property tax

Reporting periods for property tax depend on the basis on which value of the organization’s property the tax is calculated:

Which reporting period for property tax should be indicated in reporting?

Due to the fact that an organization may have property, the tax on which is calculated based on both the average annual value and the cadastral value, accountants have a question: what reporting period should be indicated in the calculation? After all, such property has different reporting periods, and the procedure for filling out the current calculation form involves indicating reporting periods only for property taxed based on the average annual value (1st quarter, 1st half of the year, 9 months).

So, the Federal Tax Service clarified that until the calculation form and the procedure for filling it out are updated, all payers are recommended to indicate the following codes reflecting the reporting period for corporate property tax (Letter of the Federal Tax Service dated March 25, 2016 No. BS-4-11 /5197@):

Deadline for submitting property tax returns for the 3rd quarter of 2017

Articles on the topic

All organizations that pay property tax submit a tax return for 9 months (calculation of the advance payment for property tax). The deadline for submitting the property tax return for the 3rd quarter of 2017, as well as the procedure for filling out the calculation, can be found in our article. Download the form and fill it out with us.

What is the deadline for submitting a property tax return for the 3rd quarter of 2017?

Submit a property tax declaration based on the results of the tax period - year (Article 386 of the Tax Code of the Russian Federation). The deadline for such a declaration is no later than March 30 of the following year.

In those regions where local authorities have established reporting periods, it is necessary to submit an advance payment calculation, the deadline for its submission is no later than 30 calendar days from the end of the reporting period.

The deadline for calculating the advance payment of property tax for the 3rd quarter of 2017 is no later than October 30, 2017.

Please note that the company submits a property tax return only once a year, and every quarter it submits not a declaration, but a calculation of advance payments for property tax. But many companies still call quarterly reports a declaration.

The deadline for paying property tax for the 3rd quarter of 2017 is set at the level of regional legislation; accordingly, this deadline is different in different regions.

Who submits the property tax return for the 3rd quarter?

All organizations that have assets in account 01 “Fixed Assets” or 03 “Profitable Investments in Material Assets” submit a declaration (as well as calculation of the advance payment).

Important! If the residual value of your fixed assets in the balance sheet is zero, then also submit a declaration and calculation of advances, since in this case, the company is not exempt from this obligation (letter of the Federal Tax Service of Russia dated February 8, 2010 No. 3-3-05/128).

Every accountant should know this!

What property do you need to report for in the 3rd quarter of 2017?

Property can be movable and immovable. Real estate is taxed:

Movable property is taxed only at its residual value. Movable property of the first and second depreciation groups are not subject to property tax. In addition, movable objects that are included in the third to tenth depreciation groups are also not subject to tax if the following conditions are met:

If you don’t have such property on your balance sheet, don’t submit the calculation. This is confirmed by the Tax Code of the Russian Federation (clause 1 of Article 373, Article 374, clause 1 of Article 386), as well as the letter of the Ministry of Finance of the Russian Federation dated September 23, 2011 No. 03-05-05-01/74.

Individuals and individual entrepreneurs do not pay this tax and do not submit declarations.

How to submit a property tax return

You can submit the calculation in two versions: on paper and electronically. It all depends on the number of employees in your company.

Deadlines for filing property tax returns for 2017

Organizations that have movable and immovable property on their balance sheet submit a property tax return for 2017. The deadlines for delivery are established by the Tax Code of the Russian Federation. For failure to comply with the requirements of the code, the Federal Tax Service will fine you.

Deadlines for submitting property tax returns for 2017: deadlines (table)

Organizations submit a property tax return for the past year to the tax office no later than March 30 of the new year (clause 3 of Article 386 of the Tax Code of the Russian Federation). In cases where the last day of the deadline falls on a day recognized as a weekend or non-working holiday, the end of the deadline is considered to be the nearest working day (Article 6.1 of the Tax Code of the Russian Federation).

The deadline for submitting the property tax return for 2017 will not be postponed; it must be submitted no later than March 30, 2018. The established date applies to all organizations and does not depend on the method of tax calculation.

Deadline for filing property tax returns for 2017

Property tax return for 2017: new form

Property tax return for 2017: sample form

If the tax period for property tax is considered to be a year, that is, the declaration is submitted only for the year, then the reporting periods depend on the value at which the property is taxed.

Reporting periods for payers calculating tax from cadastral value are: 1st, 2nd and 3rd quarter. And if the book value (average annual) value of the property is taken into account, the reporting periods are 1 quarter, six months and 9 months.

At the end of each reporting period, calculations of advance payments are submitted to the inspection. Deadline - no later than 30 days from the end date of the relevant period. At the same time, regions may not establish reporting periods (Article 379 of the Tax Code of the Russian Federation).

The reporting period codes for liquidation or reorganization are different (51, 47 and 48 for the 1st quarter, 2nd quarter (half year) and 3rd quarter (9 months), respectively).

Deadlines for submitting advance calculations for corporate property tax

Failure to meet deadlines for submitting property tax returns for 2017: sanctions

Failure to submit a return on time may result in fines. The amount of the fine is regulated by paragraph 1 of Article 119 of the Tax Code of the Russian Federation. According to this provision, failure to submit a declaration within the legal deadline will result in a fine in the amount of 5% of the unpaid amount of property tax.

The fine is charged for each full or partial month from the date established for reporting. By law, the fine cannot exceed 30% of the unpaid tax amount. But it cannot be less than 1000 rubles.

Thus, the specific amount of the fine depends on the amount of arrears. In this regard, a reasonable question arises.

Will it be possible to avoid a fine if there is no tax arrears, but the deadline for submitting the declaration is overdue?

The Plenum of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 57 dated July 30, 2013, answered this question unequivocally. The fine will have to be paid in any case. The court explained that the absence of a taxpayer's arrears on the declared tax or the amount of tax due does not exempt him from the fine. In this case, the fine is subject to a minimum amount of 1,000 rubles.

In addition to this fine, the director and accountant of the company will also be held liable under Article 15.6 of the Code of Administrative Offenses of the Russian Federation. According to this norm, failure to provide information necessary for tax control entails the imposition of an administrative fine on officials - from 300 to 500 rubles.

Who must comply with the deadline for filing a property tax return?

The obligation to submit declarations is established for all organizations that own property. And both immovable and movable. If a company has at least one fixed asset that is subject to property tax by law, it will be required to report on it.

This also applies to real estate for which the rights have not been registered. The Ministry of Finance pointed out this circumstance in a letter dated November 25, 2015 No. 03-05-04-01/68419. The agency indicated that the acceptance of an asset for accounting as a fixed asset is not linked to the state registration of ownership rights to it.

Real estate objects are taxed from the date they are placed on the organization’s balance sheet as fixed assets. Accordingly, declarations must also be submitted for such objects.

On the other hand, those organizations that do not have fixed assets should not submit any zero declarations. The same Ministry of Finance, in letter dated February 28, 2013 No. 03-02-08/5904, indicated that in the absence of property recognized as an object of taxation, the organization does not have an obligation to submit reports.

Let us remind you that the property tax declaration form was approved by order of the Federal Tax Service dated November 24, 2011 No. ММВ-7-11/895. The form consists of a title page and three sections.

Organizations with more than 100 employees report electronically. All other enterprises are on paper.

Where to file a property tax return for 2017

Organizations are required to submit declarations at their location, at the location of each separate division that has a separate balance sheet, as well as at the location of each property.

The procedure for filling out a tax return for the property tax of organizations, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895, requires reporting on all objects, depending on the type of object and the place where it is located.

So, the declaration is submitted to the inspection office at the following place:

www.gazeta-unp.ru

Property tax: due date – 2018

srok_otchetnosti_po_nalogu_na_imushchestvo.jpg

Organizational property tax is levied on movable and immovable property assets of companies. Payers can be not only domestic enterprises, but also foreign organizations (Article 374 of the Tax Code of the Russian Federation). Chapter 30 of the Tax Code regulates, along with the procedure for calculating property tax, the deadlines for submitting reports on it. For calculated tax obligations, business entities must submit a property tax declaration to the Federal Tax Service, as well as quarterly calculations for advance payments (if tax advances are provided for by regional legislation).

Property tax: reporting deadline – 2018

The tax period for property tax is equal to a calendar year, reporting periods are quarterly, half-yearly, and 9 months. The declaration is submitted to the Federal Tax Service based on the results of the tax year, and at the end of the next reporting period, calculations for advance transfers are submitted (clause 1 of Article 386 of the Tax Code of the Russian Federation).

The declaration can be submitted to the department of the Federal Tax Service (clause 1 of Article 386 of the Tax Code of the Russian Federation):

- with reference to the location of the company;

- by location of one or more separate divisions (provided that these divisions form a balance sheet separately from the parent enterprise);

- taking into account the location of the taxable object (each immovable asset separately);

- with reference to the territory where the assets forming the UGSS (unified gas supply system) are located.

- the calculation of the advance payment for the 1st quarter should have been submitted to the Federal Tax Service no later than May 3, 2018 (the deadline was postponed due to the May Day holiday);

- The results of the six months are reflected in the calculations and submitted to the Federal Tax Service by July 30, 2018. inclusive;

- calculations for 9 months are submitted to the tax authority no later than October 30, 2018.

- amendments have been made to the Tax Code;

- the last day for preparing and sending a declaration or advance payment coincided with a non-working day (weekend or public holiday).

If the organization is one of the largest companies, the declaration forms are submitted by it at the place where the status of the largest taxpayer is assigned.

The deadlines for submitting tax reports can be adjusted by the laws of the constituent entities of the Russian Federation within the limits established by Chapter 30 of the Tax Code of the Russian Federation, therefore taxpayers need to clarify the deadlines in force in their region.

In paragraph 3 of Art. 386 of the Tax Code of the Russian Federation states that at the end of tax periods, companies should calculate tax liabilities on property assets and transmit information about the accruals made to the regulatory authority by March 30 of the following reporting year.

For the property tax return completed for the past 2017, the deadline for submission in 2018 has already passed; it had to be submitted by March 30. The 2018 declaration must be submitted to the tax authorities no later than April 1, 2019 (since March 30 falls on a Saturday).

The updated sample of the declaration form was approved by order of the Federal Tax Service of the Russian Federation No. ММВ-7-21/271@, dated 03/31/2017.

In relation to settlements for advance transfers, it is necessary to focus on the norms of clause 2 of Art. 386 Tax Code of the Russian Federation. If the regional law provides for the payment of advances on property tax, the deadline for submitting reports, including 2018, falls on the 30th day after the end of the reporting interval:

The form for calculating advance payments was approved by the same order of the Federal Tax Service as the declaration - No. ММВ-7-21/271@ dated March 31, 2017. In 2017, companies were given the right to fill out calculations of the old type, but for tax liabilities accrued for periods 2018, it is required to submit calculations using a new template.

The deadlines for sending property tax reporting forms to the tax authorities, established by the Tax Code, are adjusted only in two cases:

The established deadlines are the same for all business entities, regardless of how they determine the tax base (based on the cadastral or average annual value of taxable property). Delay threatens the company with a fine in the amount of 5-30% of the amount of tax unpaid according to the declaration, but not less than 1000 rubles. (Article 119 of the Tax Code of the Russian Federation). Officials are punished with a fine of 300 to 500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

Property tax return for the 4th quarter of 2017: deadlines for submission

What is the deadline to submit a property tax return for the 4th quarter of 2017? By what date should the annual report be submitted to the Federal Tax Service? We will provide the exact deadlines for submitting the property declaration.

Who should account for the property?

All organizations paying property tax must also submit a declaration for this tax. The declaration must be submitted based on the results of the tax period – 2017. In this way, it is more correct to call the submission of the declaration not for the 4th quarter of 2017, but for the entire 2017. This will comply with the norms of the Tax Code of the Russian Federation on property taxes.

If in 2017 the organization did not have fixed assets (taxable objects) on its balance sheet that are subject to property tax, then it is not required to submit declarations for the 4th quarter of 2017. They also do not submit property tax returns and individual entrepreneurs. They do not pay corporate property tax.

Use the new property declaration form

In 2017, a new property tax declaration form was approved. It is required to be filled out as part of the declaration for the 4th quarter of 2017 (or rather, the annual declaration). The amendments are provided for by Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271).

The new declaration form, approved by Order of the Federal Tax Service dated March 31, 2017 No. ММВ-7-21/271@, additionally includes Section 2.1 “Information on real estate objects taxed at the average annual cost.” It is required to be submitted by all taxpayers who submit a property declaration for the 4th quarter of 2017 using the new form.

Download the new property tax declaration form for the 4th quarter of 2017.

When to report for the 4th quarter of 2017

The deadline for submitting the property tax return for the 4th quarter of 2017 is March 30, 2018 (Clause 2 of Article 386 of the Tax Code of the Russian Federation).

Please note that if the last day of the deadline falls on a weekend, then reports can be submitted on the next working day (clause 7 of Article 6.1 of the Tax Code of the Russian Federation). However, the deadline for submitting the property tax return for the 4th quarter of 2017 has not been moved, since March 30, 2018 is Friday.

If you miss the deadline for submitting the declaration for the 4th quarter of 2018

If an organization violates the deadline for submitting a property tax return for the 4th quarter of 2017, then it faces a fine under Article 119 of the Tax Code of the Russian Federation: 5 percent of the unpaid amount for each month of delay (full and incomplete). In this case, the minimum fine is 1000 rubles, the maximum is 30 percent.

Many people know that after the tax period, certain categories of citizens are required to submit reporting documentation to the tax department. In this regard, the question arises of who submits the property tax return in 2019.

General information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Legislative regulation

The process of collecting property taxes is regulated by the Tax Code of the Russian Federation, as well as a number of legal acts. You should also know that this payment applies to local ones, i.e. All funds received from citizens are transferred to the regional budget.

In this regard, municipal authorities are given the right to make certain changes to the tax.

Who files a property tax return?

Organizations that own movable or immovable property on the balance sheet of the enterprise's fixed assets are required to submit a tax return. It must be submitted to the tax authority at the place of registration of the property for each reporting period. This is discussed in.

If an organization has main 1st and 2nd depreciation groups, their value is not indicated in the advance tax calculation since they are not subject to taxation. If an organization has a group 3 - 10 that falls under the benefit, its residual value will be displayed in the second section of the tax return.

If the tax amount takes a negative value due to provided benefits or tax deductions, the legal entity is required to submit a zero declaration.

To organize, in most cases, advance payments for property tax are provided for, it will also be necessary to draw up reporting documentation.

If an organization does not have fixed assets subject to property tax, there is no need to submit a declaration, since in this case the organization is not a taxpayer. This is enshrined in . Entrepreneurs are also exempt from filing a declaration.

Individuals

Individuals do not file a tax return. For these categories of citizens, Federal Tax Service employees independently calculate the tax amount, after which citizens receive a tax notice by mail informing them of the amount and deadlines for payment.

It also contains a receipt for payment. Individuals are also required to pay personal income tax.

Legal

Legal entities that have taxable property as part of the fixed assets of an enterprise are required to submit reporting documentation to the tax authority at the end of each tax period.

Deadlines

A tax return must be filed at the end of each reporting period. At the end of the year, the declaration is submitted no later than March 30 of the year following the end of the tax period. This is regulated by Article 386. Tax Code of the Russian Federation.

If the tax payment deadline falls on a weekend, documents are submitted on the first working day following that.

If during the year the organization lost its fixed assets, the declaration can be submitted early. In this case, the documents are submitted after the end of the month in which the last taxable object was written off from the balance sheet of the enterprise.

However, if the organization acquires other fixed assets before the end of the year, the tax code obliges the company to file an updated declaration and pay taxes.

Where to submit?

When wondering where to submit a tax return, you should know that according to current legislation, property tax is credited only to the regional budget, that is, there is no need to send funds to the treasury of municipalities.

When an organization owns real estate, the tax base of which is the cadastral value, reporting documentation on it is sent to the tax department at the place of registration of such an object. In most cases, the declaration is submitted at the location of the parent organization.

Delivery methods

The completed declaration can be submitted in one of the following ways:

- personal visit to the tax office;

- by courier;

- by mail;

- using electronic resources.

Nowadays, the most popular option for filing a declaration is electronically. However, this will require the creation of an electronic digital signature. You will be required to pay a fee for this service periodically.

A big advantage of filing a declaration via the Internet is the availability of a ready-made declaration form in an electronic version, i.e. the taxpayer will only need to fill out the proposed fields.

On specialized portals you can:

- create a declaration;

- prepare an electronic file;

- print the completed form;

- send a declaration to the Federal Tax Service.

Design rules

When filling out a declaration of any type, you must:

- use the declaration form required at the given time, because changes in this matter occur quite often;

- write all amounts in rubles, without indicating kopecks;

- write letters and numbers large and clearly when filling out the declaration manually;

- take into account that there is the possibility of manually and electronically filling out a document, as well as various ways of submitting it to the Federal Tax Service office, namely by personal appeal or by post;

- when filling out the declaration, be guided by an official document called “Procedure for filling out a tax return,” which describes in detail and explains how to fill out each page and line of the document.

The declaration form in most cases consists of three sections and a title page. For everyone, including foreign organizations, the first two sections and the title page are required to be filled out.

After 2017, a number of innovations were introduced into the declaration. The main ones are as follows:

- The column indicating the OKVED code was excluded from the document form.

- The list of designation codes for other types of property assets has been expanded.

- It is now possible to submit a declaration to the relevant authorities without prior certification with the company’s seal.

- An additional section was introduced to objectively detail information about the property of real estate assets, which are taxed at the average annual value.

- A line has appeared to indicate property codes and the size of the taxpayer’s shares in real estate.

- New items have appeared.

Responsibility for late delivery

If a property tax payment is late, the company may be subject to penalties. He may also be brought to administrative or tax liability.

it is determined by the provisions of both federal and regional legislation - it forms an obligation for the payer to draw up and send a declaration and advance payment to the Federal Tax Service. Let's study the procedure for providing these documents to tax authorities in more detail.

Who submits declarations and other types of property tax reports?

The declaration and advance calculation - the reports required by law on the tax in question - are submitted by companies that operate:

- According to OSN they have:

- property of any type put on the balance sheet as fixed assets;

- residential real estate.

- According to the special regime they have:

- residential real estate that is not included on the balance sheet as fixed assets;

- movable property put on the balance sheet as fixed assets before 2013 (or later - if the business was reorganized, liquidated or transferred from one interdependent entity to another);

- property specified in paragraph 1 of Art. 378.2 Tax Code of the Russian Federation.

Moreover, if the property is classified as belonging to the 1st or 2nd depreciation categories, which are established by the provisions of the Russian Government Decree No. 1 dated January 1, 2002, then there is no need to pay tax on this property and, accordingly, submit reports on it.

When to submit property tax reports?

Firms obligated to pay the tax in question must submit to the Federal Tax Service:

- advance tax calculation - by the 30th day of the month following the reporting period - quarter;

- declaration for the tax in question - before March 30 of the year following the reporting year.

At the same time, the obligation to provide an advance payment (as well as making advance payments to the budget) may not be provided for by the legislation of the subject of the Russian Federation. If this is so, then the taxpayer submits only a declaration from the reports to the Federal Tax Service.

Documents included in the property tax reporting of legal entities are submitted:

- to the inspectorate at the place of tax registration of the payer - if his property is located in the relevant municipality;

- to the inspectorate at the location of the payer’s property - if it does not coincide with the place of tax accounting of the company itself.

In the advance calculation for the tax in question, it is necessary to reflect the reporting periods. The procedure for determining them is characterized by a number of nuances.

Reporting period for property tax: nuances

The establishment of the reporting period depends on the method of calculating property tax:

Don't know your rights?

- Based on the book average value of the property.

With the appropriate method, the following reporting periods can be recorded in the advance calculation:

- 1st quarter;

- half year;

- 9 months.

- Based on the cadastral value of the property.

In this case, the reporting periods are different - the 1st, 2nd and 3rd quarters.

In fact, this means that in 2017 the advance payment is submitted to the Federal Tax Service:

- until May 2 - for the 1st quarter (for both methods of calculating tax);

- until July 31 - for the six months (at the average value of assets) or the 2nd quarter (at the cadastral price);

- until October 30 - for 9 months (average price), 3rd quarter (cadastral price).

The average value of property is established on the basis of the company's accounting documents. Cadastral - determined by Rosreestr and requested through established channels in the department.

These reporting periods are essentially quite similar, but the difference between them predetermines differences in the methods of tax calculation. In addition, certain nuances characterize the indication of billing periods directly in the form of advance payment. Let's study them.

Reporting period in the form of advance payment: nuances

By Order of the Federal Tax Service of Russia dated March 31, 2017 No. ММВ-7-21/271, new forms of declaration and advance payment were introduced, which are provided by property tax payers of legal entities.

On the one hand, this regulatory act is applied with the beginning of the use of property tax returns for legal entities for 2017. However, if the taxpayer uses the advance report form approved by the new order for the reporting periods of 2017, then the territorial divisions of the Federal Tax Service are recommended to accept this form (letter of the Federal Tax Service of the Russian Federation dated April 14, 2017 No. BS-4-21/7139).

Using the new form may be preferable for the payer, since, unlike the previous form introduced by Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 (for reporting for 2016 and earlier periods), it contains the field “Reporting period", while in the old version of the document this field was absent and information about the reporting period was recorded in the "Tax period" field using the codes specified in the letter of the Federal Tax Service of the Russian Federation dated March 25, 2016 No. BS-4-11/5197.

The codes that must be used when reflecting the reporting period in the new advance payment form are given in Appendix No. 1 to the Procedure approved by Order No. MMV-7-21/271.

Let us note that a number of noticeable changes have appeared in the declaration form introduced by the new order of the Federal Tax Service. In particular, a new element was added to it - section 2.1, which reflects information about property for which the cadastral value has not been established, that is, when the tax on it is calculated at the average cost.

Firms that transfer property tax for legal entities submit 2 reporting documents to the Federal Tax Service - a declaration at the end of the year and an advance payment quarterly, based on the results of the reporting periods. The first document is submitted in any case, the second is submitted, unless otherwise established by the legislation of the subject of the Russian Federation. At the same time, for the reporting periods of 2017, you can use the new advance report form approved by Order No. ММВ-7-21/271.